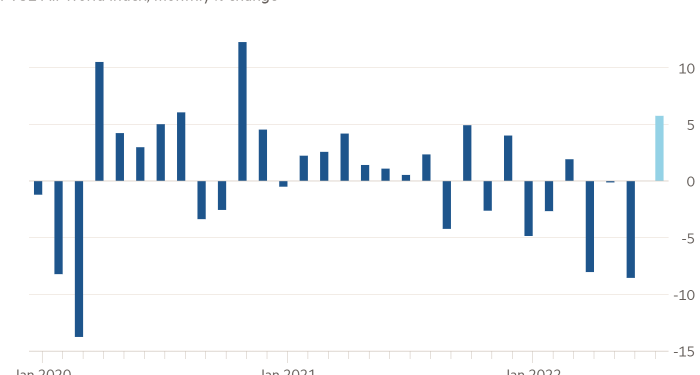

Global stocks were on track to post their best month since late 2020, bouncing back from a savage first half of 2022 as easing rate rise expectations and upbeat earnings from big tech groups fuelled a broad rally.

The FTSE All-World index of developed and emerging market shares has jumped 6 per cent in July, with sentiment boosted this week by resilient quarterly updates from America’s tech titans that signalled the dominant US equity sector could withstand an economic slowdown.

The strong performance in July stands in contrast to the first six months of this year, when the global stock index slumped about 20 per cent, dragged lower by the worst first-half performance for the $44tn US equity markets in more than 50 years.

“The tech earnings season has been a bit better than the market feared,” said Baylee Wakefield, multi-asset fund manager at Aviva Investors.

“Investors are also betting that much of the negative [economic] news has been priced in, that the Federal Reserve could become less aggressive in tightening monetary policy, and there’s enthusiasm in equity markets for slower inflation and fewer rate hikes.”

Shares in Amazon leapt 10 per cent in early trading in New York on Friday — leaving them up 28 per cent in July — after the ecommerce group beat analysts’ quarterly revenue forecasts and offered an upbeat outlook for the rest of the year because of strength in its cloud computing business.

Microsoft, Apple and Google parent Alphabet have all also issued more confident outlooks than investors had expected, lifting the US tech sector that has an outsized weighting in global markets.

In a sign of how investor sentiment is brightening, US equity funds tracked by EPFR recorded their largest inflow in six weeks this week, picking up $9.5bn of net new investments, according to Bank of America.

The blue-chip S&P 500 has jumped more than 8 per cent this month, with 86 per cent of the stocks listed on the index rising since the end of June, according to FactSet data. Across the Atlantic, Europe’s Stoxx 600 has gained about 7 per cent.

The Fed, the world’s most influential central bank, sharply lifted interest rates in the first seven months of this year. On Thursday, however, data showed the US economy had contracted for a second consecutive quarter, sparking hopes that the worst inflationary cycle for four decades would moderate and that the central bank may slow its policy tightening.

“Investors have been more worried about inflation and what that does to interest rates than they have about anything else,” said Rebecca Chesworth, senior equities strategist at State Street’s SPDR ETF business.

“So they’ve taken any sign that inflation will reduce and turned bullish on that.”

Futures pricing on Friday implied the Fed’s main funds rate would peak at 3.25 per cent next February from a range of 2.25 to 2.5 per cent at present. In mid-June, such predictions ran as high as 3.9 per cent.

But strategists at Barclays warned that July’s strong performance for stocks and bonds “could be brought back down to earth” by inflation remaining elevated as a result of Russia’s invasion of Ukraine.

“The fundamental outlook remains clouded by the dramatic slowing in the economy and high energy prices,” they said in a note to clients. “It feels optimistic to believe the Fed can soon reverse course.”