European equities edged up on Monday, following falls on Wall Street in the previous session, as debate about the Omicron coronavirus variant and the future direction of monetary policy kept trading conditions volatile.

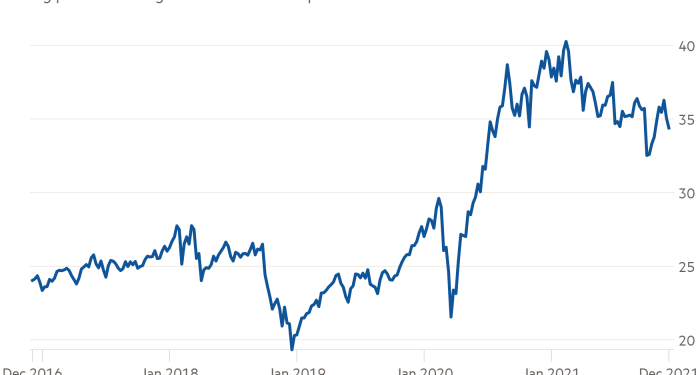

The Stoxx 600 share index gained 0.5 per cent. London’s FTSE 100, which is dominated by economically sensitive banks, commodities producers and miners, rose 0.9 per cent. Meanwhile, futures contracts tracking Wall Street’s S&P 500 share index rose about 0.3 per cent, while those tracking the technology-focused Nasdaq 100 dipped 0.3 per cent.

The moves came after investors on Friday retreated from shares in large US technology and other early-stage companies, whose higher valuations make them sensitive to sudden shifts in market sentiment. The Nasdaq 100 ended last week almost 2 per cent lower.

The FT Wilshire blended bitcoin price gauge, which collates data from several exchanges, fell as low as $42,222 on Saturday, from Friday’s closing level above $53,000. It traded at $48,667 on Monday.

Tech stocks, which during the pandemic era have been boosted by coronavirus restrictions forcing people to spend more time at home, may no longer receive such support, according to Trevor Greetham, head of multi-asset at Royal London. “This is now a hugely expensive sector, just very overvalued,” he said.

US jobs data released on Friday showed US employers added 210,000 workers last month, fewer than half the number economists polled by Reuters had expected, but also a significant fall in the unemployment rate to 4.2 per cent.

That report came days after Federal Reserve chair Jay Powell signalled his support for a quicker reduction of the central bank’s $120bn a month of bond purchases that have lowered borrowing costs and lifted stock valuations through the pandemic era. US consumer prices rose at their highest annual rate for 30 years in October.

The Fed’s asset purchases, while not directly responsible for flows of money into speculative tech stocks and cryptocurrencies, had created a “sense of confidence, an understanding to buy the dips, a feeling that you’ll never lose money,” said Hani Redha, multi-asset portfolio manager at PineBridge Investments.

“Normalisation of monetary policy is a headwind for markets overall,” he added. “And the areas that are most speculative and least driven by fundamentals are the most vulnerable.”

The yield on the benchmark 10-year Treasury rose about 0.05 percentage points to 1.39 per cent as the price of the debt fell. This key debt yield, which influences borrowing costs worldwide, traded at above 1.65 per cent in late November, before the World Health Organization declared Omicron a variant of concern.

On Sunday, top US health official Anthony Fauci called early signals about the severity of Omicron “encouraging”, saying to CNN “we feel certain that there will be some degree and maybe a considerable degree of protection” with booster jabs.

But investors expect markets to swing on fresh headlines about Omicron while conclusive data about its potential to overwhelm health services remains elusive.

“It has also not been a good time for the Fed to talk about speeding up monetary tightening,” Greetham said. “Central banks should step back and wait to see what happens with the variant.”

In Asia, Hong Kong’s Hang Seng index dropped 1.8 per cent, with significant share price falls for large Chinese tech companies including Alibaba and Tencent. The Topix in Tokyo closed 0.5 per cent lower.

Brent crude, the international oil benchmark, rose 3.3 per cent to $72.17 a barrel.