Berkshire Hathaway won the approval of a US energy regulator on Friday to buy up to 50 per cent in Occidental Petroleum, giving Warren Buffett’s company the option to vastly increase its stake in one of the US oil industry’s most storied producers.

The Federal Energy Regulatory Commission said Berkshire’s proposal to increase its stake in the $60bn oil company, filed last month, was “consistent with the public interest”. Berkshire had requested “authorisation to acquire up to 50 per cent” of Occidental, Ferc said.

The regulator weighed in on the application because of its potential effects on Midwestern electricity markets. Occidental’s shares jumped 9.9 per cent to $71.29 after the Ferc filing.

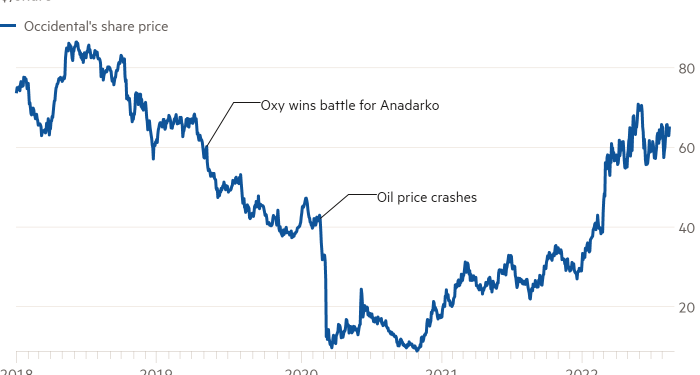

Buffett’s support was instrumental in Occidental’s $55bn takeover of Anadarko Petroleum in 2019. Occidental chief executive Vicki Hollub flew to Berkshire’s headquarters in Omaha to secure a $10bn financing package to close the deal. Berkshire took preferred shares as part of the deal and was given warrants that now entitle it to buy up to 83.9mn shares of Occidental’s common stock.

But the transaction closed just months before the coronavirus pandemic hit oil prices, heaping pressure on Occidental after it had taken on large debts to finance the Anadarko deal.

This year Berkshire has spent billions of dollars to purchase shares of Occidental in the open market. Its position in the company recently eclipsed 20 per cent, prompting speculation Berkshire could buy the business outright.

Berkshire has moved more aggressively this year to step up investments as its cash pile has swelled, and its wagers on the energy industry have stood out. Alongside purchasing tens of millions of shares of Occidental, Berkshire has ploughed money into Chevron, which ranked among its largest public investments at the end of the second quarter, worth about $24bn.

Jim Shanahan, an analyst with Edward Jones, estimated Berkshire would soon exercise the warrants to buy the 83.9mn shares, saving it more than $900mn based on Occidental’s current share price.

Berkshire did not respond to a request for comment.

An Occidental spokesman said the Ferc approval had been necessary for Berkshire to secure 50 per cent of the producer’s common shares because it owned assets subject to Ferc’s regulation. The prior approval threshold was 25 per cent, a level Berkshire was approaching.

Buffett has invested in energy companies, but for years he has primarily targeted electric utilities and pipelines. The businesses have been seen as a natural way for Berkshire to deploy the cash it generates, given the large capital projects they entail.

The anointment of Greg Abel as Buffett’s successor has also stoked expectations of more energy investment, as he rose through Berkshire’s energy unit and worked on some of the company’s bigger deals in the sector.

While the 2020 oil crash hit Occidental hard, forcing it to cut its dividend and rein in drilling plans, it has been one of the stars of the recovery, as months of capital discipline and rising oil prices have repaired the debt-laden balance sheet.

Occidental has also sought to reposition itself as one of the sector’s leaders on climate, setting a target for net zero emissions by 2050, including from the products it sells, installing renewable energy facilities in Texas, and proposing to scale up carbon capture technology.

Its net zero strategy would also leave it in a “tax advantaged” position because of tax credits available for carbon capture techniques in the Inflation Reduction Act passed by Congress, said Paul Sankey, an oil analyst at Sankey Research.

“Buffett’s Oxy investment has been a home run so far,” said Andrew Gillick, strategist at consultancy Enverus. “Now he’s doubling down on a company that is churning out free cash flow from traditional oil and gas, and is about to be a leader in the kind of carbon reduction technology the federal government is supporting.”