One thing to start:

-

America’s biggest solar farm builder says president Joe Biden is doing more harm to renewables than the Trump administration with a “dysfunctional” climate policy.

Welcome back to your Tuesday Energy Source

The latest IPCC report is out and makes for some sobering reading. Despite some pockets of progress, greenhouse gas emissions were up six per cent last year and are expected to rise again this year — making the odds of limiting warming to 1.5C degrees increasingly small.

António Guterres, secretary-general of the United Nations, rang the alarm bells: “We are on a pathway to global warming of more than double the 1.5-degree limit agreed in Paris . . . Some government and business leaders are saying one thing, but doing another. Simply put, they are lying.”

In today’s newsletter, I have a note on America’s surging fuel demand. Record high pump prices aren’t causing people to cut back on driving, so far. Myles reports on the response to reported atrocities committed by Russian soldiers in Bucha, Ukraine, which could include a harsher crackdown on Russian oil and gas flows. As Amanda shows in Data Drill, the measures taken so far have not stymied Russian energy flows, the main engine of the country’s economy.

And another reminder that our Energy Source Live conference in Houston (and online) is coming up this Thursday April 7. If you haven’t already, sign up and come join us.

Thank you as always for reading!

Justin

US drivers are willing to pay up at the pump

Record high prices at the fuel pump aren’t slowing Americans down.

As I reported over the weekend, demand for petrol in the US continues to rise. Buyers, so far, aren’t shifting away from big gas-guzzling trucks and sport utility vehicles despite petrol prices hitting record highs earlier this month and remaining well above $4 a gallon. This may not sound like a lot to our European readers paying far higher prices to fill up, but it bites harder in the US where commutes tend to be longer and cars are far less fuel efficient.

Why aren’t high fuel prices prompting people to cut back? There are a couple of factors at play.

For one, American consumers are still in relatively good financial shape after stockpiling cash during the pandemic. Even though fuel prices are high, they are not eating into Americans’ wallets in the same way they have in past price spikes.

Spending on petrol as a share of total personal consumption expenditures is averaging about 3.1 per cent, Michael Tran, an analyst at RBC, estimated. In previous periods where high prices forced people to burn less fuel, that was more like 4 per cent — or even higher, indicating that current prices aren’t stretching people’s finances as much as it would appear from first glance.

Despite the sticker shock of $4 petrol, the “psychological impact is worse than reality”, Tran said.

Another important factor driving demand higher despite elevated prices is that the country is still emerging from the pandemic. Analysts say people are likely to take the trips they have been postponing for two years even if higher fuel costs make the road trip or flight more expensive.

“If you have to pay an extra 50 or 60 cents a gallon to go visit your parents, grandparents or friends that you haven’t seen in two years, you’re going to do it anyway,” Tran added.

Analysts say that means demand for fuel, already back at pre-pandemic levels in the US, will continue to surge higher going into the summer, which is typically peak driving season, even if prices remain high.

Nor are there signs that high petrol prices are breaking up America’s love affair with ever-larger trucks and SUVs. Electric vehicle sales are rising fast, but remain a small share of total cars sold at less than 5 per cent. I spoke to a number of auto dealers around Houston who said demand for big trucks and SUVs remains as robust as ever — they make up roughly three-quarters of all sales.

When might we see consumers start to bend? National average prices would likely have to top $5 a gallon, analysts say.

The last time serious fuel demand was hit was in 2008, when pump prices were about what they are now. But when adjusted for inflation, that would point to average pump prices of roughly $5.20 a gallon, about $1 a gallon higher than they are today. Global crude prices would likely have to rise to nearly $200 a barrel to lift fuel prices that high. (Justin Jacobs)

Europe weighs ban on Russian coal and oil after Bucha killings

A European ban on Russian coal and oil imports is on the table as part of a new raft of sanctions in response to reports of atrocities carried out by Russian troops in Ukraine.

Footage emerged over the weekend of civilian killings and mass graves in the city of Bucha, just outside Kyiv. The US and EU said they would respond by intensifying sanctions.

French president Emmanuel Macron yesterday said there were “very clear indications” war crimes had been committed and that coal and oil should be included in any new sanctions. EU environment commissioner Virginijus Sinkevičius echoed the call.

Commissioners are expected to formally endorse a fifth package of sanctions on Russia today, which will be voted on by member states tomorrow. Any intensification is likely to exclude gas, given member states’ reliance on Russian imports.

Macron said French authorities were co-ordinating with other EU member states over the next steps — in particular Germany, which is wary of cutting off Russian energy imports.

The finger pointing over the state of European energy policy continued, meanwhile, with the head of Enel, the world’s second-largest utility, saying the bloc should have “aggressively” addressed its dependence on imported gas long ago.

US President Joe Biden said a war-crimes tribunal should be set up over the Bucha killings and said the US would also look to add more sanctions. Washington has already banned Russian coal, oil and gas, and the White House has indicated it is considering widening the net on some existing sanctions to hit third parties.

Our Lex columnists argue the unilateral imposition of such so-called “secondary sanctions” by the US could be circumvented.

Meanwhile, Beijing, whose response will be key in any efforts to isolate Russia from global markets, remained silent on the alleged war crimes. (Myles McCormick)

Data Drill

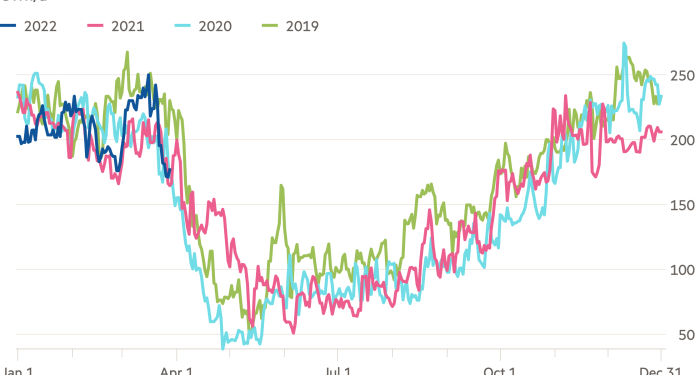

The US, EU, and their allies have imposed hard sanctions on Russia, including a US ban on Russian oil and gas imports and the exclusion of several Russian banks from the international financial system. While the efficacy of sanctions is difficult to measure, data from analytics firm Kayrros suggest the current round of restrictions has not made much of a dent in Russia’s economy.

Key indicators of Russia’s economic activity — coal power generation and cement production — have yet to deviate from historic levels, according to Kayrros. The firm also found that the number of crude oil tankers leaving Russian ports is rising after a sharp decline following the invasion of Ukraine. Kayrros points to India, a top consumer of oil and a country heavily reliant on oil imports, as an emerging market for cheap Russian crude. (Amanda Chu)

Power Points

-

Soaring prices for battery materials threaten the profitability of electric vehicles.

-

Enel chief blames poorly-planned policies for the EU’s reliance on Russian gas.

-

Opinion: Big Oil has nothing to complain about under Joe Biden.

-

Known for its lights, Las Vegas is trying to become one of the country’s most energy-efficient cities. (The Nation)