Banks, fund managers and other companies are rapidly stepping up their use of replacement rates for Libor in derivatives trades in the final quarter of 2021, as the tainted lending benchmark nears its switch-off day.

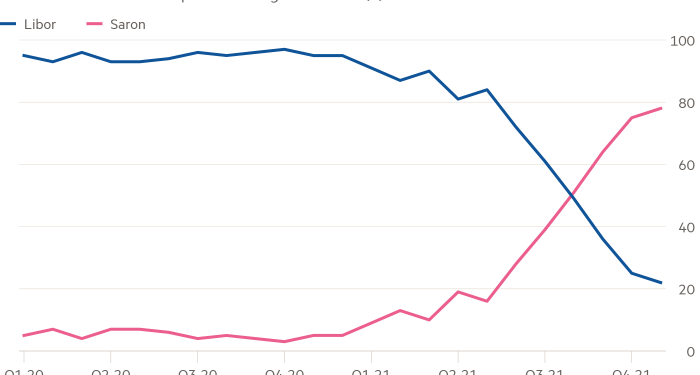

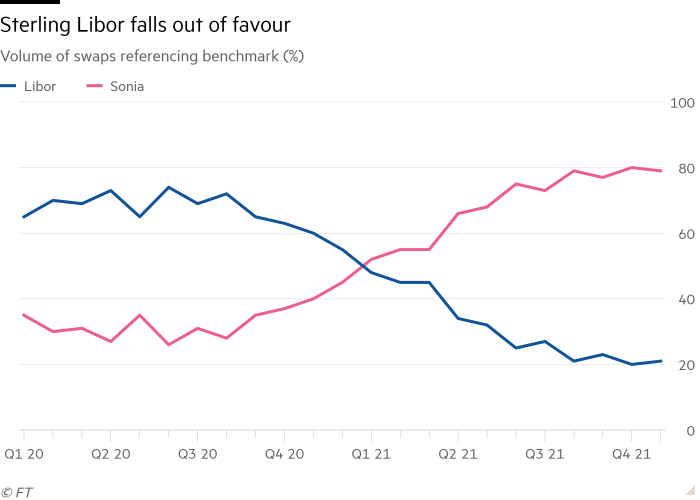

The majority of volumes of new privately negotiated swaps deals in the British pound, Japanese yen, Swiss franc and Singapore dollar, now largely use the new so-called “risk free” rates that authorities prefer instead of Libor, according to data from Osttra, a UK data provider.

These swaps had proven to be a particularly thorny problem in the four-year regulatory push to wind down the Libor lending rate at the end of December, accounting for most of the $265tn of outstanding Libor-linked deals.

That means increasing efforts to switch to new alternatives marks a key milestone in retiring what was once one of the most important benchmarks in financial markets.

After the scandals, in which investment bank traders tried to rig the rate, and its declining relevance to market activity, UK regulators decided to kill Libor from the end of 2021. Twenty-four out of the 35 daily Libor settings will cease in January; six more will continue temporarily in a synthetic form, as a fallback to help the market switch over, but may be discontinued over the next 18 months.

Volume of trades referencing Sonia, the sterling Libor replacement, has touched 80 per cent in each of the past three months while Tona, the replacement for Japanese yen hit 71 per cent, Osttra said. Saron, the equivalent for the Swiss franc, hit 78 per cent.

“Clients who transitioned away from Libor proactively had the benefit of designing the components of their new portfolio instead of having the terms dictated by the fallbacks,” said Bhas Nalabothula, head of European institutional rates at Tradeweb.

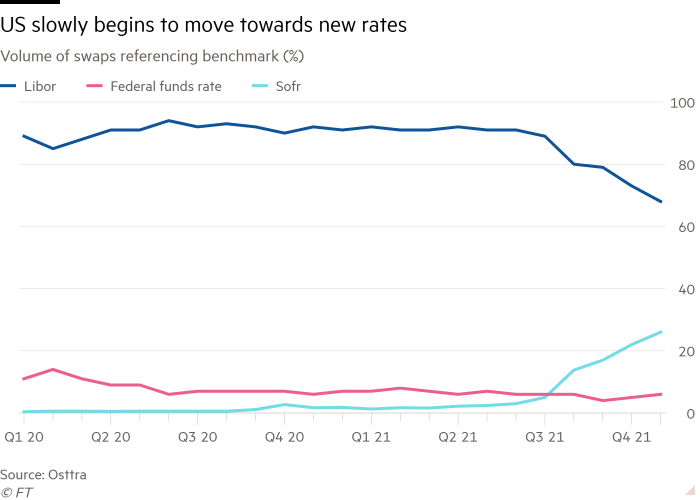

The laggard remains US dollar Libor, the biggest and most important Libor rate, and UK regulators have allowed five quotes to continue until June 2023 to account for the slow progress.

But banks will be barred from underwriting new loans using Libor starting in 2022, and the share of Libor in new swaps business has fallen from 90 per cent in August to just 68 per cent, Osttra said.

Kirston Winters, head of legal, compliance and government affairs at Osttra, said progress had been made in some currencies. “There is clearly still a way to go to see the new risk free rates completely replace the ‘-ibors’ in global swaps trading,” he said.

The majority of open deals are held at clearing houses, which stand between parties in a deal and prevent a default from infecting the market. The companies that run the biggest, such as LCH, ICE Clear Europe, CME Group and Eurex, are switching over their open contracts in stages. Earlier this month LCH, the world’s largest clearing house, converted about 100,000 Swiss franc, euro and Japanese yen derivatives, with a notional value of $6tn, in to the new rates. At the weekend it will transition sterling swaps, worth about $19tn, in to the alternative rate.

In a speech last week, Edwin Schooling Latter, who is leading the push to switch at the Financial Conduct Authority, said the UK regulator in the past had worried about the pace of change in US dollar markets, but that change had been dramatic as investors began to use Sofr, the US dollar Libor replacement. “All of those numbers are now better than I would dare to have predicted a year ago,” he said.

Even so, the regulator expected some Libor-based swaps to be unprepared for the change, particularly on deals where one side had not completed the paperwork.