Italian stocks and bonds sold off on Thursday after Prime Minister Mario Draghi resigned and the European Central Bank sharply raised interest rates in its effort to tame blistering inflation.

The yield on Italy’s 10-year government bond jumped 0.24 percentage points to 3.6 per cent as Draghi’s national unity coalition unravelled and the ECB lifted its deposit rate by a larger-than-expected 0.5 percentage points to zero. Thursday’s rate rise was the first by the ECB since 2011 and ended an eight-year stretch of negative interest rates.

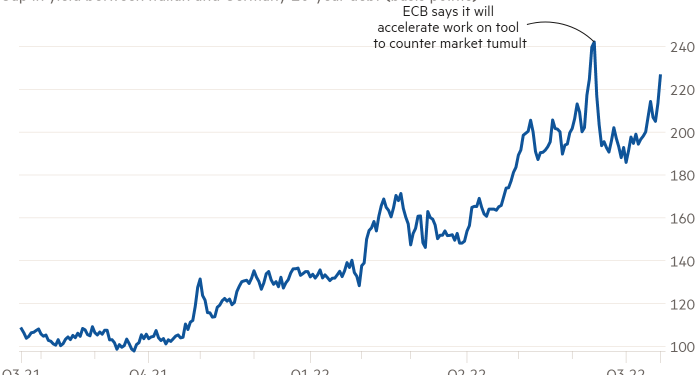

The decline in Italian bond prices on Thursday took the gap between Italian and German benchmark 10-year yields — a closely watched gauge of market stress — to 2.3 percentage points, reflecting a widening of close to 0.3 percentage points in just two days.

The ECB had previously signalled that it would raise borrowing costs by 0.25 percentage points this month as it moved to tackle rapid consumer price growth. But on Thursday the central bank said it had deemed it “appropriate to take a larger first step on its policy rate normalisation path” because of inflation risks and the “reinforced support” provided by a new bond-buying programme aimed at limiting divergence in borrowing costs between the bloc’s strongest and weakest countries.

The ECB’s decision came after Italy’s Draghi handed his resignation to President Sergio Mattarella on Thursday morning, having won a confidence vote on Wednesday night but lost the support of members of his coalition. Mattarella is now expected to dissolve parliament and announce snap elections.

“The shocking collapse of Draghi’s administration raises important questions ahead of new elections,” said analysts at US bank JPMorgan. “The populist coup against Draghi raises our sensitivity to risks from erratic policymaking.”

In equity markets, a FTSE gauge of Italian stocks lost 1.4 per cent. The country’s largest banks, which are big holders of Italian debt, led the declines, with Intesa Sanpaolo and UniCredit down more than 2 per cent and 4 per cent respectively.

Europe’s regional Stoxx Europe 600 index dipped 0.3 per cent in volatile trading. The euro slipped 0.1 per cent to $1.017 against the dollar after initially popping on the rate decision. The common currency had last week tumbled to parity with the greenback on concerns over the bloc’s economic outlook.

Wall Street’s S&P 500 index traded flat after the New York opening bell.