What a difference a week makes eh? The miasmic glumness hanging over town has given way to the first signs of spring, and suddenly, things seem a touch better. Until you check the news at least.

On that note, it’s time for another round of FT Alphaville’s Wot U Know Quiz, or FAWUK. The rules, like the song, remain the same. Eight questions, six allegedly on finance, one price guess and one “guess who tweeted this nonsense”. Winner gets a piece of tat from one of our desks, and a lifetime subscription to FT Alphaville.

And away we go:

-

On FT Alphaville this week, two of the FT’s best dug into the spaghetti junction of subsidiaries and investment companies linked to under scrutiny German real estate company Adler Group. Name two of countries where some of these companies are incorporated?

-

The LME’s attempt to bring back order to the nickel market continues to resemble a clown car with a wheel missing. When the market first reopened earlier this week after trading was suspended, what was the maximum percentage move the price could drop in day before trading was halted?

-

Bank of England governor Andrew Bailey loves a kip, apparently. Even during working hours. At his old gig at the FCA, he reportedly fell asleep during a meeting regarding which financial scandal?

-

Walking political PR experiment Rishi Sunak is back in the news this week ahead of the Spring Statement. In a previous life he was a hedgie at two London-baed funds. Name one of them.

-

Deliveroo said this week it expects to be profitable — on an underlying basis at least — soon. Which year is it targeting to get into the black? And for a bonus, how many years is that after it was founded?

-

Bidders are lining up to buy Chelsea from all corners of the world. Which US private equity fund co-founded by Howard Marks is one of the latest to chuck its name into the ring?

-

Price guess time. Twitter IPO’d back in 2013 at $26 per share. And Friday’s close, will it be above or below that price?

-

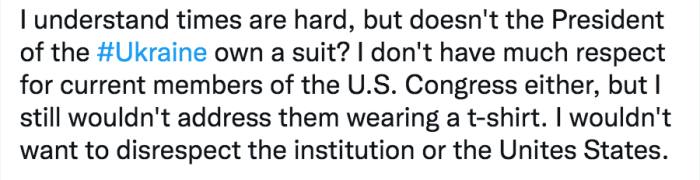

Who tweeted his nonsense? (Hint: renowned goldbug)

Answers in the comments, or to Jamie (jamie.powell@ft.com) or Claire (claire.jones@ft.com). Have a decent weekend all.