European stocks and US equity futures fell sharply, shares in Moscow plunged, traders piled into low-risk government debt and gold hit a 17-month high after Russian president Vladimir Putin launched a military invasion of Ukraine.

After explosions were reported near Kyiv early on Thursday morning, the regional Stoxx Europe 600 share index lost as much as 4.2 per cent, taking it through a technical correction — defined as a 10 per cent decline from a recent peak. Germany’s Xetra Dax fell 4.8 per cent, with similar falls across most European bourses.

The spot gold price rose more than 3 per cent to almost $1,974 a troy ounce — its highest since September 2020.

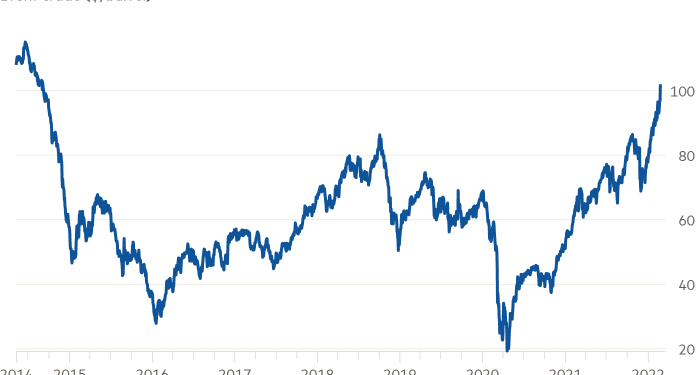

Ahead of EU leaders meeting later on Thursday to decide on further sanctions against Russia, a major oil producer, Brent crude oil rose as much as 9.2 per cent to $105.79, crossing the $100 threshold for the first time since 2014. European natural gas contracts surged 40 per cent to €117 per megawatt hour.

The escalation of the conflict in Ukraine is dominating the global market narrative because of the potential for Russia’s energy and resources being cut out of global supply chains, exacerbating already high inflation and prompting central banks to respond with rapid interest rate rises.

“A situation which seriously chokes off energy supplies from Russia will affect the world as a negative supply shock,” said Sunil Krishnan, head of multi-asset funds at Aviva Investors.

“Geopolitical tension is raising oil prices, meaning the inflation that was deemed transitory a few months ago could last even longer,” added Trevor Greetham, head of multi-asset at Royal London Asset Management.

“A big inflation impact in the US and Europe means central banks could raise interest rates further than anticipated, which brings a risk of economic stagflation.”

The US Federal Reserve was already expected to embark on a string of rate rises from next month — having pinned borrowing costs close to zero since March 2020 — in response to consumer price inflation hitting a 40-year high.

Russia’s benchmark Moex index plummeted as much as 45 per cent on Thursday, before paring back to a 33 per cent loss.

The rouble weakened to almost 90 per dollar, a record low against the US currency. London-listed shares of Russian steelmaker Evraz fell more than a quarter, and oil and gas producer Gazprom lost 31 per cent.

In government debt markets, the yield on the 10-year US Treasury note fell 0.1 percentage point to 1.87 per cent as the benchmark government debt instrument rose in price. German Bunds also rallied, with the yield on the 10-year security, which sets borrowing costs across the eurozone, 0.09 percentage points lower at 0.13 per cent.

Traders also moved to buy protection against riskier European companies defaulting on their debts if geopolitical tensions raise commodity prices to unmanageable levels.

The iTraxx Crossover index, which reflects the cost of hedging against such defaults, jumped more than 30 basis points (0.3 percentage points) to 385bp, its highest since June 2020 when companies were recovering from the initial shock of the coronavirus crisis.

The dollar index, which tends to rise when market stress increases demand for the reserve currency, rose almost 1 per cent. The euro fell 1.2 per cent against the dollar to $1.117.

In Asia, Hong Kong’s benchmark Hang Seng index fell more than 3 per cent.

Additional reporting by Robert Smith in London and Leo Lewis in Tokyo