Pyth — a crypto project built by some of the world’s largest high-speed traders — is to add a governance token to its network, in a bid to spur users to supply top-quality data to its feed of trading prices.

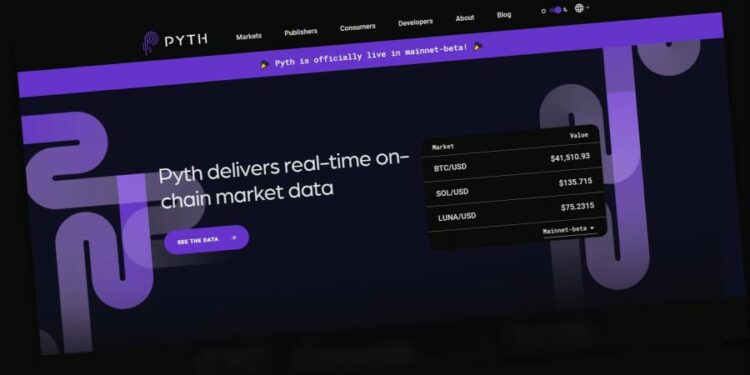

The digital token, called PYTH, could bring its owners fees from the information they supply to the Pyth project. Pyth acts as a price feed of data from equity, conventional currency, crypto and commodity markets.

The data is published on a blockchain anonymously in less than a second, and can be used for other crypto projects. Details were laid out in a white paper published by the Pyth network on Tuesday.

Pyth has persuaded traditional rivals such as Jump Trading, DRW Cumberland, Jane Street, GTS, Hudson River Trading and Two Sigma — some of the biggest traders in financial markets — to join crypto-native traders such as FTX, DV Chain and Genesis in supplying data to the price feed.

The project has been running since August, and more than 40 exchanges and trading institutions now contribute to it.

But in spite of its roster of reputable names, Pyth has occasionally been hit by bugs. One incident last September led the feed to post erroneously that the price of Bitcoin had fallen 90 per cent.

Pyth’s backers want to change the economics of and distribution for market data, which they say is too concentrated in favour of a few central parties, such as exchanges. Crypto technology offers a potential alternative, because a blockchain guarantees the provenance of an asset and its owner.

The white paper said that payments from users who take the data feed will provide an incentive to the companies that publish their data to the network.

If publishers distribute inaccurate data, the network may take away some of their PYTH tokens, the white paper said. It also proposed that about a fifth of the data fees per product will go into a reward pool.

Pyth’s long-term plan is to become a fully-decentralised organisation, whose rules are automated or developed by consensus among its members.

“Right now Pyth is built upon trust. Over time we want to really encode that. [The paper] shows how to reward accurate data and penalise inaccurate data,” said Mike Cahill, a board member of the Pyth Data Association, which wrote the paper.

“The vision for Pyth is to be the highest quality data oracle network.”

There will be 10bn PYTH governance tokens in issue, and the white paper said the total supply would not increase. Moreover, 85 per cent of the tokens will be locked, and cannot be traded, at the start. They will be steadily unlocked monthly over seven years to increase the supply to the market over time.

Before then, the Pyth Data Association expects to transfer full control of the protocol to token owners.

Users with an as-yet unspecified minimum of PYTH tokens that have been staked in the network will be able to make governance proposals and vote on developments for the network. Early participants in Pyth may receive further tokens.