Investors have been waiting for a wave of Russian companies to default on their debts since the west froze Moscow out of the global financial system in retaliation for the war in Ukraine. So Gazprom’s decision to repay a $1.3bn bond in full on Monday caught bondholders off guard.

Earlier this month, president Vladimir Putin described those countries imposing economic sanctions as “unfriendly”, and said Russian companies could repay investors there in roubles rather than foreign currency — effectively a default in all but name. And yet fund managers in Europe and the US got their dollars back from Gazprom two days later. Oil company Rosneft followed suit with a $2bn repayment on Thursday.

But not all Russian borrowers are paying up. Investors said they were yet to receive a coupon payment on a Russian Railways euro-denominated bond which had been expect to arrive on Thursday, Bloomberg reported.

The result is confusion among foreign investors, who hold some $21bn of Russian foreign-currency corporate debt.

“Gazprom and Rosneft have shown investors that the situation can be very uncertain right up until the last minute,” said Sergey Dergachev, head of emerging market corporate debt at Union Investment. “Whether companies go on paying will depend on the future path of sanctions on Russia.”

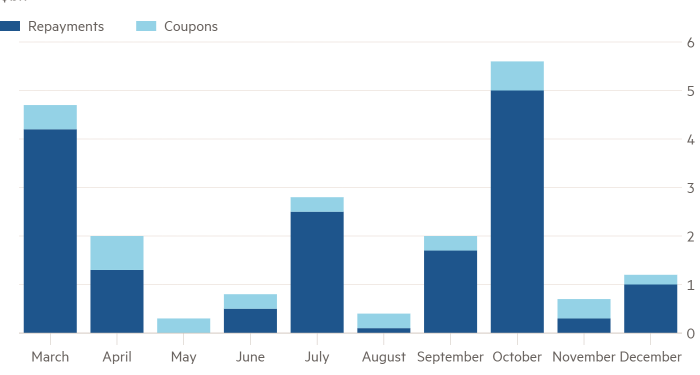

Russian companies have $98bn of foreign currency bonds outstanding, according to JPMorgan, down from a peak of $169bn in 2013, the year before Moscow’s annexation of Crimea. Almost half of that $98bn is due for repayment in the next three years, with $17bn owed in 2022 alone.

Russia’s corporate bond market is highly concentrated, with the biggest oil and gas companies such as Rosneft, Transneft and Gazprom accounting for around half of the total. Among the biggest holders of Gazprom’s foreign currency bonds are Pimco, Carmignac Gestion, and Vanguard, according to Bloomberg data.

This week’s repayments demonstrate that firms with a significant presence outside Russia and large dollar revenues are able and willing to use their foreign currency to repay bondholders.

“It seems like some Russian corporates are trying to keep things as normal and friendly as possible with creditors, perhaps there’s a gentleman’s agreement [to continue paying],” said Charles-Henry Monchau, chief investment officer at Syz Bank, who added that it was unlikely Gazprom and Rosneft had acted without Putin’s consent.

But investors are not assuming a general willingness on the part of corporate Russia to continue to honour overseas debts, particularly given the government — which faces an interest payment on its dollar debt next week — is widely expected to default in the coming weeks.

“While we see a possibility for continued debt service made from funds already offshore, it will become increasingly difficult for debtors to continue to access hard currency and pay,” said analysts at Citi in a note to clients. “If the sovereign defaults, it may be politically impossible for corporates to [pay].”

Investors are also nervous that the Gazprom and Rosneft payments were already in train before Putin issued his rouble-repayment plan at the weekend — and so may not set a precedent for upcoming redemptions.

“It’s possible the decree came later and they just chose not to cancel payment instructions,” said Kaan Nazli, a portfolio manager at Neuberger Berman.

The next tests of Russian companies’ willingness to pay comes with upcoming redemptions including a $483mn bond from gold mining group Polyus — one of 26 natural resource companies to have had its credit rating downgraded by Fitch in recent weeks — on March 28 as well as $625mn from Russian Railways and $156mn from oil conglomerate Borets International.

Investors are likely to remain in the dark until the last moment, creating an uncomfortable situation for bondholders — and a potential opening for opportunistic buyers. Funds that sold the Gazprom bond at prices as low as 50 cents on the dollar last week lost out, while those lucky enough to scoop up a bargain doubled their money in a matter of days.

Such a strategy remains risky, though. It is “highly likely” that many Russian firms would default on their debts at some point this year, said Liam Peach, emerging market economist at Capital Economics. “Russian corporates should, in principle, benefit enormously from sky-high commodity prices,” Peach said. “But revenues of export-orientated companies are likely to be affected by sanctions, restrictions on international trade and ‘self-sanctioning’ by foreign businesses.”

Many investors are choosing to sit on their hands, reluctant to transact in a market where the gap between offers to buy and sell bonds has ballooned.

“It’s almost impossible to get a full picture of what’s going on,” said Dergachev. “So we’re not adding to positions, but we’re not selling.”