Global equities headed for one of their worst weeks of the past year, with a sharp downturn in tech stocks spreading to other sectors as brewing jitters over corporate earnings and economic growth darkened sentiment.

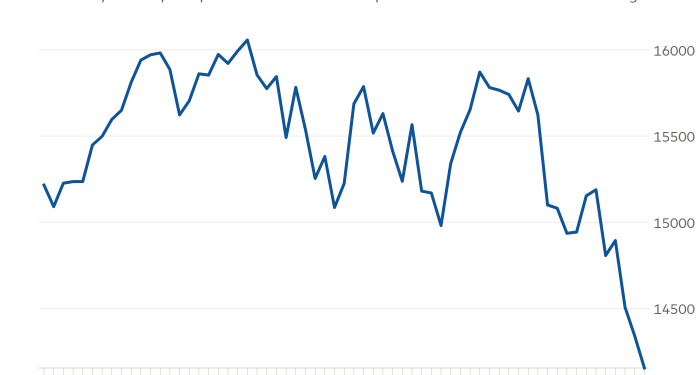

The FTSE All World index of developed and emerging market shares has fallen around 3 per cent since last Friday, leaving it on course to record its steepest fall since February 2021.

Markets in Asia and Europe have come under pressure in recent days, but the heaviest selling has been in the US, home to the tech behemoths that have powered global equities higher since the early days of the pandemic.

The rally for big tech groups abruptly reversed in January, with this year’s surge in bond yields dealing a heavy blow to companies coveted for their strong growth prospects. This week, however, angst over corporate earnings — a key pillar of the market rally since the March 2020 nadir — has flared up.

Shares in Netflix, a heavyweight in US stock indices and member of the Fang club of big tech companies, tumbled by a fifth in pre-market trading on Friday after the streaming group warned late on Thursday that subscriber growth would slow substantially. The fall would shave around $45bn from its market value if sustained to the close on Wall Street.

Futures markets signalled another choppy session for Wall Street stocks after the tech-heavy Nasdaq Composite index closed 1.3 per cent lower on Thursday — down almost 13 per cent from a record high struck in November.

Analysts said negative sentiment that was initially focused on the tech sector is now spilling over in to other corners of the market. “Some kind of contagion from tech to the rest was inevitable at some point,” said Luca Paolini, chief strategist at Pictet Asset Management. “When you have these kinds of losses they affect sentiment and everything else goes down.”

The Russell 2000 index of domestically focused, smaller US businesses has shed 6 per cent this week to Thursday’s close. Meanwhile, Europe’s regional Stoxx 600 equity gauge has fallen 1.6 per cent over the same period as oil and gas, resources, chemicals and banking stocks fell alongside technology shares on Friday.

Shares in Siemens Energy fell almost 14 per cent on Friday after the European group lowered its full-year profit outlook. Brent crude, the oil benchmark, dropped 1.1 per cent.

The heavy falls came as veteran US investor Jeremy Grantham, co-founder of investment group GMO, warned in an investor note this week that US stocks were in a “superbubble” that is poised to burst in spectacular fashion.

Investors worldwide have spent 2022 so far grappling with how to adjust their portfolios for the prospect of the US central bank raising interest rates about four times this year.

This hawkish shift by the world’s most influential central bank has eroded investors’ confidence in the path of global economic recovery — with worries building that the Fed’s attempt to tame inflation could also derail economic growth.

“There are two strong themes here,” said Edward Park, chief investment officer at investment management group Brooks Macdonald. “While work from home stocks have been struggling, markets are now looking further ahead to question whether economic growth is strong enough to survive a major tightening cycle by the Fed.”

Tatjana Greil Castro, co-head of public markets at credit investor Muzinich & Co, added that “the fear now is that the Fed is going to be too hawkish and it could kill the economy.

US Treasuries firmed on Friday, extending a rally from that began in the previous session, The yield on the 10-year US Treasury note fell 0.07 percentage points to 1.76 per cent as its price rose, bucking a trend where traders have sold the benchmark debt instrument in anticipation of the Fed reversing a policy of buying Treasuries to suppress borrowing costs.