Government bond markets and stocks dropped on Tuesday after hotter than expected eurozone inflation data intensified questions about how far central banks will raise interest rates to curb price growth.

In Europe, the yield on Germany’s 10-year Bund — a proxy for borrowing costs across the EU — added 0.08 percentage points to 1.13 per cent, extending a bout of selling from the previous session after German inflation data also came in worse than expected. Italy’s equivalent yield rose 0.15 percentage points. Bond yields rise as their prices fall.

US bonds similarly dropped, with the yield on the benchmark 10-year Treasury note climbing 0.09 percentage points to 2.84 per cent.

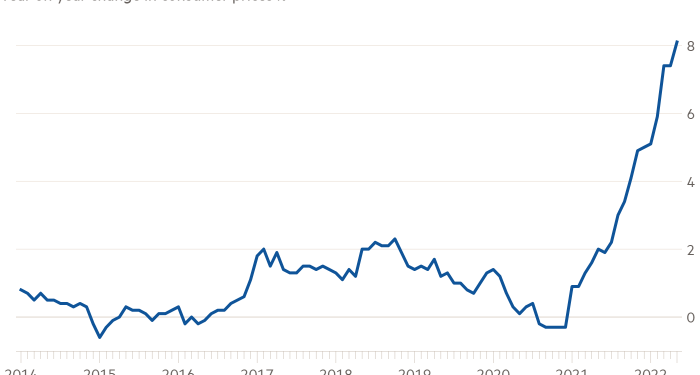

Those moves came after fresh data on Tuesday showed that eurozone consumer price growth reached 8.1 per cent in May, up from 7.4 per cent in April and higher than economists’ expectations of 7.7 per cent. The rise in Treasury yields also followed the Memorial day holiday on Monday, when US equity and bond markets were closed.

Kasper Elmgreen, head of equities at Amundi, Europe’s largest asset manager, said: “The direction of travel from a number of data points shows inflation in Europe is surprising on the upside. We haven’t seen the peak yet. It’s something the European Central Bank will have to address.”

Ahead of the inflation data release, Philip Lane, chief economist of the European Central Bank, had said that quarter-percentage-point interest rate rises in July and September would be the central bank’s “benchmark pace”. He noted in an interview with Spanish business newspaper Cinco Días that the process of withdrawing stimulus “should be gradual”.

In equity markets, Wall Street’s S&P 500 dropped 1 per cent in early dealings and the tech-heavy Nasdaq Composite fell 0.8 per cent. Europe’s regional Stoxx 600 stock index was down 0.7 per cent, while Germany’s Dax fell 1.1 per cent.

The prospect of rising interest rates and slowing growth creates an “anti-Goldilocks” scenario for global markets where neither bonds nor equities are attractive, said Hani Redha, a multi-asset strategist at PineBridge Investments. Commenting on the rally in US stocks last Friday, he said he anticipated further drops for equities this week: “The stronger and more forceful those rallies, the more convinced I am we’re in a bear market.”

In commodities, Brent crude rose 1.9 per cent to $124 a barrel after the EU agreed a ban on most Russian oil imports. The international oil benchmark had climbed above $120 a barrel on Monday for the first time since March.

That provided further momentum for European oil stocks, with Shell and BP up 1.5 per cent and 1.3 per cent respectively. The energy-heavy FTSE 100 rose 0.3 per cent.

“This is the story of the day,” said Elmgreen. “But the bigger picture is the Russian invasion of Ukraine put a significant risk premium on a range of commodities. In the long term, agricultural commodities will join energy, with food price rises on the horizon.”

Elsewhere in equities, Hong Kong’s Hang Seng index gained 1.4 per cent, after data showed China’s manufacturing activity in May contracted at a slower pace than the previous month. An official manufacturing purchasing managers’ index rose to 49.6, up from 47.4 in April. Any reading below 50 signals a contraction.

Shanghai on Monday evening also announced a partial easing of some of its coronavirus lockdown restrictions.

The dollar index, which measures the currency against six others, added 0.3 per cent, while the euro and the pound both fell 0.6 per cent against the US currency.