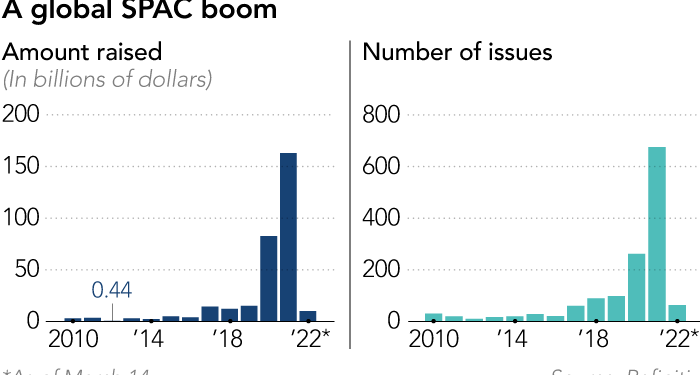

The race between Singapore and Hong Kong to attract special purpose acquisition companies is off to a cautious start, damping hopes the phenomenon could quickly produce a juicy revenue stream for Asia’s top stock exchanges.

The two exchanges spent last year preparing new rules to encourage Spac listings after seeing hundreds of such flotations in the US and worrying that Asian companies would be lured away to list in New York.

Spacs provide companies with an alternative way of going public. They are shell corporations that raise capital through a stock market listing and then acquire a functioning company, thus making it public without it having to go through the traditional process of an initial public offering.

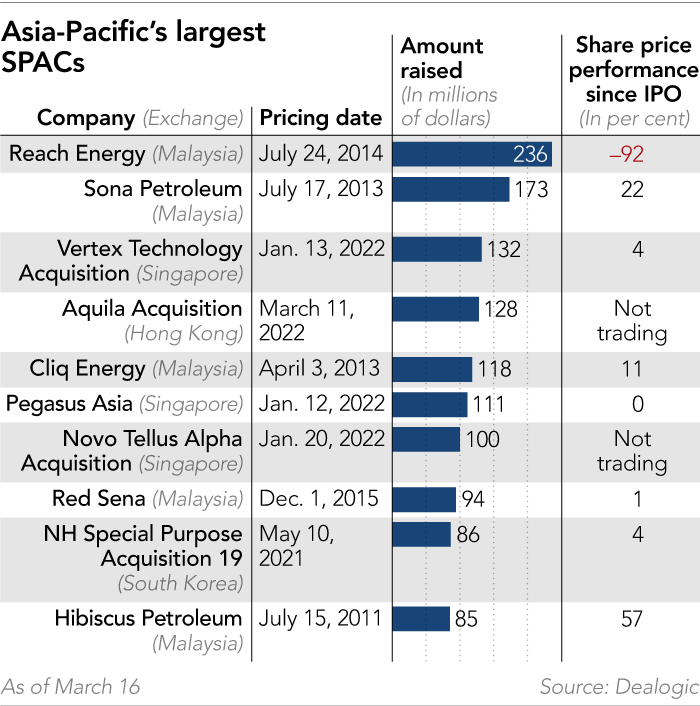

The Hong Kong Stock Exchange’s first Spac made a muted debut in mid-March. Aquila Acquisition, set up by an affiliate of China Merchants Bank, raised HK$1bn ($130mn), the minimum amount allowed. The haul was slightly less than the amount raised by Vertex Technology Acquisition, the Temasek-backed vehicle that was Singapore’s first Spac listing in January.

A further 10 Spacs have made filings with the Hong Kong Stock Exchange, with backers that include the Olympic gymnast-turned-sportswear tycoon Li Ning, Hong Kong property tycoon Adrian Cheng and financial firms ranging from Tiger Jade Capital and Primavera Capital to Agricultural Bank of China.

In Singapore, after the initial burst of three Spac IPOs in January, the exchange saw no activity in February or March, with no further Spac listings or new prospectuses lodged.

Hong Kong introduced more stringent rules for Spacs than other markets, but is pitching the move as a bid for quality over quantity.

“If there is an oversupply of Spacs compared to [acquisition] targets, it is not a good sign and will be a major concern for the regulators,” said Ryan Wu, lead client services partner at Deloitte China. “That is also the reason why Hong Kong has much more stringent rules than anywhere else.”

Under Hong Kong’s rules, until a Spac completes an acquisition, only institutional investors and individuals with at least HK$8mn in financial assets can buy its shares. And the Spac must bring in new investors at the time of the acquisition.

Despite the stricter regime, the expectation among analysts is that Hong Kong will prove more popular than Singapore for Spac listings due to its deeper liquidity and proximity to mainland China. There are some 300 — private companies worth over $1bn — in China, more than anywhere else apart from the US, so it is a natural hunting ground for Hong Kong Spacs looking for acquisition targets.

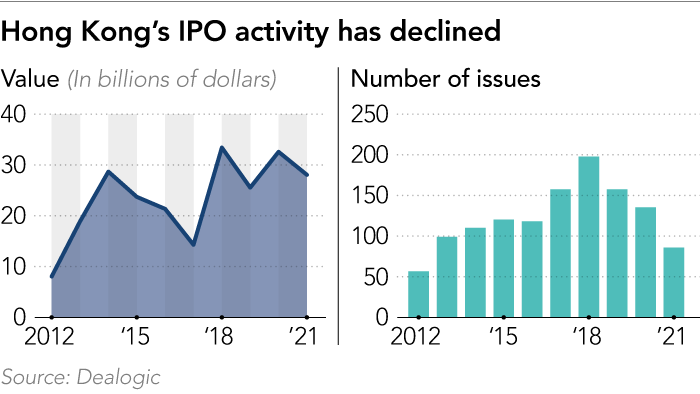

The Hong Kong Stock Exchange certainly hopes so. It is struggling with a decline in IPOs, recording only 95 last year, down 34 per cent from 2020, according to Dealogic. The bourse fell from No. 2 to No. 4 in terms of funds raised by IPOs in 2021, overtaken by the New York Stock Exchange and Shanghai bourse. Nasdaq in the US was No. 1.

Aquila Acquisition closed on March 30 down 7.2 per cent from its IPO price of HK$10 after only a small number of trades. All three of Singapore’s Spacs have recently traded slightly below their IPO prices of S$5 each. Unlike at the peak of the US Spac boom a year ago, when investors chased new shares higher, betting the vehicles would acquire hot start-ups, Asian investors appear content to wait and see.

Peggy Mak, head of research at the corporate advisory specialist SAC Capital, said the real test would come when Spacs eventually choose which company to combine with, and the Singaporean Spacs launched so far have been taking their time.

“Their business combination — we thought it would be earlier, but now it’s almost like the end of the first quarter but still nothing happened,” she told Nikkei Asia. “It’s a bit slower than expected.”

While Hong Kong and Singapore are new to the Spac game, the vehicles have been allowed on other exchanges in Asia, where their record is mixed.

Since 1995, the 10 largest Asia-Pacific listed Spacs, which now include the Singaporean and Hong Kong listings, have raised a combined $1.26bn, according to Dealogic. Reach Energy, set up to acquire an oil and gas production company, has plunged 92 per cent since listing in 2014 in Malaysia. Hibiscus Petroleum, another Malaysian oil and gas Spac, has made the biggest gains of the 10.

The entry of Hong Kong and Singapore comes after interest cooled in the US. Regulators there stepped up scrutiny of Spac accounting, and of forecasts made by the acquisition targets, and there has been a surge of lawsuits by investors claiming to have been misled after share prices tumbled.

Mengyu Lu, a partner at Kirkland & Ellis, a law firm, said Spac listings in Hong Kong have been impacted by the tougher environment in the US, as some foreign funds that were previously interested in Hong Kong have decided to wait and watch how the Asian market evolves.

Financial firms looking to launch Spacs may also have been waiting for the recent bout of market volatility to subside. The Hang Seng index lost more than a quarter of its value in the space of a month to March 15, before staging a rebound.

“Recently, numerous prominent Chinese private equity funds have also expressed interest in promoting Spacs,” Lu said. “They may now be waiting for the market to rebound a bit from its dramatic fall before taking action.”

Wild swings in stock markets also complicate negotiations on how to value an acquisition target in a deal to combine with a Spac. The private company’s shareholders receive shares in the listed Spac, but the percentage depends on the value ascribed to the business.

“There is a lot of Spac activity that’s taking place, but their valuations right now are extremely high. Getting to a point where you can agree on a valuation for a target to ultimately take public, that’s the critical part,” said Benjamin Quinlan, chief executive of consultancy Quinlan & Associates.

Quinlan expects there to be a “lower volume of listings, but higher quality of listings” in Hong Kong.

“Spacs in Hong Kong will not be built on hype, as it is a totally different environment. And I think because of that, you both see better quality deals come through Hong Kong, but you just won’t see the crazy kind of volumes that they did in the US, so it’s a quality-versus-quantity trade-off,” he said.

A version of this article was first published by Nikkei Asia on March 21 2022. ©2022 Nikkei Inc. All rights reserved

Related stories

-

China’s Fosun in $1.5bn deal to sell Lanvin fashion unit to Spac

-

‘Gold rush’: ASEAN start-up fundraising more than doubled in 2021