Right now, the dollar is the world’s most popular reserve currency by some margin. It plays a vital role in facilitating world trade and global finance, enabling the US to use it as a mightily effective weapon against those who stand against the aims of its foreign policy.

Yet some think the weaponisation of the dollar against Russia will hasten the dollar’s demise. Countries at odds with Washington will start switching their war chests of reserves into other currencies, they argue. Add this to the long-term trend of America’s declining share of global output and trade and the dollar’s future would seem dark.

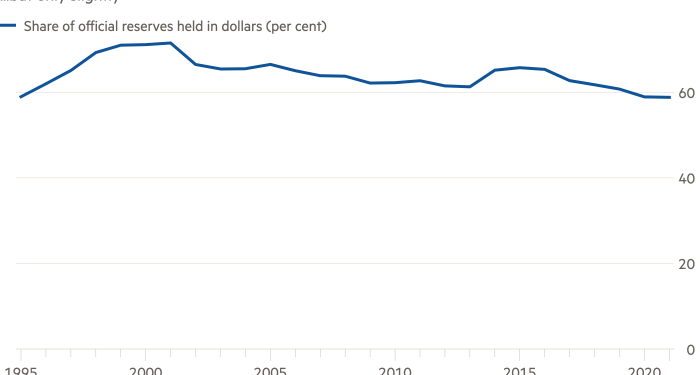

Yet, shifting the composition of your reserves is easier said than done. While the dollar’s appeal has waned, the switch to other currencies has only been slight — as the IMF’s latest Cofer figures show:

History offers some clues on how things might shake out. As a note published by Goldman Sachs’ Cristina Tessari and Zach Pandl last week points out, a nation’s reserve currency status often lingers longer than other facets of its global dominance.

The Goldman note looks to the example of the UK, from whom the US inherited its reserve currency crown. Here’s the back-story:

Sounds familiar to the dollar’s role in global finance today right? So what comes next?

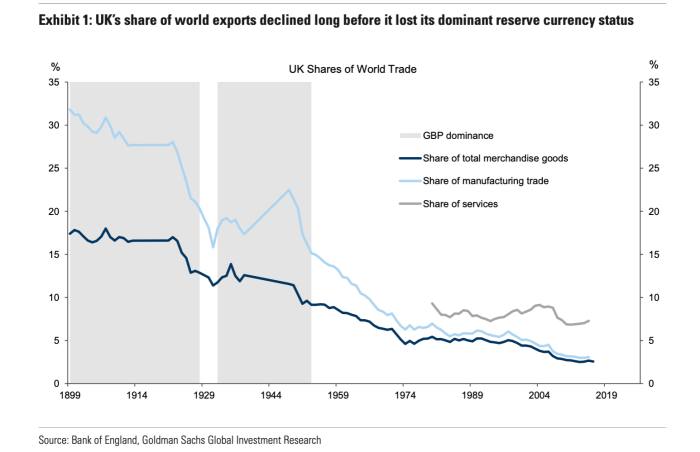

Well a drop in the UK’s economic influence did not immediately lead people to ditch sterling. While Britain’s share of world trade began to decline during the 1920s, the pound remained the reserve currency of choice up until the second half of the 1950s, when it was finally overtaken by the dollar.

Goldman Sachs argues that the dollar today faces many of the same challenges as the pound in the early 20th century. Those include a small share of global trade volumes relative to the currency’s dominance, a deteriorating net foreign asset position, and adverse geopolitical trends.

At the same time, there are important differences — among them less severe domestic economic conditions than those the UK faced in the 1950s. Which leads to this conclusion:

Interesting indeed.

However, we think there are other important differences between then and now that the note neglects to mention. Chiefly the question of dollar substitutes.

Right now the biggest threat to Washington’s dominance, both militarily and economically, is Beijing. Yet there remain a dearth of yuan-denominated assets that investors can purchase.

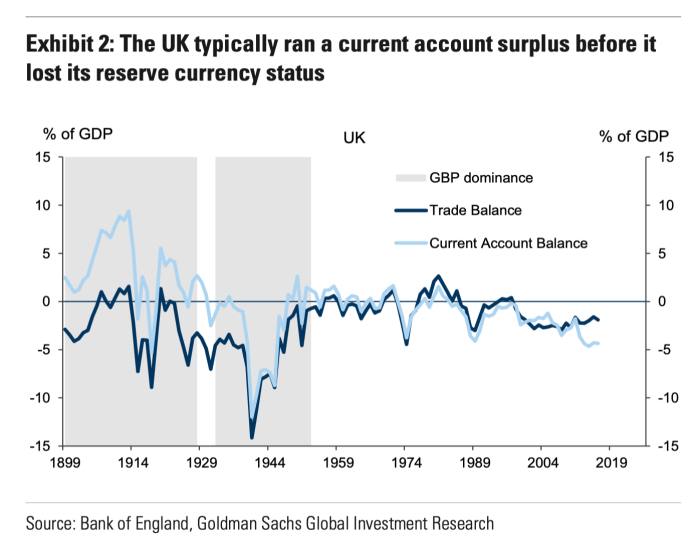

This isn’t necessarily about China needing to turn its current account surplus into deficit and create the equivalent of the US Treasury market. As the Goldman note rightly points out, the UK often ran current account surpluses during the period when the pound was the most popular global currency.

Yet it will need to open up access to its capital markets far more than it has done so far. For all the talk of ending the dollar’s hegemony, Beijing is only letting the renminbi become more convertible on its own terms. Which happen to be rather slower than international investors would like.

Secondly, money is as much a legal construct as an economic one. The dollar’s dominance works because people largely trust things like New York law, and institutions like the Federal Reserve (no sniggering at the back please). And there is relatively little difference between them and the legal framework of England and Wales (and the workings of the Bank of England). Certainly when one sets them against the decision-making process in Beijing.

However, that does not mean that the dollar’s dominance is entirely unassailable. We imagine most people reading this would rather have the US as the world’s financial policeman than China. But the reality is that many in positions of power in places like India, or Brazil, may not share that view.

The greenback’s reserve status reflects many things — including how willing other countries are to align themselves with US foreign policy. And how powerful those countries that do share Washington’s views are on the global stage.

Which leads us to conclude that rather than trying to work out whether the dollar will be toppled, a more probable course may be a move to a multipolar world of two economic systems. One where the greenback remains top dog, another where it is supplanted by the renminbi.