A computer-powered investment fund run by AQR posted double-digit gains in the opening days of 2022, building on a strong performance last year that has bolstered industry hopes that the long “quant winter” has finally passed.

AQR Capital Management’s Absolute Return fund, which combines a broad array of investment strategies, last week notched up gains of 10.4 per cent net of fees. The rise marked its strongest ever five-day period since inception 23 years ago, according to people familiar with the matter.

AQR’s co-founder Clifford Asness described the week as “epic” on Twitter. Absolute Return’s gains come after returning 16.8 per cent to investors in 2021.

The strong run for AQR, which was one of the victims of a years-long period of lacklustre returns produced by traders that use fast computers and mathematical models to place bets, comes as the broader industry is also showing signs of recovery.

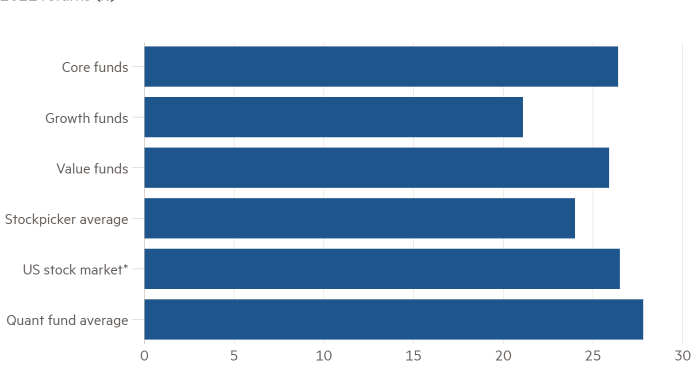

The average quant equity fund tracked by Bank of America returned 27.8 per cent last year, compared with the US stock market’s 26.5 per cent returns and the average 24 per cent gains of traditional stockpickers.

“It looks like 2020 was more of a bump in the road than something fundamental,” said Isabelle Bourcier, head of quantitative investing at BNP Paribas Asset Management. “The recovery in 2021 has been quite good and I’m confident for 2022.”

Many of the bigger market signals exploited by quantitative investors have struggled in recent years, with the outbreak of the Covid-19 pandemic proving to be particularly rough on some strategies. This had sparked a debate over whether quant investing was merely suffering a bad spell or had become obsolete.

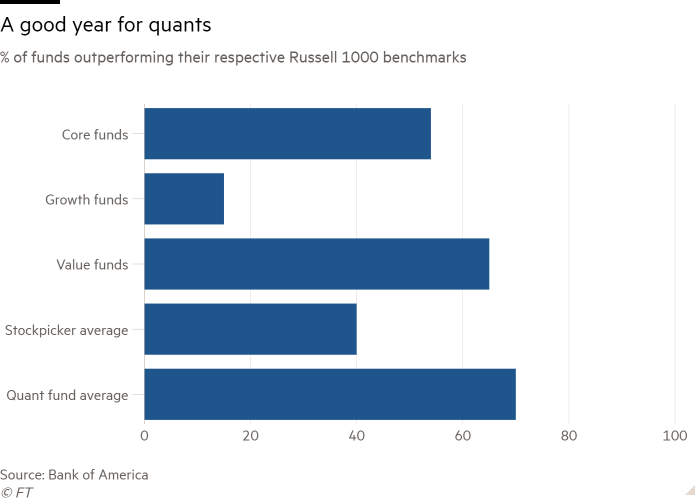

However, last year’s performance indicates a strong turnround. About 70 per cent of large quant funds outperformed their benchmarks in 2021, according to BofA, compared to just 40 per cent for stockpickers. Quant funds focused on smaller stocks did even better last year, with all but one of the 15 funds monitored by BofA outperforming the Russell 2000 index of smaller listed companies and outperforming by 12 percentage points on average.

“We are encouraged by the exceptional performance across our strategies to start 2022, especially following a strong year for many of them in 2021,” Asness said in an email. “While timing is always uncertain, and it won’t be a straight line, we believe this positions AQR for one of the most robust recoveries for factor investing since the tech bubble of 1999.”

Quantitative investment strategies vary greatly, from the complex and expensive — typically run by big hedge funds in London, New York or Hong Kong — to simpler forms that can be packaged up and sold to ordinary investors through mutual funds or even exchange traded funds.

The latter often involves seeking to take advantage of longstanding market patterns known as “factors” or “risk premia”, such as the tendency of unglamorous or steady stocks to outperform the broader market in the long run, or that past winners often keep outperforming past losers.

One of the biggest challenges confronting more mainstream quant strategies was the long stretch of miserable performances suffered by the “value” factor — systematically buying low-valued stocks and avoiding or betting against expensive ones. Despite a century of data indicating that they tend to do well in the long run, value strategies suffered a barren decade before the pain was compounded by the pandemic.

However, value stocks enjoyed a renaissance last year, with long-shunned areas such as energy and banks rediscovering their vim and topping the table of the best-performing sectors in 2021. US energy equities alone returned about 46 per cent last year — their biggest gain in at least two decades.

“This showed typical signs of a post-recession recovery with investors taking on more risk as fiscal stimulus and dovish monetary policy encouraged the markets to look past the pandemic,” Hal Reynolds, chief investment officer of Los Angeles Capital, a quantitative asset manager, said in the firm’s year-end review.

Many in the quant industry expect the resurgence of value stocks to continue — given how cheap several remain compared to the broader stock market — and hope this will entrench the recovery and attract investors back to quant strategies. The first trading days of 2022 have been exceptionally good for value and painful for previously high-flying “growth” stocks.

But it may not be plain sailing, according to some quant analysts. Eric Sorensen, a veteran of the industry who led a pioneering quant research desk at Salomon Brothers in the 1980s, is optimistic that the coming year will prove to be fertile for many strategies. But he argued that some rivals were not evolving enough.

“I think there’s still a lot of quantitative firms who go the easy route and say: ‘Well, this stuff is working again. I’m just going to go back and use what has been shown to work in the past’,” said Sorensen, the chief executive of quant asset manager PanAgora. “I don’t believe you can do that. I think you have to stay ahead of the curve.”

Moreover, the financial environment is becoming more treacherous. Reynolds at Los Angeles Capital cautioned that the cross-currents of 2022 — a stubborn pandemic, economies in flux and central banks tightening monetary policy — could shake things up.

“The accelerated rollout of vaccines globally suggests we are on a strong path to recovering from the economic crisis, but the effectiveness of the vaccines against new strains and the extent to which health policy can remain ahead of the virus path will be important risk factors,” he said.