Jump Trading’s crypto arm has not covered itself in glory in the terra-luna implosion. But the trading firm has now published an interesting postmortem into the debacle.

If it is to be believed, the owner of the Ethereum address 0x8d47F08EBc5554504742f547eb721a43d4947D0A and Terra address terra1yl8l5dzz4jhnzzh6jxq6pdezd2z4qgmgrdt82k (‘Wallet A’) has some questions to answer. The whole report is interesting, but especially what it considers the first fatal blow, on May 7.

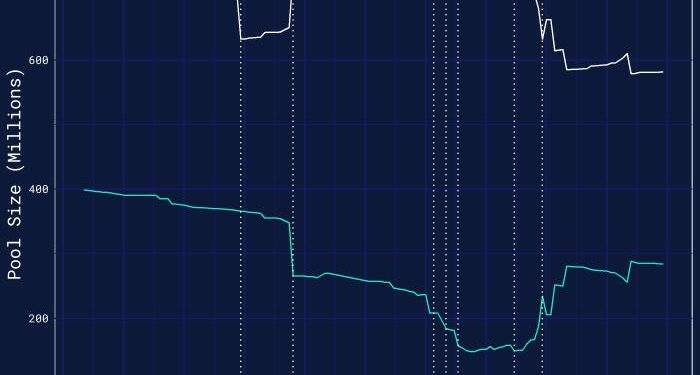

According to Jump Crypto’s Nihar Shah and Maher Latif, the crucial events happened on a trading pool called Curve over a 75 minute window late on Saturday, May 7. For reference, Terraform Labs is the company of Do Kwon, the person behind the algorithmic stablecoin terraUSD (UST), and USD Coin (USDC) is a rival stablecoin.

Here’s how it played out that Saturday night:

Jump focuses a lot on Wallet A, noting that it had earlier that day also transferred $108mn in UST to the crypto exchange Binance. The events of that Saturday cascaded and eventually caused the whole “stablecoin” project to collapse a few days later.

Here is what Jump had to say about the mysterious Wallet A’s actions. A lightly edited synopsis below (check out Jump’s full report for footnotes, sources and some links to the underlying hashes).

In a move we’re sure will cause a million trad-fi conspiracy theories to bloom, Jump then argues that Wallet A’s actions are very differently from what it would normally expect from a crypto pro.

Snitches.

We’re uncertain of what to make of all this. But we’d note that Jump was a big backer of Do Kwon and Terraform Labs, and seems to be trying to deflect blame towards some mysterious assailant, Wallet A. Wallet B also seems like an intriguing account, but doesn’t get the same scrutiny, for example.

But even if is true that one crypto whale could wreak such havoc — if the project was so vulnerable to an attack like this — it was very clearly congenitally and fatally flawed. And Jump’s heavy involvement lent its considerable credibility to it.

Here’s what Jump Crypto head Kanav Kariya had to say about Terraform Labs’ Do Kwan last year:

Moreover, as Jump’s postmortem also admitted, the project’s final death sentence came from the exodus of seven big depositors in UST’s Anchor protocol, while smaller depositors actually increased their exposure even as the project imploded.

Plus ca change. As is so often the case in crypto, the whales escaped unscathed, while smaller ordinary investors became the bagholders.

Check out the replies to Jump’s tweet thread on the report to get an idea of what they think of all this.