US government debt came under fresh selling pressure on Friday following the worst quarter for Treasuries on record, as investors looked ahead to central banks tightening monetary policy to curb surging inflation.

The yield on the 10-year US Treasury note, which moves inversely to its price and underpins global borrowing costs, rose 0.12 percentage points to 2.445 per cent.

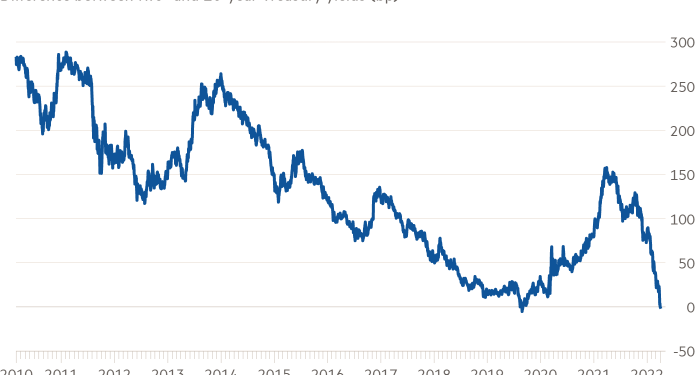

The yield on the two-year note added 0.16 percentage points to 2.448 per cent, having climbed above the 10-year earlier this week for the first time since August 2019.

Such inversions of the US yield curve have typically been perceived as a sign that the economy is at risk of recession. Emmanuel Cau, European equity strategist at Barclays, said the inversion “is something to keep an eye on, but more likely indicates recession in late 2023/early 2024 rather than imminently”.

A Bloomberg index of total returns from Treasuries fell by a record 5.6 per cent in the first three months of the year.

Ewout van Schaick, head of multi-asset at NN Investment Partners, said Friday’s sell-off was the “continuation of last quarter’s trend”, when investors pulled out of US government bonds over concerns that the Federal Reserve may damp economic growth by raising interest rates to combat inflation.

A fresh batch of labour market data on Friday showed that the US recorded another month of jobs growth in March, adding 431,000 positions. That figure compared with a Reuters forecast of 490,000 and marked a decline from February’s revised figure of 750,000.

“The Fed is going to have to [raise rates by] 50 basis points, this is a hot market,” said Steven Blitz, chief US economist at TS Lombard. “You can’t add this many jobs a month and think there’s a recession on the way”.

At the same time, average hourly earnings rose 0.4 per cent month on month, compared with a revised 0.1 per cent gain in February, taking the annual average earnings increase for March to 5.6 per cent. The US’s unemployment rate fell from 3.8 per cent to 3.6 per cent, broadly in line with a Reuters forecast of 3.7 per cent.

In equity markets, US and European shares edged higher after closing out their worst quarter in two years. Wall Street’s benchmark S&P 500 and the technology-heavy Nasdaq Composite both added 0.2 per cent, after dropping 4.9 per cent and 9.1 per cent respectively in the first three months of 2022.

In Europe, the regional Stoxx 600 index, which fell almost 7 per cent in the first quarter, added 0.6 per cent. Germany’s Dax added 0.6 per cent and London’s FTSE 100 rose 0.4 per cent.

Oil prices were steadier after dropping on Thursday as the White House announced a “historic release” from its emergency reserves — pledging to boost supply by about 1mn barrels a day for the next six months in an effort to cool prices that have soared since Russian president Vladimir Putin launched his invasion of Ukraine.

Brent crude, the international benchmark, added 0.2 per cent to $105 a barrel. US marker West Texas Intermediate fell 0.4 per cent to trade at $99.9.

Asian stocks slipped lower in early trade before trimming their losses, with Hong Kong’s Hang Seng index closing 0.2 per cent higher and Japan’s Topix down 0.1 per cent.

The Hang Seng Tech index, which tracks Hong Kong-listed Chinese technology companies, fell 0.7 per cent, having closed 1.4 per cent lower on Thursday.