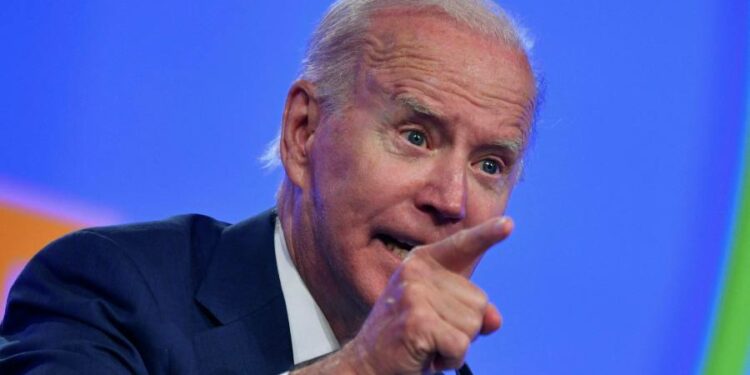

US president Joe Biden on Wednesday took aim at refiners for not producing more petrol, saying their rising profit margins “at a time of war” were “not acceptable”.

In letters sent to seven oil companies including ExxonMobil, BP, Shell and Valero, Biden called for “immediate actions” to supply more fuel, and said the administration was prepared to use “all reasonable and appropriate” tools to help increase supply in the near term.

Biden called on the refiners to explain why they had shut down some plants that make fuel, which had contributed to “an unprecedented disconnect between the price of oil and the price of gas”.

“There is no question that Vladimir Putin is principally responsible for the intense financial pain the American people and their refineries are bearing,” the president wrote. “But amid a war that has raised gasoline prices more than $1.70 a gallon, historically high refinery profit margins are worsening that pain.”

Neither the companies nor their trade groups immediately responded to requests for comment.

Analysts said the letters were another effort to shift blame for an oil market rally that has prompted US petrol prices to more than double since Biden entered office last year, hitting a record high above $5 a gallon last week.

American petrol prices, equivalent to about £1.07 per litre, remain well below levels in Europe, but have fuelled decades-high economy-wide inflation in the US, sapping Biden’s approval ratings ahead of crucial midterm elections this year.

Some US oil companies and refineries are reporting record cash flows as soaring global demand for their products, coupled with tepid supply growth, helps push crude and petrol prices to multi-year highs.

In a bid to drive down crude prices, the White House has since August repeatedly called on Opec+ producers to increase supply, released record amounts of oil from a federal strategic petroleum stockpile, and recently loosened pollution controls on petrol blends.

Biden will also travel to Saudi Arabia, the world’s top oil exporter, next month during a trip to the Middle East — part of a thawing of relations between the White House and the Saudi court.

Oil prices have doubled since the start of 2021, including the sharp rise this year following Moscow’s invasion of Ukraine and a widening embargo on Russian crude.

The Biden administration has also called on US shale producers to increase production, reversing earlier efforts to limit drilling. US oil output remains well below the highs struck before the pandemic.

US refining capacity averaged 18.8mn barrels a day in 2019 but has fallen below 18mn b/d this year — due in part to the collapse of refining margins during the pandemic and the high cost of maintaining operations, analysts say.

Global refiners’ output has also decreased because of a drop in refined products from China. Sanctions on Russia threaten to tighten supplies further.

Analysts said there was little refiners in the US could do in the short term to fix the shortages — and that adding new capacity may compromise their climate pledges.

“There’s no refining capacity sitting on the sidelines idle that would not require a lot of time and money to restart, meaning it can’t help during the summer at the very least,” said Robert Campbell, head of energy transition research at Energy Aspects.

For some that recently shut refineries, such as Shell, resuming operations would significantly increase their greenhouse gas emissions, Campbell said, adding that doubts about long-term oil demand made costly investments difficult.

“I understand that many factors contributed to the business decisions to reduce refinery capacity, which occurred before I took office,” Biden wrote in his letters, which were also sent to Marathon Petroleum, Phillips 66 and Chevron. “But at a time of war, refinery profit margins well above normal being passed directly on to American families are not acceptable.”