Coinbase is slowing its hiring plans in the latest sign that a sharp pullback in the trading of digital tokens such as bitcoin is exacting a heavy toll on the one of the world’s biggest crypto exchanges.

The US group made the announcement in a letter to employees, which was disclosed in a filing with the Securities and Exchange Commission on Tuesday. Last week, it revealed net losses of $430mn in the first quarter, far worse than analysts had expected.

The slowdown marks a drastic change of strategy for Coinbase, which had been planning a further aggressive hiring spree for a second year in a row.

In February, the US-listed company detailed plans to add 2,000 employees to product, engineering and design, further swelling an employee base that had grown to 3,730 people at the end of last year. A year earlier, the exchange had just 1,250 employees.

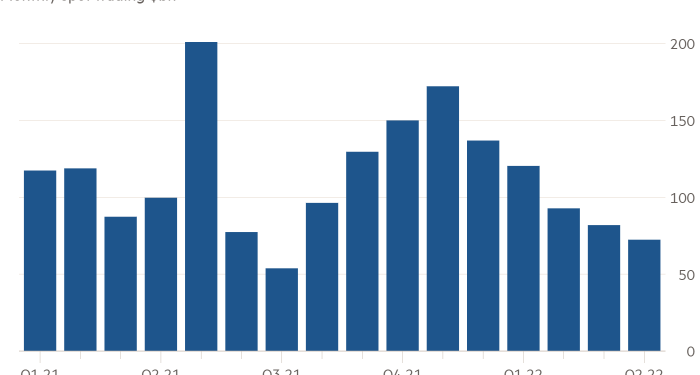

But crypto traders have been put off by heavy falls in the value of digital assets this year. Spot trading of digital tokens on Coinbase registered at around $72bn in April, compared with an average of $118bn over the previous 12 months, according to CryptoCompare data collated by The Block Crypto.

The cooldown comes as the total circulating value in the crypto market has declined by more than 40 per cent to $1.4tn this year. Bitcoin, the world’s most popular cryptocurrency, recently slumped below $30,000 for the first time since July 2021.

Emilie Choi, Coinbase’s president and chief operating officer, said in the letter to employees that the decision to slow the group’s pace of growth was taken in a bid to meet the financial targets it had given investors for its second quarter.

“Given current market conditions, we feel it’s prudent to slow hiring and reassess our headcount needs against our highest-priority business goals,” Choi wrote.

Coinbase’s revelation last week that fewer trades were being transacted on its marketplace than in the previous quarter has badly shaken investor confidence. The company’s shares have lost around three-quarters of their value this year, but news of the slowdown in hiring pushed shares up around 6 per cent in pre-market trading on Tuesday to about $65. This remains well below the $381 opening price at its direct listing last April.

“We know this is a confusing time and that market downturns can feel scary,” added Choi. “But as we said at last week’s Town Hall, we plan for all market scenarios, and now we are starting to put some of those plans into practice.” She noted that it was not the first market downturn the exchange had witnessed.

Investors have also taken fright at Coinbase’s disclosure that customers’ money could be at risk if the company went bankrupt. Funds would not be ringfenced and secure — as they would at a bank — but could go into the general fund for all unsecured creditors, the company said in a regulatory filing.

The company said the disclosure was part of new requirements from US regulators. “We have no risk of bankruptcy. Your funds are safe at Coinbase, just as they’ve always been,” chief executive Brian Armstrong wrote on Twitter.

David Trainer, chief executive of investment research firm New Constructs, recently told the Financial Times the crypto exchange needed to address investor concerns. “This public acknowledgment could spark fear in the company’s clients. We’re not sure that this stock is worth more than the cash on its books, or $33 per share,” he added.