UK regulators have driven “buy now, pay later” services to redraft terms that risked harming consumers as concerns mount over the rapidly growing payment method.

The UK market for BNPL schemes quadrupled to £2.7bn in 2020 according to the Woolard review commissioned by the Financial Conduct Authority, published last February. A separate academic analysis estimated the market may have increased in value last year to £5.7bn.

The FCA announced on Monday that BNPL platforms had revised terms that could allow them to terminate, suspend or restrict access to customer accounts for any reason without notice.

Other changes covered cancellation policy. Under the previous terms, customers may have had to continue paying instalments on refunded items until sellers notified platforms that returned items had been received.

BNPL, which allows users to either pay for goods by instalment or delay transactions for a period of time, has proved a popular alternative to other forms of unsecured lending.

The sector currently lacks specific regulation so the FCA used the broader legislation of the Consumer Rights Act to assess the fairness and transparency of terms used by Klarna, Clearpay, Laybuy and Openpay.

Interest on transactions is not charged unless users miss payments, while some providers have done away with late payments or interest charges altogether.

The BNPL service has become ubiquitous across sectors including fashion and sports retail, and is increasingly common in higher-ticket markets, such as homeware.

Neobanks Revolut and Monzo are both experimenting with providing BNPL products. Barclays launched an instalments option in partnership with Amazon last year for payments over £100, although unlike BNPL platforms it charges interest over the payment period.

But regulators have growing concerns about buy now, pay later providers, which they say could encourage spending even when users cannot afford it. UK-based BNPL Zilch came under criticism last month for encouraging shoppers to use the service to buy supermarket treats like cheap pizzas, raising debt concerns.

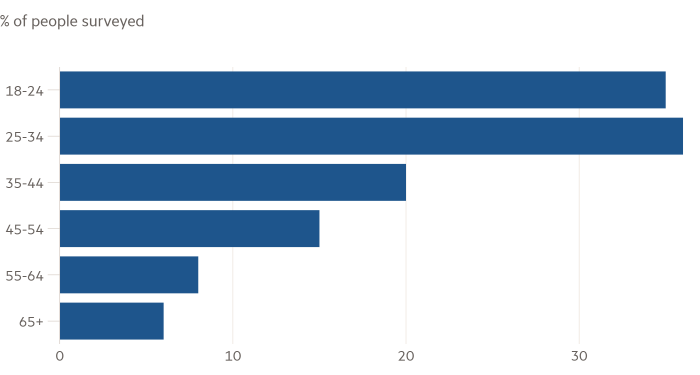

A third of millennials who use BNPL said they had been charged late payment fees, according to research commissioned by financial literacy charity The Centre for Financial Capability.

Another concern is that without effective credit checks in place, consumers could find themselves in a debt spiral due to making purchases across multiple services.

The UK Treasury launched its consultation into BNLP financing in October. The FCA said in August that it planned to consult on the sector after the government review was complete.

In December, the US Consumer Financial Protection Bureau ordered firms, including Klarna and PayPal, to provide information on business practices, citing concerns including the accumulation of debt.

Consumer groups concerned about the impact of BNPL welcomed the decision. “Our real fear is that many people don’t understand what they are signing up to, or the consequences if things go wrong,” said Matthew Upton, director of policy at Citizens Advice.