Will jobs data signal a soft landing for the US economy?

US jobs data for August are expected to come in lower than those for July, but remain in expansion territory — reflecting a 20th straight month of growth.

Economists project that figures on Friday will show the US added 290,000 jobs in August, marking a 45 per cent drop after July’s figure of 528,000 significantly surpassed estimates.

Jennifer Lee, a senior economist at the Bank of Montreal, said the August consensus reflects a sea change for employers, who may still need more workers, but have adjusted their expectations in a tight labour market where the unemployment rate sits at historical lows. BMO expects 250,000 jobs to have been added.

“Let’s say you were looking for 12 people to hire and you’ve been finding it very difficult to find the right people,” Lee said. “You might be thinking, do I really need another 12 people to hire? Maybe we can get by with only six [hires] . . . and squeeze a little bit more out of the existing workforce.”

Strong worker demand, combined with a recent durable goods report that reflected a monthly uptick in business investment, are indicators to Lee that the US economy is holding up even as the Federal Reserve raises interest rates to cool it.

Even as big retailers have cut their full-year guidance, they have still reported strong sales figures that signal resilience in US consumer spending. Macy’s and Nordstrom have in recent days topped analysts’ expectations for quarterly revenues, and Home Depot reported record-high quarterly sales earlier in August.

Lee said she expects a “significant slowdown” in the US economy in the second half of 2022 and into 2023, but is not ready to call this a recession.

“If it’s a recession, it’ll be the strangest one ever,” she said. Jaren Kerr

Have soaring natural gas prices propelled eurozone inflation even higher?

Eurozone inflation data for August will be closely scrutinised next week as investors question how far the European Central Bank will need to tighten monetary policy against a backdrop of soaring energy costs.

Escalating oil and natural gas prices, stoked by Russia’s war in Ukraine, pushed eurozone inflation to 8.9 per cent in July. Economists polled by Reuters expect that figure to reach 9 per cent when data are released on Wednesday.

Jane Foley, head of FX strategy at Rabobank, said increasing gas prices have caused investors to have a “real negative sentiment surrounding the eurozone that has built up over the past few weeks”.

Contracts linked to TTF, Europe’s wholesale natural gas price, hit a record high on Friday above €343 a megawatt hour.

The ECB is expected to raise interest rates by at least 0.5 percentage points at its September meeting in an effort to tackle record inflation. But investors are concerned that higher borrowing costs risk tipping the region into recession.

Germany’s central bank chief has already warned that inflation will not subside by 2023 and that the record energy prices triggered by Russia’s supply squeeze would push the country’s inflation to above 10 per cent by the autumn. Nikou Asgari

Did UK mortgage approvals drop further in July?

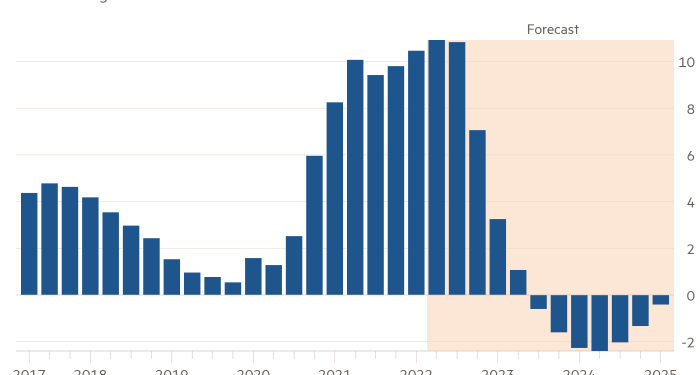

UK mortgage approvals are expected to have fallen further in July, continuing a downward trend caused by rising mortgage rates and historically high inflation.

Economists polled by Reuters expect the Bank of England to reveal that 61,750 mortgages were approved last month, down from 63,726 in June and from a peak of more than 100,000 in November 2020.

Bucking the trend, Sandra Horsfield, an economist at Investec, expects a small increase [to 64,100] but added that “their trend is still pointing down — a picture that, as long as interest rates are rising steeply and economic prospects and confidence are deteriorating, should remain in place”.

In June, the Bank of England’s data showed that the interest rate on newly drawn mortgages increased by 20 basis points (0.2 percentage points) to 2.15 per cent, the highest since 2016, following six consecutive policy interest rate increases by the BoE.

Market pricing implies expectations that the policy rate will more than double to 4 per cent by early next year from its current level of 1.75 per cent, as energy and consumer prices continue to soar.

As a result, consultancy Oxford Economics forecasts house prices will start shrinking on an annual basis from next year, down from the double-digit expansion of early this year.

“Skyrocketing house prices are likely to feel the pull of gravity from the escalating cost of living crunch come autumn, with the impending rise to the energy price cap set to further fuel inflation and the spectre of higher interest rates to combat rising prices upping borrowing costs,” said Myron Jobson, senior personal finance analyst at investment service provider Interactive Investor. Valentina Romei