Global stocks rebounded on Tuesday, although investors remained on edge over the prospect of fresh travel restrictions to combat the fast-spreading Omicron coronavirus variant.

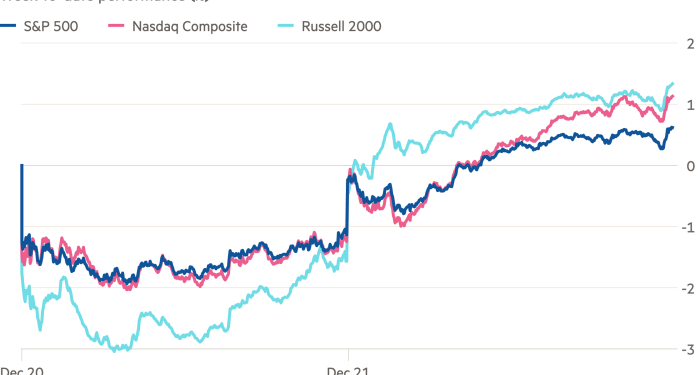

Wall Street’s blue-chip S&P 500 index gained 1.8 per cent, clawing back the entirety of its losses on Monday, while the tech-heavy Nasdaq Composite rose 2.4 per cent.

Stocks have been particularly volatile as the year draws to a close, with the benchmark S&P 500 registering 1 per cent or larger swings between the high and low points of each of the past five trading days, including today. The previous three trading days had been the S&P’s longest losing streak since October.

That is in part due to the panoply of factors confronting money managers at year’s end, including questions over the viability of US president Joe Biden’s $1.75tn stimulus plan that has stalled in Congress, as well as the severity and economic effect of the Omicron variant. The Federal Reserve’s and Bank of England’s moves to tighten monetary policy have also sent ripples through financial markets.

“A year dominated by an apparently insatiable appetite for all things risky seems to be ending in a far more nervous mood,” said Andrew Lapthorne, a strategist with Société Générale.

The turbulent moves have not been isolated to the US. On Tuesday, Europe’s Stoxx 600 index rallied 1.4 per cent, reversing Monday’s 1.4 per cent decline. London’s FTSE 100, Germany’s Dax and France’s Cac 40 all advanced by nearly 1.4 per cent.

Announcements on Monday from vaccine manufacturers and regulators offered investors hope and cause for caution. The European Medicines Agency told the Financial Times that early evidence suggested a “clear” drop in the effectiveness of existing jabs against the Omicron variant. Hours later, Moderna said a half dose of its Covid-19 vaccine elicited a robust antibody response.

In addition to the human toll, the spread of the highly mutated variant was likely to add to inflationary pressures by exacerbating existing supply chain issues, according to Emmanuel Cau, a strategist at Barclays.

But if governments were to reimpose nationwide lockdowns — a strategy the Netherlands has already employed — “it would be a different, deflationary, story” because it would heavily knock consumer demand, he said.

Leading central banks last week adopted a more aggressive stance on tackling elevated inflation. The withdrawal of pandemic-era stimulus has investors girded for volatility, given equity and fixed income valuations have been supported by large-scale government spending programmes and central bank bond buying.

While markets have whipsawed on the effects of the Omicron variant, they have not fallen meaningfully from record highs hit last month. Mark Haefele, chief investment officer at UBS Global Wealth Management, said he expected markets to “look through Omicron concerns”. “While mindful of risks around . . . variants and inflation, we keep a positive outlook on stocks for the start of 2022,” he added.

The Omicron variant is now dominant in the US, according to the Centers for Disease Control and Prevention, accounting for 73 per cent of sequenced cases, up from 13 per cent in the previous week.

In fixed income markets, the yield on 10-year US government debt rose 0.04 percentage points to 1.47 per cent, while the two-year yield increased 0.04 percentage points to 0.67 per cent.

Oil prices also rebounded. Brent, the international benchmark, gained 3.4 per cent to $73.98 a barrel, while US benchmark West Texas Intermediate climbed 3.7 per cent to $71.12.

European wholesale gas prices continued their seemingly inexorable rise, with futures contracts linked to TTF, the region’s benchmark contract, jumping more than a fifth to close at €181 per megawatt hour.