Japan is forging ahead with plans to buy up vast quantities of bonds in a bid to support the country’s economy, drawing a stark contrast to other major countries that are exiting stimulus programmes.

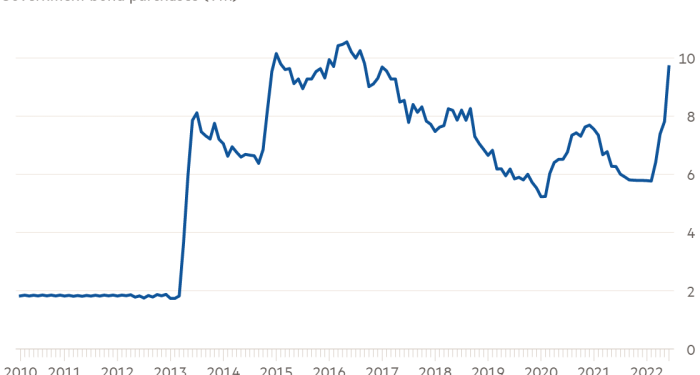

The Bank of Japan will buy about ¥10tn worth of bonds in June — roughly equal to the US Federal Reserve scooping up $300bn worth of debt per month when adjusting for gross domestic product, according to Deutsche Bank calculations.

Policymakers in Tokyo are pursuing the bond-buying programme as part of a plan to keep a lid on medium-term costs known as yield-curve control that has been in place since 2016. The scheme’s continuation pushes Japan far out of line with even its most dovish global peers, such as the Swiss National Bank that this week surprised markets with its first interest rate rise in 15 years.

“This is an extreme level of money printing given that every other central bank in the world is tightening policy,” said George Saravelos, head of European foreign exchange strategy at Deutsche Bank.

The BoJ on Friday said it would hold interest rates in negative territory and also continue targeting a 10-year bond yield of within 0.25 percentage points either side of zero.

Intense pressures in the global bond market have pushed the 10-year Japanese government bond yield right up to the upper limit, meaning the central bank has had to purchase big batches of debt on a regular basis to maintain its target.

Japan’s decision to continue buying bonds has hit the yen, which plunged earlier this week to a near 24-year low beyond ¥135 against the dollar.

BoJ policymakers say the underlying economy is too weak to withstand monetary policy tightening and are also wary of reversing progress on exiting a protracted period of tepid price growth and even deflation.

Core consumer prices, which exclude volatile food prices, have risen at their fastest pace in seven years, hitting the BoJ’s target with annual growth of 2.1 per cent in April.

However, even as price growth in Japan has heated up in recent months, it remains much lower than levels across other major economies. US core inflation registered 6 per cent in May, while that figure was almost 4 per cent in the eurozone last month.

“The Bank of Japan is happy to continue being the ‘odd one out’ among central banks,” said Takayuki Toji, an economist at Sumitomo Mitsui Trust Asset Management.

Additional reporting by Hudson Lockett in Hong Kong