Investors are pulling back from European corporate debt as central banks prepare to curtail the stimulus that has offered unprecedented support to borrowers in a taste of the more challenging environment ahead.

European high-yield funds registered an outflow of €724mn in the week ending February 16, according to a survey of fund managers carried out by JPMorgan. Outflows from investment grade funds, which are considered less risky, were even larger at €2.3bn.

Bank of America said in a note on Friday that high-yield European funds had so far this year shed 2.8 per cent of assets under management, marking their worst start to a year since 2018.

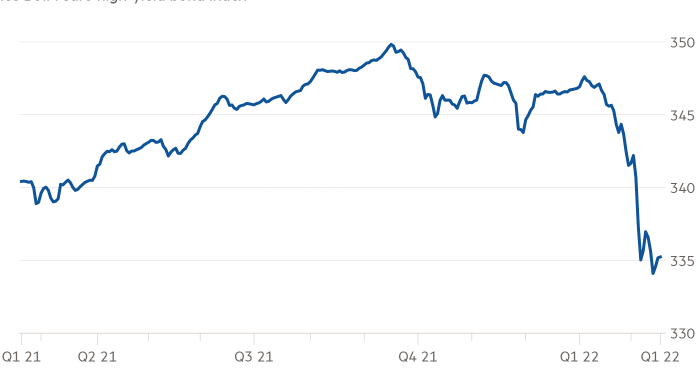

In another sign of selling in the market, an Ice Data Services index tracking European high-yield bonds has dropped 3.3 per cent since the end of last year, leaving it on track for the worst two-month run since the market ructions at the start of the pandemic in March 2020.

The moves come as yields on short-term government debt have jumped on both sides of the Atlantic, rendering returns from higher-risk corporate bonds less appealing to investors.

Markets are pricing in a 0.25 percentage point rise in US interest rates for the Federal Reserve’s next meeting in March and have recently dialled up their bets that the European Central Bank will be forced into action sooner than previously expected to tackle eurozone inflation, which last month rose at an annual rate of 5.1 per cent.

As a result, the yield on two-year US Treasuries, which are particularly sensitive to potential changes in interest rates, has more than tripled to 1.6 per cent in just three months. The yield on equivalent German debt, although still in negative territory, has also risen sharply, reflecting falling prices.

Bill Ammons, portfolio manager at AlbaCore Capital, said it was unsurprising that fixed income products were coming “under a bit of pressure” given the increasingly hawkish noises emanating from both the Fed and the ECB.

Yet the threat of corporate borrowers defaulting on their loans remained low, Ammons added, with “most companies in really good shape”.

The ECB appears to be equally unfazed, writing in its January economic bulletin that lenders “continue to hold an overall benign view of credit risks” thanks to their confident stance on economic growth.

Parmeshwar Chadha, global high yield fund manager at Newton Investment Management, said he expected the high-yield market to “enter a period of stabilisation” over the coming months as markets moved past “peak anxiety” around inflation.

With default rates at historic lows and corporate fundamentals still “fairly strong”, Chadha said high-yield would likely remain the best performing asset class within fixed income, returning between 3 and 4 per cent over the next 12 months.