European shares were poised to snap a three-day winning streak on Thursday, while US stock futures fell, after disappointing quarterly updates from tech groups that had thrived during the pandemic.

Europe’s Stoxx 600 index dropped 0.5 per cent, with its technology sub-index down 1.8 per cent.

Futures contracts tracking Wall Street’s Nasdaq 100 fell 2.1 per cent. The tech-heavy gauge had dropped more than 7 per cent so far this year at the close on Wednesday.

Facebook owner Meta shed almost $200bn of its value after reporting its first decline in daily active users and warning of increased competition from rivals such as ByteDance’s TikTok platform. Shares in the company fell more than a fifth in pre-market trading on Thursday, putting them on track for their worst day since Meta listed in 2012.

Shares in PayPal had dropped a quarter on Wednesday after it warned a weakening ecommerce environment would slow its growth rate. Spotify, another pandemic winner, also delivered a weak outlook for first-quarter subscriber growth.

Investors have been jittery for months about the highly valued tech companies that dominate Wall Street’s main equity indices, fearful of slowing growth as coronavirus restrictions end.

Global central banks are also poised to reduce their huge sovereign debt purchasing programmes, implemented in March 2020 to insulate markets from the shocks of coronavirus. Prospects of low-risk bonds falling in price, therefore offering higher income yields, have lessened the lustre of more speculative stocks.

“Fingers have been hovering over the sell trigger for the tech sector,” said Gregory Perdon, co-chief investment officer at Arbuthnot Latham. “So when you get an announcement like [Meta’s], investors see the beginning of the end.”

Negative sentiment driven by Meta’s earnings ricocheted across the sector on Thursday, hitting even the largest and most profitable of Wall Street’s tech titans. Shares in Amazon fell 3.7 per cent in pre-market dealings, and Apple was down 1 per cent, although social media groups were hit harder. Snap dropped 15 per cent and Twitter fell 7 per cent.

Ark Innovation, speculative tech investor Cathie Wood’s flagship exchange traded fund, fell 4 per cent in pre-market trade.

“The spillover is a natural phenomenon in any equity sector, as there are basket trades,” Perdon said. “But we are making the distinction between tech that still has the prospect to deliver and unprofitable tech.”

In government debt markets, the yield on the UK’s benchmark 10-year gilt rose 0.08 percentage points to 1.34 per cent after the Bank of England raised interest rates by a quarter point to 0.5 per cent and bumped up its inflation forecast to an April peak of 7.25 per cent.

Germany’s equivalent Bund yield added 0.03 percentage points to 0.07 per cent as the European Central Bank, in a monetary policy decision issued shortly after the BoE’s, held its main deposit rate at minus 0.5 per cent.

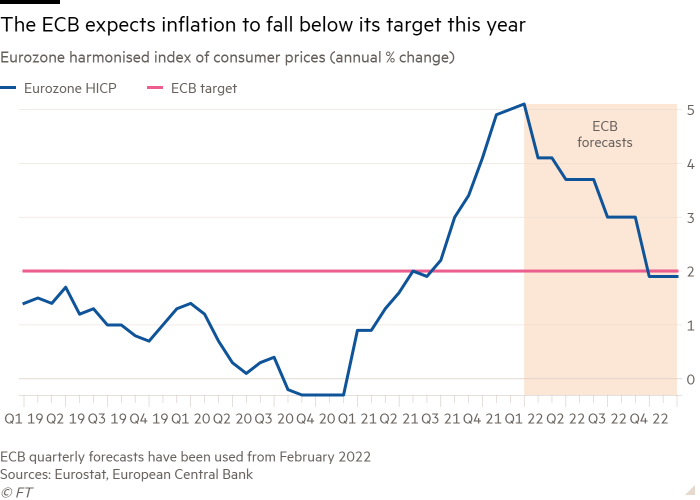

Traders are focused on whether ECB president Christine Lagarde, who has resisted calls to raise rates this year, will make any statements in a press conference on Thursday that appears overly dovish. Eurozone inflation hit a new record of 5.1 per cent in January.

“Our concern is the market challenging the ECB in their resolve, to say it is too dovish and behind the curve,” said Tatjana Greil Castro, co-head of public markets at credit investor Muzinich & Co.

She said this could lead to a sell-off of eurozone debt as investors bet on the ECB leaving monetary policy loose for too long and then tightening rapidly. “I don’t think they will reverse course, and from past experience, what happens next is the market will go after them.”