Investors are no longer paying so much to insulate themselves from the kinds of tremors they have witnessed over the past month, with market gauges showing some of the extreme trepidation has passed.

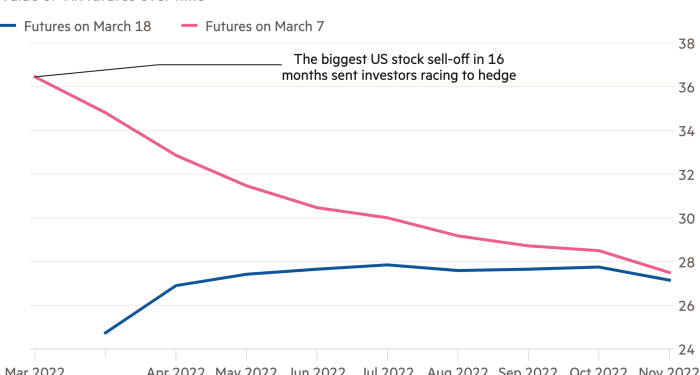

Traders in US stock and derivatives markets have been closely watching the price of futures on the Cboe’s Vix index, often referred to as Wall Street’s fear gauge. Last month, on the cusp of Russia’s invasion of Ukraine, the price of March Vix futures rose above the value of those that expire between April and November, a sign many investors had hedged against an immediate drop in the market.

That move, a so-called inversion of the Vix futures curve, also indicated that investors expected volatility in March to be far higher than further out in the future. It is a relatively unusual development given investors generally have less clarity of what will happen many months from now and as a result pay up to hedge for that future risk.

But their fears came to pass, with violent swings in stock, bond and commodity markets as Russian forces moved into Ukraine and investors awaited the first rate rise from the Federal Reserve since 2018. The benchmark S&P 500 dropped nearly 15 per cent from its peak while the tech-heavy Nasdaq Composite fell more than 20 per cent from its all-time high.

In recent days that inversion has reversed, with the price of March Vix futures contracts dipping back below those that expire later this year. Traders said it indicated that some of the extreme unease about how far financial markets could lurch lower had dissipated.

Investors have credited that move to several factors, including the fact many funds that had used futures and options to hedge themselves in March had closed out positions, taking profits on the recent market declines.

Charlie McElligott, a strategist on Nomura’s derivatives trading desk, said the move meant that futures no longer offered a “panicky” market signal and the fact the inversion had disappeared meant some funds would begin to dip their toes back into markets.

The accompanying sharp drop in the Cboe’s Vvix index, which measures how volatile the Vix index is, signalled that demand to hedge tail risk had “cratered”, he noted.

While the war in Ukraine continues to rage, traders said other tail risks that were hard to hedge were no longer as worrisome. Some pointed to the fact that policymakers at the Fed last week laid out their plans for lifting interest rates, removing some uncertainty over how aggressively the US central bank would tighten policy.

“Post-Fed your event horizon has changed a bit,” said Peter van Dooijeweert, a hedging specialist at hedge fund Man Group. “Do you think the Fed will give you any new information in the next meeting? Maybe not.”

Instead he said inflation and employment data over the next three to 12 months would shape how the Fed responds, and in turn, how markets moved.

“Now I’m more worried about the next three months versus three weeks ago where I was just worried about tomorrow,” he added.