Global government bonds sold off on Tuesday after Russia launched a new offensive in Ukraine and the IMF warned that the war would hit growth while simultaneously stoking inflation.

Eurozone bonds were hit hardest, while stocks in the region fell, as the fund said commodity-importing nations in Europe would be more affected than the US by fuel and food price surges caused by the conflict.

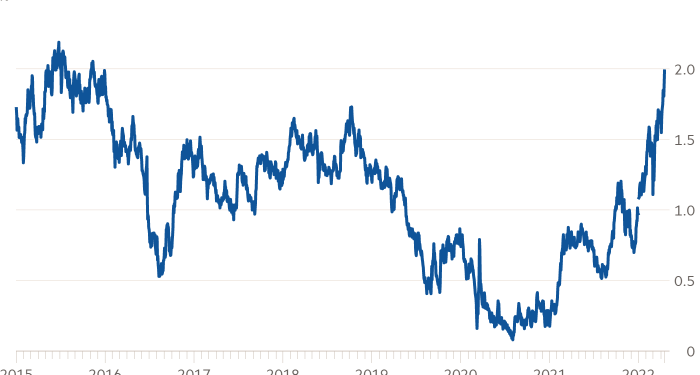

The yield on Germany’s 10-year Bund jumped 0.1 percentage points to 0.94 per cent — its highest level since July 2015 — as prospects of sustained inflation in the eurozone damped the appeal of bonds’ fixed income payments and raised expectations of the European Central Bank lifting interest rates.

The equivalent UK gilt yield added 0.09 percentage points to 1.98 per cent. Bond yields move inversely to prices.

“Europe is in more of a precarious situation than the US,” said Mary Nicola, multi-asset portfolio manager at PineBridge. “We see impacts on sentiment and economic activity that aren’t going to go away.”

“There is more concern about inflation in Europe, and expectations of the ECB raising interest rates are being baked in,” said Brian Nick, chief investment strategist at Nuveen.

Markets, Nick added, were now expecting the ECB “to raise interest rates more to deal with inflation than it had been predicted to previously.”

The IMF on Tuesday cut its global growth forecast for 2022 to 3.6 per cent, down 0.8 percentage points since its January projections, saying “global economic prospects have been severely set back, largely because of Russia’s invasion of Ukraine.”

US Treasuries also came under pressure, with the yield on the policy-sensitive two-year note adding 0.07 percentage points to 2.53 per cent. At the longer-dated end, the yield on the 30-year Treasury note rose above 3 per cent for the first time since 2019.

The moves came as traders awaited a speech on Thursday by Federal Reserve chair Jay Powell, which may offer signs about how aggressively the US central bank will raise interest rates this year after the annual pace of consumer price growth hit 8.5 per cent in March. A handful of other Fed officials are also due to speak in the coming days.

In equity markets, the regional Stoxx Europe 600 share index fell 1.1 per cent, while London’s FTSE 100 lost 0.2 per cent and Germany’s Xetra Dax dropped 0.7 per cent.

On Wall Street, the benchmark S&P 500 share index added 0.5 per cent in early dealings after seesawing for much of Monday’s session. The technology-focused Nasdaq Composite edged up 0.2 per cent.

Investors were also looking ahead to a week of corporate earnings for clues about how the business world is grappling with inflation and the uncertain growth outlook. Streaming group Netflix will post quarterly numbers on Tuesday, with analysts watching to see whether a trend that led to UK households cancelling subscriptions to deal with rising living costs will be replicated elsewhere.

The price of gold, which reached its highest point in a month on Monday as economic growth concerns drove investors to buy up the haven asset, slipped 0.8 per cent to $1,964 a troy ounce.

Brent crude oil dropped 3 per cent to $109.67 a barrel after rallying in recent days.

In Asia, Hong Kong’s Hang Seng share index fell 2.3 per cent after Chinese regulators banned the lucrative business of livestreaming unauthorised video games.