The astonishing rise and fall of Bed Bath & Beyond’s stock price this month has put a spotlight on the investor Ryan Cohen, who through his social media savvy and his portfolio has become a baron of the meme-stock realm.

Cohen is the chair of GameStop, the video game retailer that was among the first stocks to lift off in early 2021 after its embrace by retail traders congregating in online message boards. He was the co-founder of Chewy, the pet supply retailer he sold for $3.35bn in 2017.

The 37-year-old has also become one of the most influential figures among the legions of amateur investors who have demonstrated their collective power to move the price of so-called meme stocks. Cohen’s tweets and investments are dissected, copied and amplified on social media sites such as Reddit. Recent moves in Bed Bath & Beyond show how this can be a volatile mix.

Shares in the homewares company had already been surging when on Monday, August 15, Cohen filed documents with the US Securities and Exchange Commission detailing a previous purchase in February and March of a large number of call options on the stock.

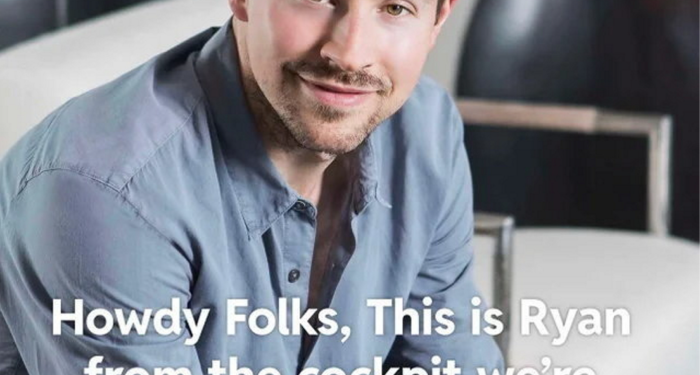

The disclosure helped push Bed Bath & Beyond shares up 30 per cent the next day. On Reddit, a forum member posted a meme with a message written below Cohen’s visage. “Howdy folks,” it read. “This is Ryan from the cockpit we’re expecting some turbulence just remain in your seats.”

There was turbulence. On Wednesday, August 17, Cohen disclosed that he was selling his entire stake, and by Thursday he had fully closed his position with a gain of about $60mn. The sales sparked the worst one-day pullback in the history of Bed Bath & Beyond stock.

While some retail investors took to Reddit to express dismay, still more rallied around Cohen. One wrote that it just “wasn’t like him” to “pull the rug out” from under his followers. “Not gonna lie . . . did panic . . . but bought more. I have faith in him and this will make sense soon!” said another user.

“Cohen is the most highly regarded person in these communities, after Keith Gill,” said Christopher Kardatzke, co-founder of alternative data provider Quiver Quantitative, referring to a widely followed meme-stock trader better known by his YouTube username, Roaring Kitty. “A lot of the interest in Bed Bath as a meme stock had to do with Ryan Cohen’s involvement.”

“Usually a large insider sale is unanimously seen as a bad thing, but within this community there are theories that maybe Cohen sold Bed Bath in order to create a merger with GameStop,” Kardatzke said.

GameStop and Bed Bath & Beyond shares feature on Reddit boards dedicated to the other stock. Cohen has also “hodl’d”, or “held on (for dear life)” to his GameStop shares despite their run-up in value, which was interpreted as an act of camaraderie and earned him respect.

Cohen bought a 13 per cent stake in GameStop in 2020 and joined its board in January 2021. Reddit traders, already interested in the stock because of its heavy interest from short sellers and its low price, saw Cohen as a harbinger of an ecommerce turnround for the bricks-and-mortar retailer. GameStop’s shares rose from $5 to more than $85 in early 2021.

Cohen’s prominence has also been aided by his understanding of online trading humour. When Cohen tweeted a frog emoji with a picture of an ice-cream cone in February 2021, Reddit posts launched into theories about what it meant for GameStop shares.

A week after disclosing his stake in Bed Bath & Beyond, Cohen tweeted: “Short sellers are the dumb stormtroopers of the investing galaxy.” The following week the company’s shares climbed to their highest level for the year.

Cohen wrote in an SEC filing that he was “the chairman of GameStop and overseeing a systematic transformation”.

While GameStop’s share price his risen, analysts say the company’s business fundamentals are largely unchanged since his arrival. Current and former GameStop executives contacted for this story declined to comment.

“His big idea was — wait for it — NFT wallets,” said one GameStop analyst.

As for Bed Bath & Beyond: “The fundamentals have deteriorated significantly since he took his stake,” said Justin Kleber, an analyst at Baird. The company is scheduled to provide a “strategic update” to investors on Wednesday.

Experts said that nothing about Cohen’s Bed Bath & Beyond sale was illegal under securities law. He was not on its board and carried no restrictions that come with unfettered access to privileged information available to officers and directors. He also did not make false claims about the company to the public that would amount to a traditional “pump and dump”.

“The obligation that he has, though, is to speak truthfully about his intentions,” said enforcement lawyer and former SEC assistant director, Gregory Bruch. “If his intentions were different than his actions that is [a] basis to conduct an investigation.”

Through a spokesperson, Cohen declined to comment.

In a letter to the board when he took his Bed Bath & Beyond stake, Cohen said his investment was “maniacally focused on the long-term”.