Wall Street stock futures and European shares rallied, while oil prices fell, after Russia said it had withdrawn some troops from the Ukraine border and dismissed invasion fears that had rattled markets in recent days.

Futures contracts tracking the S&P 500 gauge added 1.3 per cent following a statement from Russia’s defence ministry, which said it had started pulling some troops back to their bases after the completion of what it said were military drills.

Contracts tracking the Nasdaq 100, which has heavy weightings of highly valued technology stocks that are sensitive to swings in market sentiment, gained 1.7 per cent.

Brent crude, the oil benchmark, fell as much as 3.5 per cent to $94.19 a barrel after rallying as high as $96.78 on Monday, its strongest level in seven years. European gas contracts for next-month delivery fell 9 per cent to €73 per megawatt hour.

Russia is estimated to have maintained a force of more than 100,000 troops near Ukraine in recent weeks. But on Tuesday, Kremlin spokesman Dmitry Peskov dismissed White House claims an invasion was likely as “information madness”. A defence ministry spokesman also said troops that had been carrying out “combat training events” had now “completed their tasks”.

A Nato spokesman cautioned there was “no sign” of de-escalation by Russian forces as some analysts queried whether the market response to Russia’s announcement on troops was too buoyant.

“There is much more we don’t know about the situation at hand than what we do know,” analysts at Bespoke Investment Group said in a note to clients.

The Vix, the measure of expected volatility on the S&P 500, moderated from Monday’s highs but remained at an elevated reading of 26.3.

The Stoxx Europe 600 share index, which fell almost 2 per cent on Monday, added 1.2 per cent on Tuesday. London’s FTSE 100 rose 0.8 per cent, and Germany’s Xetra Dax gained 1.7 per cent.

Tensions over Ukraine, which have been building for more than two months, have taken centre stage in global markets after the US warned last Friday of an immediate threat Russia would invade its neighbour.

The potential for western sanctions on Russia, a key supplier of oil, gas and metals to global supply chains already snarled up by Covid-19-related disruptions, have sharpened jitters about high inflation and central banks responding with rapid interest rate rises.

Consumer prices rose at a record pace in the eurozone last month and hit a 40-year high in the US.

Russia has “strategic importance in a world that is moving from a low inflation backdrop to one where inflationary pressures have exploded into the public consciousness,” said John O’Toole, head of multi-asset fund solutions at Amundi.

Russia’s rouble rose 1.7 per cent against the US dollar on Tuesday. Ukraine’s currency, the hryvnia, added 0.9 per cent.

Haven assets fell in price, with the US dollar index down 0.4 per cent. The yield on Germany’s 10-year Bund, which moves inversely to the price of the security, rose 0.05 percentage points to 0.32 per cent.

The yield on the 10-year Treasury note rose 0.05 percentage points to 2.04 per cent, close to its highest level since late 2019.

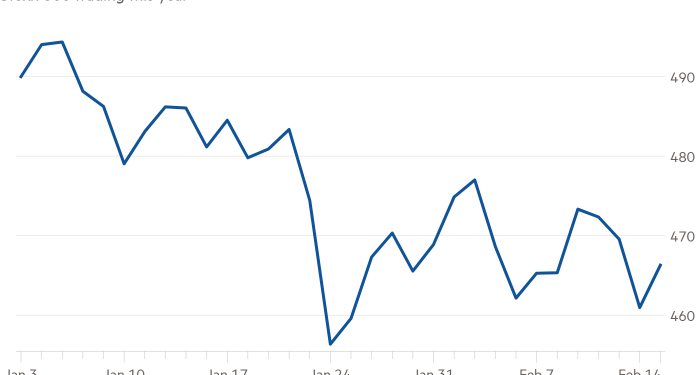

The Stoxx is down more than 4 per cent this year while the S&P has lost 7.6 per cent.

“The Russia-Ukraine situation is coming at an inopportune time when markets were already fragile,” said Olivier Marciot, cross-asset fund manager at Unigestion, referring to expectations the US Federal Reserve would raise interest rates up to seven times this year, after pinning borrowing costs close to zero in March 2020.

“Markets are therefore being very reactive to any incremental piece of news that comes out.”