Global bond markets are on course for their worst year since 1999 after a global surge in inflation battered an asset class that is typically allergic to rising prices.

The Barclays global aggregate bond index — a broad benchmark of $68tn of sovereign and corporate debt — has delivered a negative return of 4.8 per cent so far in 2021.

The decline has been largely driven by two periods of heavy selling in government debt. At the start of the year, investors dumped longer-term government bonds in the so-called “reflation trade” as they bet that the recovery from the pandemic would usher in a period of sustained growth and inflation. Then, in the autumn, shorter-dated debt took a hammering as central banks signalled they were preparing to respond to high levels of inflation with interest rate rises.

In the US, which comprises more than a third of the index and saw inflation surge to a four-decade high of 6.8 per cent in November, the 10-year US Treasury yield has risen to 1.49 per cent from 0.93 per cent at the start of the year, reflecting falling bond prices. The two-year yield has climbed to 0.65 per cent from 0.12 per cent.

“We shouldn’t be too surprised that bonds are a bad investment when inflation is running at 6 per cent,” said James Athey, a portfolio manager at Aberdeen Standard Investments. “The bad news for bond investors is that next year looks tricky too. We have the potential for a further shock if central banks move quicker than expected, and I don’t think [riskier bonds] are particularly attractively priced.”

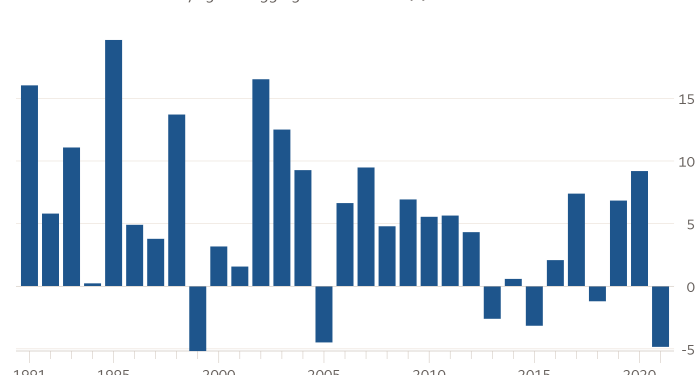

During four decades of rising bond markets, years of negative returns have been relatively few and far between. The global aggregate index last recorded weaker returns in 1999, when it lost 5.2 per cent as investors fled bond markets for the booming dotcom-era stock market.

Despite 2021’s losses and the prospect of monetary tightening next year from the Federal Reserve and other central banks, some fund managers argue it is premature to call time on the 40-year bull market in fixed income.

Longer-term yields peaked in March and have fallen back even as markets moved to price in three interest rate rises from the Fed and four from the Bank of England next year, along with a reduction in the European Central Bank’s asset purchases.

The recent strength of long-dated debt is a sign that investors believe that central bankers will derail the economic recovery, or trigger a stock market sell-off, if they move to tighten policy too quickly, according to Nick Hayes, a portfolio manager at Axa Investment Managers.

“The more you raise rates today, the more they have to come back down in a couple of years time,” Hayes said. “And if the equity market retraces a bit, people will suddenly like bonds again. I’m not saying we get double-digit returns next year, but the simple fact is if you look back over the decades, a negative year has tended to be followed by a positive one.”