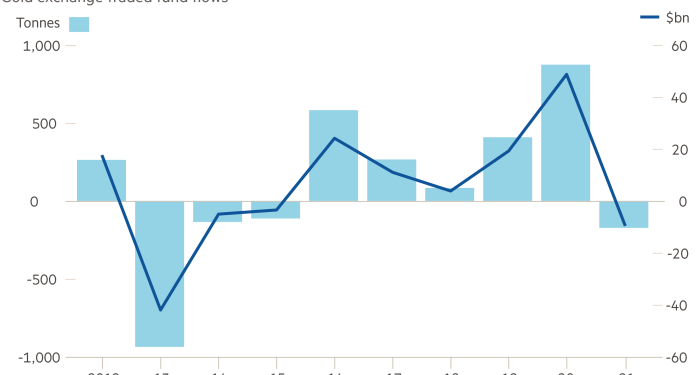

Gold exchange traded funds were hit by net outflows of $9bn last year in a retreat that could herald a significant decline in investor appetite for the precious metal in 2022.

Marking the biggest annual withdrawal from gold ETFs since 2013, analysts are now warning that the bullion market faces more significant headwinds with increases in interest rates in response to inflationary pressures and a stronger dollar expected to weigh on the price of the yellow metal this year.

“Many of the drivers that tend to be positive for the US dollar — tighter central bank policy, less US fiscal stimulus, and rising real interest rates — also tend to be negative for gold,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. UBS expects the price of gold to sink to $1,650 an ounce by the end of this year.

Assets worth $209bn are held in ETFs backed by physical gold. These funds have become a key barometer of investor sentiment towards the precious metal.

JPMorgan said that central banks’ unwinding of “ultra-accommodative” monetary policies this year would be “outright bearish” for gold, leading to a steady decline in the price to an average of $1,520 an ounce in the final quarter of 2022.

Gold hit an all-time high of $2,067 an ounce in August 2020 but its foray above the $2,000 level proved shortlived and bullion ended last year at $1,806, down 12.6 per cent from its peak.

Weaker investor interest was the principal drag on prices, as demand for gold jewellery, bars and coins, industrial usage and buying by central banks all rose last year. But selling by investors led to net outflows of 173 tonnes worth $9.1bn from physically backed gold ETFs in 2021, according to the World Gold Council, a trade body.

Ed Morse, global head of commodity research at Citi, said he expected to see “more selling pressure” on gold, leading to further ETF withdrawals of 300 tonnes this year and an additional 100 tonnes in 2023. Citi is forecasting that the price of gold will drop to an average of $1,685 an ounce this year before weakening further to average $1,500 in 2023.

Morse said he was “sympathetic” to the arguments that bloated government deficits and huge increases in public and private debt should support the gold price. But Citi has assigned only a 30 per cent probability to a new bull market run that would drive the price of gold to a new peak above the $2,000 an ounce level this year.

Most of the selling pressure last year was felt in the US where gold ETFs registered net withdrawals of 201.3 tonnes worth $10.8bn. The UK market also saw outflows of 28.5 tonnes worth $1.5bn in 2021. In the less mature Asian markets, lower gold prices spurred ETF inflows of 14.8 tonnes worth $786.5m in China. India-listed gold ETFs also saw demand increase with investors spending $595.3m to acquire $9.3 tonnes of additional holdings.

State Street which manages the world’s largest gold ETF, the SPDR Gold Trust (GLD), said it expected the yellow metal to resume its long-term structural bull market trend in 2022, driven by an increase in demand in the jewellery, industry and technology sectors in China and India.

Any escalation in geopolitical tensions between the US and China or more violence in Ukraine or Kazakhstan could “trigger safe-haven demand” for gold, said James Steel, HSBC’s veteran precious metals analyst.

“Kazakhstan is a major oil producer and a higher oil price is gold supportive,” said Steel.