One thing to start:

-

High oil prices are testing the discipline of US shale producers and their promise to keep returning capital to shareholders.

Welcome back to another Energy Source.

Soaring energy prices remain a big theme for us today. The US government’s claim of an imminent Russian invasion of Ukraine (which has been denied by Moscow) are one source of bullish sentiment. And for good reason, given that a conflict involving two major commodity producers would feed into fears of wider global shortages.

But it isn’t just a supply matter. Demand is ripping higher, especially in the US, where petroleum consumption has soared in recent weeks. For more on this see our first note.

We also have another round-up of developments across the Atlantic. Data Drill breaks down Americans’ top concerns about owning an electric vehicle. Addressing these worries could help spur EV adoption.

Oil demand spikes

America’s thirst for fossil fuels has never been greater.

Last week, the Energy Information Administration, the US government’s energy forecaster and data shop, said the four-week average for total petroleum product demand — which includes petrol, diesel, jet fuel and others — was running at 21.9mn barrels a day. That’s a record high — and 12 per cent higher than this time last year.

It is both an extraordinary reversal from the pandemic-driven collapse in fuel demand and a worrying data point about fossil fuels’ stickiness in the energy transition.

We took a closer look at the demand numbers to see what drove the record consumption (frigid weather across the north-east US was a big factor), the fuels recovering fastest from the downturn — and what it all tells us about the coming months as surging demand threatens to bring about $100-plus oil prices.

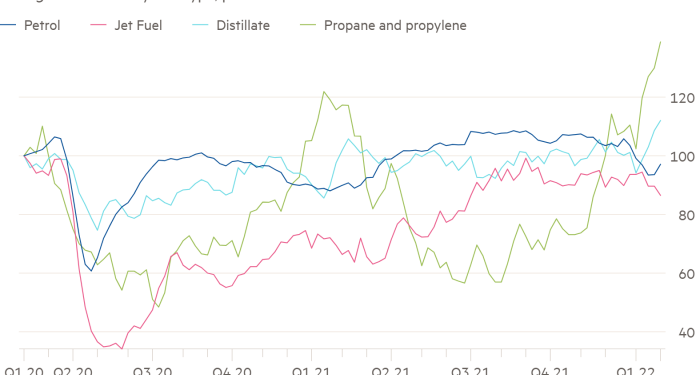

Here is a chart on the change in US demand for major fuels compared to February 2020, just before the start of the pandemic.

First, diesel, propane and other so-called heavier fuels spiked in January and early February as winter storms blanketed the north-east. Many generators and homes turned to these products to stay warm and keep the lights on as demand surged.

The EIA noted that at one point, oil-fired electricity generation — usually seen as a relic of a dirtier energy past — was delivering more than 20 per cent of the north-east’s power to top up insufficient gas and renewables supply.

This surge is largely responsible for pushing consumption to the record highs seen over the past month and are likely to fade with warmer temperatures.

Still, there appears to be plenty of room for demand for other fuels to continue to march higher and push overall consumption to fresh records. That is especially so as the Omicron outbreak fades and, as Dr Anthony Fauci put it to the Financial Times, the “full blown” phase of the pandemic comes to an end.

Take petrol demand. After falling around 40 per cent in the first months of the pandemic, drivers are now burning nearly as much petrol as they were before Covid-19 hit the US, even as prices at the pump have risen to seven-year highs.

As the Omicron variant recedes, will a more widespread return to offices and other activities drive petrol demand back to 2019 levels and higher? It seems likely. If it does, it could provide another boost for prices.

Jet fuel demand, which was hardest hit by the pandemic, is also still playing catch-up and will benefit from a wider reopening of the economy.

Expectations that demand will continue to recover at the same time that inventories are low and suppliers are struggling to keep up is fuelling oil’s bulls. (Derek Brower)

Ukraine conflict drives oil towards $100/barrel

Oil prices continue to edge towards the triple digits as the prospect of an imminent war in Ukraine looms large over energy and financial markets.

Brent crude, the international oil marker, yesterday pushed past $96 a barrel for the first time since 2014. It later dropped back slightly after Russia’s foreign minister suggested diplomacy could yet avert full-blown conflict.

The price volatility underlines fears of a hit to oil flows should Moscow proceed with an invasion of Ukraine. Russia exports 4.5mn barrels of crude a day.

But for now, Bhushan added, oil traders were still treating the prospect of a serious disruption to Russian exports as “highly unlikely”. Stock markets were also skittish yesterday.

Elsewhere, regulators in Brussels halted an antitrust probe into QatarEnergy amid concerns that gas supplies from Russia to Europe could be disrupted in the case of an invasion.

Still, diplomatic efforts to avert conflict are persisting. An hour-long call between US president Joe Biden and his Russian counterpart Vladimir Putin at the weekend appeared to go nowhere. But Sergei Lavrov, Russia’s foreign minister, said yesterday the Kremlin was prepared to keep talking to the west about its security concerns.

US officials said last night, however, that Lavrov’s comments were at odds with Russian military preparations for an assault, which had continued to advance in recent days.

Much now rests on the shoulders of Germany’s new chancellor, Olaf Scholz, who visited Kyiv yesterday, emphasising that Ukrainian membership of Nato was “not on the agenda” — a message that could be seen as an attempt to address Russia’s security concerns.

Scholz heads to Moscow today for talks with Putin. For an insight into the Russian leader’s thinking, this piece is worth a few minutes of your time. (Myles McCormick)

Data Drill

Americans thinking about buying electric vehicles after the plethora of EV advertisements on Super Bowl Sunday may soon find more public chargers available. Last Thursday, President Biden laid out plans to distribute $5bn in funds from the bipartisan infrastructure law to build electric vehicle chargers. The funding will be distributed over five years to all 50 states, DC, and Puerto Rico.

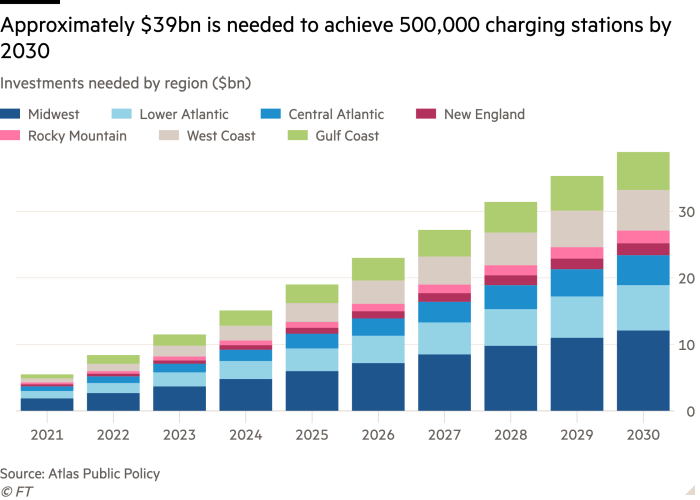

The $5bn is the most significant federal investment in EV charging to date, but nowhere near the amount necessary to achieve Biden’s plan of 500,000 charging stations by 2030. Atlas Public Policy, a DC think-tank, estimates it will cost $39bn to build out this charging network. AlixPartners, a financial consultancy, estimates a cost of $30-$50bn.

“The money is not going to be all that needs to be done by government,” said Nick Nigro, founder of Atlas. “It’s certainly going to require a considerably . . . larger role for electric utilities and the private sector if the country’s going to achieve the goal that the administration’s laid out.”

State-led funding for public chargers so far stands at less than $1bn, according to Atlas. The think-tank estimated last year that public charging commitments from utilities, states and charging service providers amounted to less than $4.5bn.

Currently, the US has approximately 47,138 public charging stations, according to US Department of Energy data. Nearly half of all stations are concentrated in just four states: California, New York, Florida, and Texas. These are also among the top in EV registrations.

Having a robust charging network is key to encouraging EV adoption. About 40 per cent of Americans cite insufficient places to charge as their biggest concern about owning or leasing an EV, according to an AlixPartners survey. (Amanda Chu)

Power Points

-

Saudi Arabia plans to become the world’s largest hydrogen producer.

-

Boston Consulting Group wants to hire climate activists in talent war among advising companies.

-

Activist hedge fund Bluebell Capital Partners wants Glencore to demerge from its coal business.

-

Metal and raw material shortages add to inflation concerns worldwide.

-

Progressives are giving up hope on Biden’s climate plan. (Politico)

-

How Super Bowl ads evolved to address climate change. (Time)