The European Central Bank has stuck to its plans for keeping interest rates unchanged while steadily reducing its bond purchases this year, defying critics who say it should tighten monetary policy faster in response to record eurozone inflation.

The ECB said on Thursday its governing council had “confirmed the decisions taken at its monetary policy meeting last December”.

Holding firm on its plans to provide a sizeable stimulus this year, the ECB said its deposit rate would stay at a record low of minus 0.5 per cent and reiterated plans for “a step-by-step reduction in asset purchases” over the next nine months.

The euro jumped to a more than two-week high against the dollar and a sell-off in eurozone bonds intensified after Lagarde declined to explicitly rule out an interest rate rise this year. The single currency was up 0.7 per cent at $1.138.

Germany’s 10-year yield, a benchmark for financial assets across the eurozone, surged to a nearly three-year high of 0.14 per cent. Traders ramped up their bets on higher interest rates, with markets pricing in a rise above minus 0.1 per cent by December as Lagarde spoke.

Net purchases through the €1.85tn pandemic emergency purchase plan would stop from the end of March, the central bank said, confirming the plan unveiled in December to partially offset this by doubling an older bond-buying programme to €40bn a month before slowing its pace back to €20bn by October.

The one notable change to its statement from December was that after saying the council stood ready to adjust all its instruments, it removed the words “in either direction” — but it was not clear if this was meant to signal a tightening had become more likely.

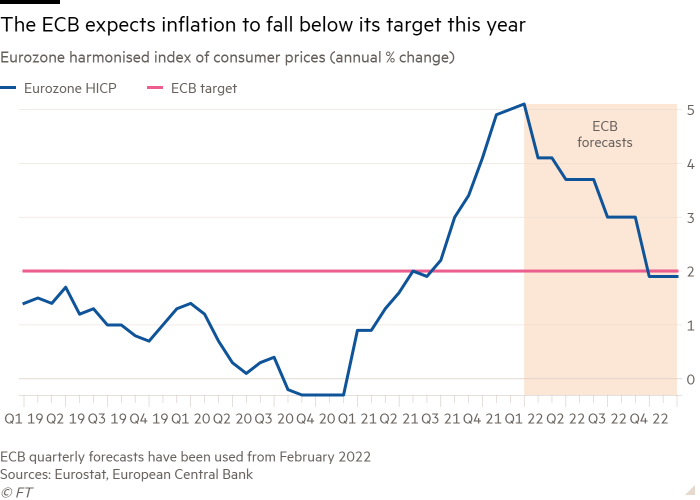

The announcement came after data this week showed eurozone inflation hit a new record of 5.1 per cent in January, well above the ECB’s 2 per cent target. Soaring prices are fuelling criticism that the ECB risks falling behind the curve on inflation and being forced into a painful policy U-turn.

ECB president Christine Lagarde is expected to be questioned about the rising cost of living at a press conference on Thursday after investors bet the central bank will be forced to change course and raise rates several times this year.

Carsten Brzeski, head of macro research at ING, said: “No one could have seriously expected the ECB to act today as there is simply nothing the ECB can do to bring down inflation immediately.” He added: “Today, it will be all about the tone and words.”

Higher than expected inflation has already led the US Federal Reserve and the Bank of England to shift to more “hawkish” policy stances. The BoE raised its main policy rate to 0.5 per cent on Thursday, less than two months after upping it to 0.25 per cent, while investors are pricing in five rate rises by the Fed this year.

In contrast, the ECB has continued to dismiss the idea of raising rates this year. The central bank on Thursday repeated its stance that it will not raise rates until it forecasts that inflation will stay above 2 per cent for much of the next two years and even then it will only do so once it stops net asset purchases. It is due to publish new quarterly inflation forecasts in March.

Jürgen Stark, the German economist who left the ECB board in 2011 in protest over its bond purchases, accused the bank of having “grievously neglected increasing signs of a prolonged and unacceptably higher inflation that could become self-reinforcing”. Writing in Die Welt newspaper last week, Stark said: “It is now time to shift into reverse gear.”