European equities and US futures dropped on Friday, as bets of impending interest rate rises and rapidly shifting sentiment towards the US tech sector continued to sour the market mood.

The regional Stoxx Europe 600 index lost 1.3 per cent, after closing 1.8 per cent lower on Thursday.

Futures markets also implied little respite for US stocks, following the worst day on Wall Street in almost a year, due to an unexpectedly strong jobs report that may strengthen the Federal Reserve’s already firm resolve to tighten monetary policy to battle inflation.

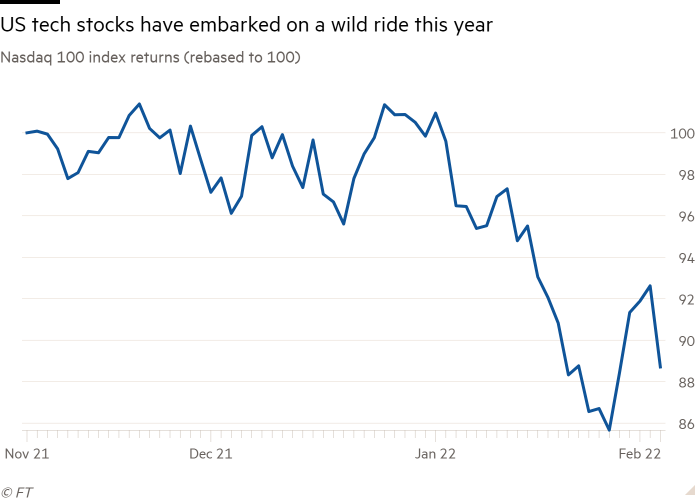

Contracts tracking the Nasdaq 100 lost 0.4 per cent, after the tech-focused index dropped 4.2 per cent on Thursday, with Facebook owner Meta losing $230bn of its market value following a weak earnings update. Those tracking the broader S&P 500 also fell 0.4 per cent.

Analysts warned that stock markets would remain volatile as global central banks responded to high inflation by rolling back the ultra-loose monetary policies they implemented to insulate financial markets from the shocks of the coronavirus pandemic.

“You’ve got a perfect storm of a sharp revaluation of the interest rate outlook from central banks, right in the teeth of an earnings season with a big discrepancy between winners and losers,” said UBS’s head of global and European equity strategy Nick Nelson.

Shares in Amazon rose 11 per cent in pre-market trading in response to the ecommerce group raising prices for its popular Prime subscription service. Snap, a social media group, rose 42 per cent after losing 24 per cent on Thursday.

Official payrolls data Friday showed US employers added 467,000 new roles in January, with economists polled by Reuters having expected a gain of just 150,000. Average earnings jumped by 5.7 per cent, compared with forecasts of 5.2 per cent.

The Fed last month signalled the potential for a rapid cycle of interest rate rises this year. Higher rates reduce the present value of companies’ future profits in investors’ models.

Markets have priced in around five US rate rises this year, a major shift from expectations at the end of 2021 that has knocked the heady valuations of many tech groups which benefited from coronavirus lockdowns.

On Friday the yield on the 10-year Treasury note climbed 0.08 percentage points to 1.91 per cent as the benchmark fixed-income security fell in price.

On Thursday, the Bank of England bumped up its inflation forecast to an April peak of 7.25 per cent, citing soaring energy prices and bottlenecks in global supply chains disrupted by coronavirus shutdowns.

Traders also now expect the European Central Bank to lift its main deposit rate close to zero by the end of the year.

The ECB introduced negative interest rates in 2014 in an effort to stimulate lending and spending. But eurozone inflation hit a record 5.1 per cent in January. The yield on Germany’s 10-year Bund, a barometer of eurozone borrowing costs, rose by about 0.05 percentage points to 0.196 per cent. Italy’s equivalent debt yield climbed 0.08 percentage points to 1.73 per cent.

Daily reversals in stock market mood have been common this year, while the general trend has been lower, with the FTSE All-World index having dropped 5 per cent so far in 2022.

Jefferies strategist Christopher Wood cautioned that a “bear market thesis” would dominate as long as the Fed maintained a “commitment to engage in meaningful monetary tightening”.

“The latest US data has offered no respite,” Wood said.

The dollar index, which measures the greenback against six major currencies, rose 0.2 per cent.