The Financial Conduct Authority is pursuing 50 investigations into cryptocurrency operators, including criminal probes, as the UK financial watchdog pushes back against a wave of scams and unregulated ventures.

The FCA said on Thursday that it had also conducted 300 inquiries involving unauthorised crypto businesses during the six months ending in September last year.

The announcement comes as financial supervisors around the world are more closely scrutinising the digital asset industry in an attempt to enhance consumer protections and cut down on the potential for money laundering across the still loosely regulated industry.

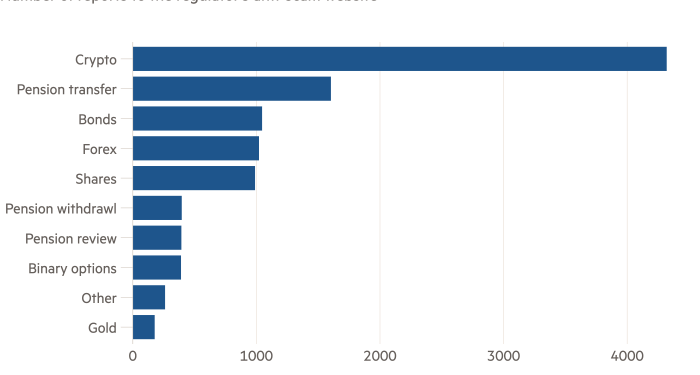

Consumers reported 4,300 potential crypto scams to the FCA’s ScamSmart website over the six-month period last year, far more than the 1,600 reports for the next most common category, related to pension transfers.

“The data we’ve published today shows how prevalent scams can be,” said Sarah Pritchard, executive director of markets at the FCA.

The watchdog’s oversight of crypto firms is mostly limited to making sure they comply with anti-money laundering standards, and shutting down unsupervised UK-based firms. However, the FCA said there was considerable overlap between unauthorised firms and those involved in scams.

The regulator maintains a list of nearly 250 firms that “appear to be carrying on cryptoasset activity that are not registered with the FCA for anti-money laundering purposes”, although it said that register likely only provides a partial picture of the unauthorised activity.

UK politicians have in recent months been increasing the pressure on the FCA to take more assertive action on crypto as the industry grows quickly.

“Why are we allowing . . . non-compliant crypto asset businesses to trade with impunity, and when can we expect that they will be put out of business?” said Lord Browne of Ladyton, a Labour peer and former cabinet minister, in the House of Lords on Wednesday.

The calls for increased oversight come as an growing number of UK retail investors are dabbling in crypto investments.

A survey by investment platform AJ Bell found that 30 per cent of crypto investors have more than 10 per cent of their portfolio in digital assets, while a third say that they aren’t prepared to lose any money on their digital asset investments. Investors’ have made these allocations even after the FCA has issued repeated warnings from the FCA that people should only invest money that they are prepared to lose in crypto.

The AJ Bell research also found that half of crypto investors don’t have an ISA while four in ten don’t have a pension. Laith Khalaf, head of investment analysis at AJ Bell, said the finding “suggests that a high proportion of crypto investors are jumping in at the deep end of the risk spectrum, and bypassing the basic building blocks of a financial plan”.