US stocks slid on Friday at the end of a week in which several big central banks acknowledged the threat posed by high inflation and the Omicron coronavirus variant.

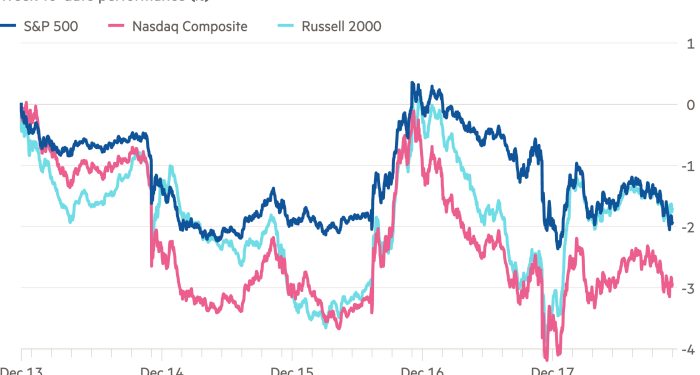

In New York, the benchmark S&P 500 fell 1 per cent, taking its losses after a volatile five trading sessions to 1.9 per cent.

The tech-heavy Nasdaq Composite also whipsawed after enduring its worst trading day since late September on Thursday, ending the trading day marginally lower. The index, which includes Apple and Tesla, fell 2.9 per cent for the week.

The push-and-pull within the $53tn US stock market comes as policymakers at several of the most important central banks begin to adjust policy and remove stimulus programmes launched at the start of the pandemic.

The US Federal Reserve this week pledged to speed up the taper of its $120bn-a-month bond-buying programme, which is now due to end in March rather than June, while policymakers indicated that interest rates may need to rise three times next year if inflation proves persistent.

“While there is clarity on Fed tapering, there is significant uncertainty about when the Fed will begin hiking rates — and that is causing rising fears that it could happen this spring,” said Kristina Hooper, Invesco’s chief global market strategist. “Heavy options trading today is also adding to turbulence.”

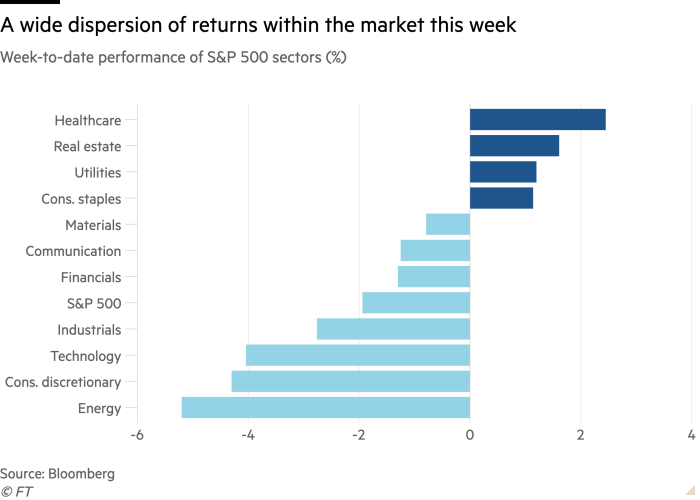

The shift has prompted a strong rotation within the market, as investors reposition portfolios for a world of tighter monetary policy. S&P 500 stocks within the energy, technology, industrial and consumer sectors have all lagged in recent trading sessions, and hundreds of companies trading in the US have struck 52-week lows this week.

Marko Kolanovic, a strategist with JPMorgan Chase, noted that over the past four weeks small-cap and value stocks had both entered correction territory, while the average US stock was down 28 per cent from its highs, even as the benchmark indices were up 20 per cent or more for the year.

“Such a divergence is unknown to us,” he said.

The yield on the 10-year US Treasury was little changed on Friday at 1.41 per cent.

The Bank of England on Thursday moved to raise interest rates from 0.1 per cent to 0.25 per cent in an attempt to damp inflation that has risen far above its target. Markets are now pricing in a roughly 70 per cent chance that the BoE will raise rates further at its next meeting.

Later on Thursday, the European Central Bank said it would scale back its pandemic-era bond purchasing programme in response to surging prices, although officials indicated they were unlikely to raise rates until at least 2023.

“It’s slowly reducing its pandemic support even though the pandemic is clearly still with us,” said Gergely Majoros, a member of European fund manager Carmignac’s investment committee. “Inflation, too, is still there, and the question now is where extra support would come from if things don’t improve.”

The region-wide Stoxx 600 index fell 0.6 per cent on Friday, while London’s FTSE 100 rose 0.1 per cent. Germany’s Dax and France’s Cac 40 both closed lower. All four indices ended the week lower.

Of the three central bank announcements, it was the BoE’s that came as most of a surprise. Bank of America wrote in a note that it had assumed UK officials would wait “for more information about the impact of Omicron” before raising rates.

“In the event, economic data this week — hawkish inflation and labour market data — appears to have dominated the BoE’s thinking,” it said.

In Asia, Hong Kong’s Hang Seng dropped 1.2 per cent and Tokyo’s Nikkei 225 fell 1.8 per cent.

In currencies, Turkey’s lira plunged 5 per cent to trade at 16.42 to the dollar, a day after the central bank cut rates for the fourth month in a row despite spiralling inflation. The dollar index, which tracks the performance of the greenback against six others, rose 0.7 per cent.

Brent crude, the international oil benchmark, fell 2 per cent to $73.52 a barrel.