Happy New Year!

Well, happy for some anyway. Because having returned bleary eyed to our desk this morning from a late flight, we revved up our chosen stock market data to see what can only be described as a Shining elevator-esque cascade of red across the most popular corners of the stock market.

Year-to-date, growth stocks — whether it be Europe’s €66bn premier payments company Adyen or the ludicrously expensive enterprise software play Snowflake — have been butchered. Conversely, old world cyclicals in sectors such as banking, energy and industrials have held up, and even outperformed.

Here’s a neat chart from the FT’s excellent Eric Platt and Joe Rennison from Wednesday that sums up the price action in this violent market rotation:

Wednesday proved no different, with speculative tech funds such as ARK’s Innovation ETF down another 7 per cent at close, thanks to further sell-offs in its core holdings such as streaming hardware and platform business Roku (down 11 per cent on the day), digital signature software player DocuSign (down 6.7 per cent) and sum of all HODLer hopes and dreams, Tesla (down 5.4 per cent). But picking on Cathie Wood’s flagship fund, which is now down 11 per cent year-to-date, is unfair. No growth stonk has been spared. Indeed, even the crypto took a hit after market close Wednesday, with bitcoin down 7 per cent over the past 24 hours to $43,000, and ethereum, the thinking man’s crypto, off 11 per cent to a touch below $3,400.

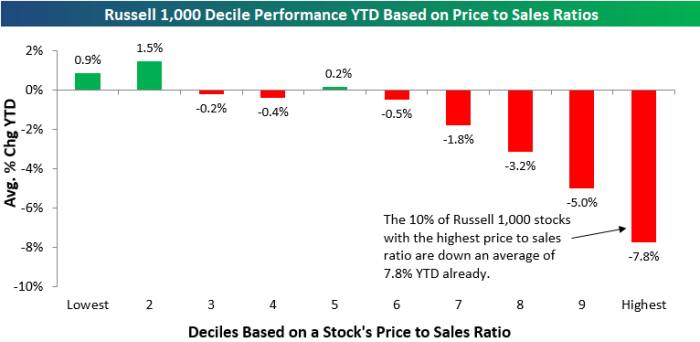

Expressing the market action succinctly is tough, but this chart from Bespoke Investment Group does a good job of showing which corners have been burned, and which have been spared the fire. Price is what you pay, value is what you get:

So what’s going on?

It’s tempting to blame the Fed. The minutes from December’s FOMC meeting, out Wednesday, signalled it plans to end its bond-buying programme faster than expected and may hike interest rates “sooner or at a faster pace” to deal with inflation.

This idea plays to the theory that stocks are priced at sum of their future cash flows, so a higher discount rate, all else being equal, will drag down the valuations of those businesses where the majority of their expected earnings are in the distant future. Rather than the here and now.

But, in a market which moves off the whims of Elon Musk tweets, co-ordinated option buying from Redditors and Robinhood’s operational performance, it feels a little too technical an explanation to FT Alphaville. For instance, if you expect to double, triple or even quadruple your money on a stonk, do you really care if the 10 year Treasury trades at 1.5 per cent, or 1.7 per cent?

Explanations abound. Sectors badly damaged by fears over the Omicron variant in December, in particular travel, have recovered on hopes its lesser severity offers a path out of lockdowns. Many of these companies — such as Ryanair, easyJet and Jet2 — approached pre-vaccine levels before Christmas, so a bounce is understandable with Omicron fears fading.

Yet, if you ask FT Alphaville, it’s pretty simple. We are, and have been, in a sentiment driven stock market. The sentiment was good. And now it’s bad.

Fundamentals were forgotten about a long, long time ago. We might be about to find out if they matter again.