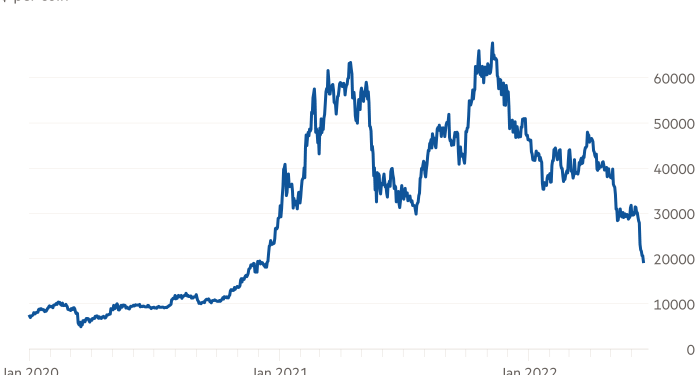

Bitcoin’s price has broken below the key threshold of $20,000 for the first time since November 2020, risking triggering a fresh wave of selling and deepening the crisis gripping the digital asset sector.

The largest cryptocurrency, which acts as a benchmark for the broader crypto market, plunged to under $19,000 on Saturday morning, a fall of around 9 per cent. That took it below the peak level of the previous bull run in crypto markets in 2017 and erased years of gains for long-term holders.

Traditional financial markets were shaken this week after a trio of big central banks, led by the US Federal Reserve, boosted borrowing costs as part of an effort to tamp down intense inflation. Global equities posted their worst week since the darkest days of the pandemic in March 2020 as traders fretted that the aggressive action could snarl global growth or even trigger a recession.

The crypto market has sustained particularly acute pressure as the race for returns prompted by the massive stimulus efforts of central banks and governments at the height of the pandemic abruptly shifts into reverse.

Investors and executives have been anxiously watching the price of bitcoin in recent days, fearing a drop below $20,000 may prompt forced liquidations of large leveraged bets in the markets, putting more pressure on the price and worsening the credit crunch that has already struck large crypto lenders and traders.

In the last week Celsius and Babel Financial, a pair of crypto lending companies, blocked withdrawals while Three Arrows failed to meet demands from lenders to stump up extra funds to cover soured bets. Last month, luna and terra — two tokens that were popular with crypto traders seeking ultra high yields — collapsed.

“The dominoes are falling now,” said Conor Ryder, analyst at research and data provider Kaiko on Friday. “With more dominoes probably comes more downward price action, which will probably see a snowball with these liquidations.”

Bitcoin has shed more than 70 per cent of its value since its peak last autumn as investors flee more speculative assets with the tightening of monetary policy around the world by central banks. Total crypto market value has dropped below $1tn from a peak of $3.2tn. The price of ether has also dipped below $1,000, taking its declines this year to more than 70 per cent. The Bitcoin price dropped to around $18,900 on Saturday, according to data from CryptoCompare.

Smaller lenders have also reduced or paused withdrawals, while Toronto-listed crypto platform Voyager on Friday inked a deal to borrow more than $200mn from trading firm Alameda.

“Today’s actions give Voyager more flexibility to mitigate current market conditions,” said Stephen Ehrlich, chief executive.

“The credit facilities will only be used by Voyager if needed to safeguard customer assets”, he added.

Ryder expects the further drop in markets to put more pressure on other lenders and traders.

“If we get another leg down, it’s going to get pretty clear, pretty quickly who was just hanging on for dear life,” he said.

Additional reporting by Adam Samson in Milan