Didi has begun informal discussions with the Hong Kong stock exchange about a public listing, according to two people familiar with the situation, as the Chinese ride-hailing leader tries to return home after its disastrous IPO in New York.

Chinese regulators in effect crashed Didi’s business in the days after its US debut last June, ordering its apps to be deleted from mobile-app stores and launching investigations into how it handles data. Didi’s shares, which began trading at $14, are now worth $4.90, having lost more than $40bn in market value.

A listing in Hong Kong is now critical for the group, after which it will start the delisting process in the US, offering holders of its US shares a one-for-one swap with its HK shares, according to one big Didi investor.

“This is the suggestion from the Chinese [government], so if they can’t pull this off then they are in the penalty box forever,” the investor said.

But a Hong Kong listing will not be straightforward and could yet take a long time to arrange, company insiders and analysts said.

Two big challenges are the unresolved government investigation into Didi and its continuing problems obtaining the correct permits for its business and drivers in several cities across China.

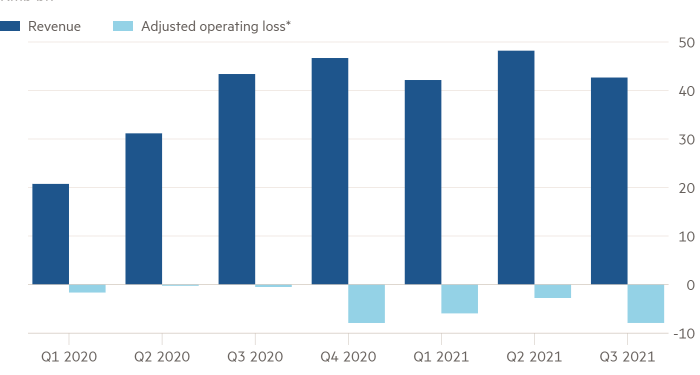

While it has been placed in limbo Didi has seen losses balloon to $7.6bn in the first nine months of last year. It is on track to burn through its cash pile and short-term investments by the middle of 2023 at its current rate of spending.

The central government investigation into Didi, which saw seven agencies, including the much-feared Ministry of State Security, send officials to its headquarters, remains unresolved.

In the initial turmoil, investigators halted all of Didi’s marketing campaigns for 45 days and banned the company from making public statements without their sign-off.

Six months on, the investigators have left Didi’s offices and filed their reports, according to two people familiar with the matter, and company insiders are waiting nervously for the verdict.

One person close to Didi’s executive team insisted that the probe had not uncovered any substantial evidence of the central allegation that Didi was transferring or exposing its sensitive data, including the ride-hailing requests to and from government ministries in Beijing, to the US.

But the person predicted that Beijing “will still find something Didi did wrong” to make an example of the company. While Didi has been allowed to announce that it wants to list in Hong Kong and to release its earnings, there is still no sign of when it will be able to offer its apps to the public again.

To try to placate the government and improve its political standing, Didi has tried to bring in state-backed investors as shareholders, according to two people involved in the process.

Founder and president Jean Liu has courted several state-backed groups, including rival ride-hailing group Shouqi and the state-owned conglomerate CITIC, but the approaches have not yet led to a deal.

Didi and CITIC Capital declined to comment. Shouqi did not respond to a request for comment.

A formal end to the investigation and the return of its apps to online stores are essential to a listing in Hong Kong, said a former executive at the exchange previously involved in vetting IPO candidates. Otherwise, “the business is not sustainable and does not satisfy exchange rules”.

But HKEX’s review process also includes a “suitability” requirement, which assesses whether companies are compliant with regulations. This was the hurdle that persuaded Didi last year to reroute its IPO to New York instead.

Local authorities across China told the Financial Times that Didi remained in breach of strict rules that required ride-hailing apps to obtain three permits from each city they operated in: a company licence, and a permit for every driver and every vehicle.

In its major market of Shanghai, an official at the road transport bureau told the FT: “[Didi] doesn’t have the correct permits, they are definitely operating here illegally.”

“We’ve fined [Didi] more than Rmb100m, but they are an internet company, so the force of the penalties we can levy don’t have much impact,” the official added.

She said her department had tried to get the city’s internet regulators to block Didi’s website and app but were stymied by jurisdictional issues since Didi’s website was not registered in Shanghai.

“We’re still collecting clues, materials and evidence to pass to the central transport department . . . perhaps they can put in place restrictions to have a bigger impact,” she added. Didi was one of a group of ride-hailing companies with poor compliance rates summoned for meetings in Shanghai in October, November and December, she said.

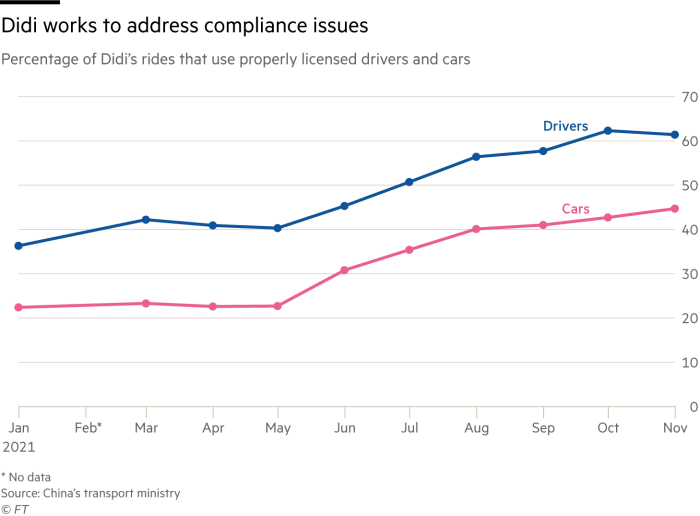

Government data show that in the month of December Didi was hit with hundreds of small fines over its compliance issues, of about Rmb10,000 ($1,570) in a number of cities across the country. In November just 44 per cent of Didi’s rides were fully compliant, though the company has made a steady improvement from the beginning of 2021.

Even in places where Didi has made progress, such as the southern city of Jieyang, where it gained an operating licence, challenges remain.

“Didi has had glaring problems operating safely and compliantly” the city’s transportation bureau said last month. “They have seriously lost our trust.”

A Jieyang official told the FT: “Didi is working with us on the rectification, but tangible results are still on the way . . . progress is a bit slow.”

Didi declined to comment on the fines and compliance issues. The person close to Didi’s executive team said the Hong Kong exchange wanted Didi to be fully compliant in 70 to 80 per cent of the company’s 100 biggest Chinese cities, but that it was impossible for Didi to do so quickly.

“HKEX lowering the compliance requirements is key to [Didi] being able to list there . . . there is currently no way that any ride-hailing company could get listed there,” the person said.

The person added that it was so far unclear if the exchange would lower its standards to accommodate the company. Didi’s rival Dida began the process for a Hong Kong IPO in the autumn of 2020, but remains unlisted so far.

Additional reporting by Maiqi Ding in Beijing