European stocks dropped and government bonds sold off sharply after the bloc’s central bank left the door open to an extra large interest rate rise in September.

The regional Stoxx 600 share index extended losses from earlier in the day to trade 1.3 per cent lower. A FTSE index of Italian stocks tumbled 2.4 per cent and Germany’s Xetra Dax lost 1.6 per cent.

Yields on German, Italian, Spanish and Greek government bonds also raced higher as investors worried about the economic fallout from the end of ultra-supportive monetary policies.

The European Central Bank said in a monetary policy statement that it would lift its main deposit rate from minus 0.5 per cent by a quarter point in July and by another unspecified amount in September.

“If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting,” the ECB said.

The central bank, which has also bought up vast quantities of eurozone government bonds in recent years to lower financing costs, confirmed in the same breath that it would end net purchases from July 1 and upgraded its inflation forecasts.

“These are all hawkish signals so there is hawkish market pricing,” said Gero Jung, chief economist at Mirabaud Asset Management.

Germany’s 10-year Bund yield, which sets borrowing costs in the eurozone, rose 0.08 percentage points to 1.43 per cent, hitting a new eight-year high. Italy’s equivalent debt yield surged by 0.23 percentage points to 3.69 per cent, more than triple its level at the start of the year. Bond yields rise as their prices fall.

“Its quite a shift [in Europe] coming after years of low inflation,” said Juliette Cohen, strategist at CPR Asset Management. Rising rates would “in fact cause quite a challenging environment for countries like Italy, which have large amounts of debt and subdued growth prospects,” she said.

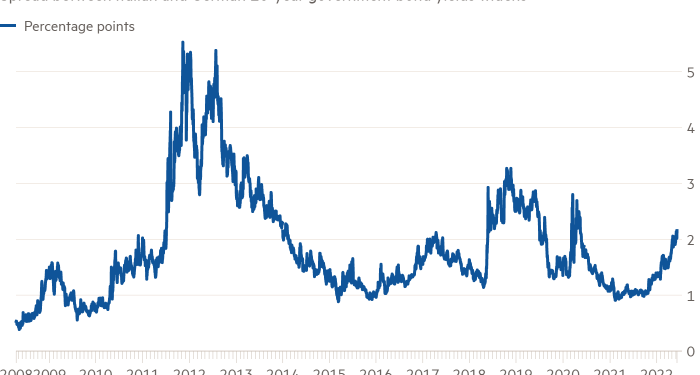

The gap between Italy and Germany’s borrowing costs, as expressed by the nation’s 10-year bond yields, hit its highest since May 2020 at 2.15 percentage points after the monetary policy statement.

The eurozone central bank is tightening monetary policy as part of a global shift to higher borrowing costs to battle inflation, which began rising in 2021 as coronavirus shutdowns ended and has been exacerbated by Russia’s invasion of Ukraine.

US data on Friday are expected to show the annual pace of consumer price rises in the world’s largest economy held at above 8 per cent in May.

Wall Street stocks followed Europe lower on Thursday, while Treasury bonds also dropped in price. The blue-chip S&P 500 share index lost 0.4 per cent in early dealings and the tech-heavy Nasdaq Composite fell 0.5 per cent.

The 10-year US Treasury yield rose 0.02 percentage points to 3.04 per cent, while the policy-sensitive two-year yield rose 0.03 percentage points to 2.81 per cent.

In Asia, a broad FTSE index of equities outside Japan fell 0.8 per cent, while the Nikkei 225 in Tokyo closed flat. The Japanese yen touched a new 20-year low against the dollar of ¥134.55 before settling back to ¥133.7.

Traders are betting against the Japanese currency after Bank of Japan governor Haruhiko Kuroda said, in claims that he later withdrew, that consumers were “tolerant” of rising prices.

Brent crude, the oil benchmark, edged 0.4 per cent lower to $123.08 a barrel, having advanced more than 50 per cent so far this year.