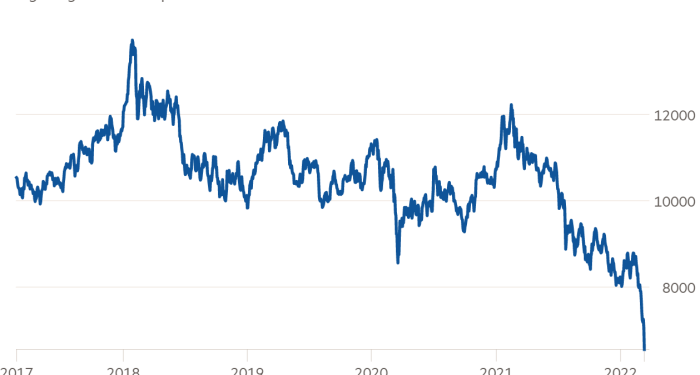

Chinese stocks in Hong Kong fell the most since the global financial crisis, as the country’s worst nationwide outbreak of Covid-19 since the pandemic began threatened valuations across every sector from technology to casino gambling.

The Hang Seng China Enterprises index of mainland Chinese stocks closed more than 7 per cent lower on Monday after authorities announced a six-day lockdown in the tech and manufacturing hub of Shenzhen. That marked its largest one-day fall since November 2008.

China had until recently managed to contain outbreaks of the virus with the strategy it developed early in the pandemic: citywide lockdowns, mass testing and stringent contact tracing whenever an infection is detected. That has prevented nationwide waves of Covid for most of the last two years.

But strategists and economists warned that with daily cases now numbering in the thousands, more cities could soon follow the example of Shenzhen, which has shut down public transport and travel into and out of the city for a week. The drop in stocks shows that this can still bite investors.

“If the lockdown is extended, China’s economic growth could be significantly affected,” said Raymond Yeung, chief economist for Greater China at ANZ. He added that just a one-week lockdown of the affected region could shave as much as 0.8 percentage points off annual economic growth.

Losses were especially sharp on Monday for issuers with heavy exposure to sectors most vulnerable to economic disruption, including consumer and travel stocks. The Hang Seng Tech index of large Chinese tech groups fell a record 11 per cent, as did a Bloomberg index of listed casino operators in Macau.

Dozens of factories in Shenzhen have already been ordered to close, including those of Apple supplier Foxconn, as the worsening outbreak tests President Xi Jinping’s commitment to the zero-Covid strategy adopted at the outset of the pandemic.

Analysts at ING said there was “no suggestion” Beijing was prepared to loosen up Covid controls as Omicron cases rocketed higher. They also warned that any discovery of Covid at Shenzhen’s port of Yantian could suspend operations for at least two weeks, exacerbating supply chain issues already affecting global electronics manufacturers.

Russ Mould, investment director at AJ Bell, said reports that Russia had asked China for military equipment to support its invasion of Ukraine were also weighing on Chinese stocks.

The effects of the lockdown in Shenzhen, a hub for electronics manufacturing, would be felt far beyond China’s borders, he added: “Any prolonged disruption to operations could cause yet another global supply chain crunch.”