Russia cutting gas supplies to Europe has long been one of the EU’s greatest fears. This week it became a reality.

Moscow has blamed the decision to restrict volumes on the Nord Stream 1 pipeline to Germany on sanctions imposed after the invasion of Ukraine, specifically those by Canada that left key pumping equipment stranded at a Siemens Energy factory in Montreal.

But few in the west are buying Moscow’s line. Russia has access to alternative supply routes to keep export customers supplied, but declined to utilise them. With the cuts coinciding with a visit by the leaders of Germany, Italy and France to Kyiv this week, Germany’s vice-chancellor Robert Habeck said any technical issues were clearly a “pretext” for Russia to squeeze Europe’s economy.

Fatih Birol, head of the International Energy Agency, said the cuts by state-run Gazprom appeared to be a “strategic” move by Moscow that would remind Europe that it should not feel “too safe or too comfortable”.

Georg Zachmann, senior fellow at the Bruegel think-tank, accused Moscow of “trying to play divide and rule”, saying President Vladimir Putin’s regime wanted to “increase its leverage over Europe ahead of the winter, and any eventual settlement in Ukraine.”

Unless Russia restores volumes quickly the industry fears Europe will struggle to store enough gas ahead of the winter months when demand will be highest. But even if full supply returns then the events of this week has finally sunk the belief once common in the industry that Russia would not turn the gas weapon on its largest customers.

What is clear is that Russia’s decision, which has reduced capacity on NS1 by 60 per cent and led to lower flows to countries from France to Slovakia, has moved the energy crisis into a new and dangerous phase.

“The current situation is one of the worst outcomes we had contemplated,” Edward Morse, analyst at Citi, said this week as he warned that prices would likely need to soar this winter to constrain demand if Russian flows do not return.

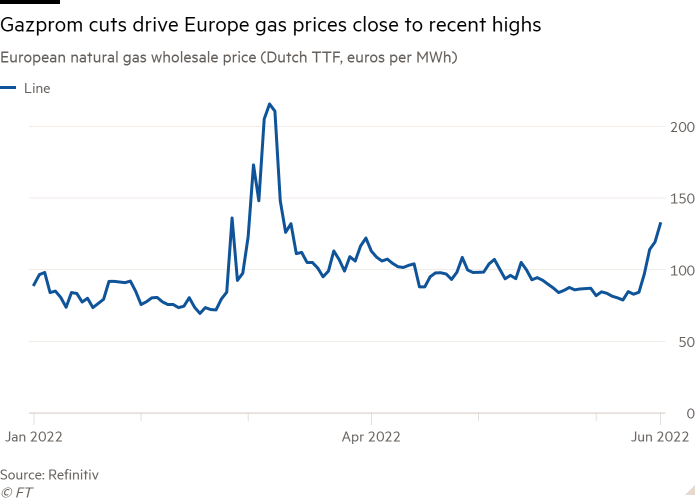

Gas prices have already jumped — from very high levels — gaining more than 60 per cent this week to about €130 per megawatt hour. This has compounded global anxiety about soaring inflation as central banks struggle to get a handle on rising prices without triggering a widespread economic slowdown.

For some the Russian gas cuts were inevitable. Europe has made clear since the Ukraine invasion in February that it wanted to kick its addiction to Russian energy as soon as possible. The percentage of European gas consumption that comes from Russia has roughly halved since the war to 20 per cent of the total, according to consultancy ICIS.

The EU has also moved to tighten sanctions against Russia, banning seaborne imports of crude and moving towards prohibiting insurance for any tanker carrying Russian oil, with the UK also onboard.

Laurent Ruseckas, a gas market specialist at IHS Markit, said that while Moscow could soon restore supplies, there was a risk it would double down on its position and make even bigger cuts this winter.

“There’s a growing likelihood that this is a prelude to the main show,” he said, adding that he feared Moscow saw the potential to weaken sanctions by ramping up the pressure on Europe’s economy.

“If there’s an explicit ‘we’ll cut off the gas if you don’t lift sanctions’ then I’m confident they’ll get a very short answer,” he said. “But I’m worried there’s enough support for this approach in Moscow to make it a very real possibility.”

If Russian gas flows do not recover soon then Europe would need to step up the hunt for more seaborne cargoes of liquefied natural gas to replace it. But the fragility of this option has been exposed in the past fortnight.

A fire at an LNG terminal in Texas that is responsible for almost 20 per cent of all US liquefaction capacity has closed the plant for at least three months and it is unlikely to be fully back until the end of the year.

Europe has benefited from lower Chinese demand for imported fuel as the country grapples with how to control coronavirus but it is unclear how long that “zero Covid” policy will persist.

With one eye on a potentially difficult winter, Germany has been one of the few major economies to launch an efficiency drive, calling on citizens to conserve energy this summer so that there is more gas available to go into storage ahead of the colder seasons. Italy, where supplies from Gazprom have dropped by 15 per cent, could activate an emergency plan to curtail gas use next week, including curbing supplies to some industrial users. But others, including the UK, have so far declined to make a conservation push a national priority.

Another option would be to burn more highly polluting coal and consider other politically challenging policies. The Groningen gasfield in the Netherlands was once Europe’s largest but its output has been capped after causing a number of large earth tremors that damaged buildings. It is still viewed in the industry as one option if there are prolonged shortages.

Long-term the EU will utilise more renewables but there is not enough time to add significant capacity ahead of the winter.

Henning Gloystein, an analyst at Eurasia Group, advised the EU to plan for Russia to fully end all gas supplies and ramp up imports from other sources. “In the worst case, it would require some form of gas rationing to maintain supply for essential industries and services,” he said.

Some have suggested the EU should go on the offensive. Zachmann at Bruegel said Europe could compel its power utilities to effectively cancel any long-term contracts they had with Gazprom. The European buyers could then offer to purchase a fixed volume of gas at a fixed price, offering Russia better terms for higher volumes.

If Russia then decided to halt supplies entirely Europe could respond, “but just sitting there like a frog in the water and letting the Russians turn up the temperature is not a good plan,” Zachmann said.

“Russia has said ‘it’s our gas, it’s our game’ but we need to say ‘it’s our money, it’s our game’.”

Additional reporting by Tom Wilson in London and Amy Kazmin in Rome