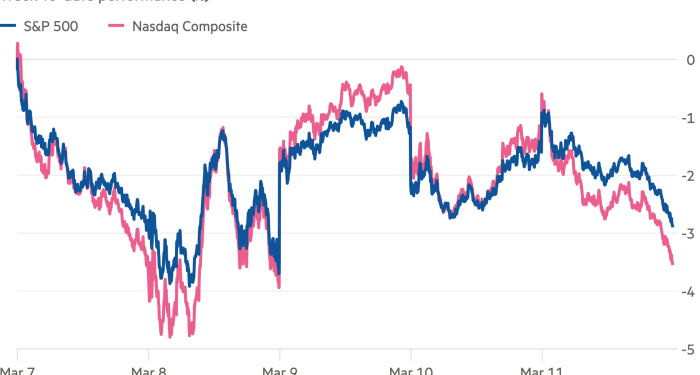

US stocks fell on Friday and registered their worst week in nearly two months as fighting in Ukraine intensified and risk appetite on Wall Street withered.

The benchmark S&P 500 slid 1.3 per cent on Friday, with the declines accelerating into the close. The drop took the S&P 500’s losses for the week to 2.9 per cent, its largest decline since late January.

The tech-heavy Nasdaq Composite slid 2.2 per cent, taking its fall for the week to 3.5 per cent.

Markets have swung violently on developments in Ukraine, as Russia’s invasion of the country reverberates across the globe. Surging commodity prices, which preceded data this week showing US inflation had hit its highest level in 40 years, have unnerved traders and cast many economic forecasts into doubt.

Economists at Goldman Sachs lowered their US growth forecast for 2022 to 1.75 per cent late on Thursday, from 2 per cent previously. Jan Hatzius, chief economist at the bank, said the downgrade was made “to reflect higher oil prices and other drags on growth related to the war in Ukraine”.

Investors have turned to derivatives markets to hedge themselves from further volatility in markets, particularly in credit, as they look for signs of the economic fallout from the war and jump in commodities.

The number of put equity contracts on one popular high yield corporate bond exchange traded fund — known by its ticker HYG — was approaching a record level this week. Those contracts could pay off if the value of the fund drops.

The cautious mood among investors was also prevalent in the $22tn US Treasury market, as investors dumped US government debt. Yields rise when a bond’s price falls.

The yield on the policy sensitive two-year note rose 0.05 percentage points to 1.74 per cent as investors dialled up bets that Federal Reserve would need to tighten policy aggressively to cool inflation. The benchmark 10-year Treasury yield increased by 0.01 percentage point to 2 per cent.

Trading in overnight funding markets on Friday showed that Wall Street expected the Fed to lift rates to about 1.75 per cent by the end of the year, based on prices of fed funds futures. That’s up from roughly 1.3 per cent at the start of the month, with investors signalling their belief that the Fed could deliver one supersized 50 basis point rate increase this year.

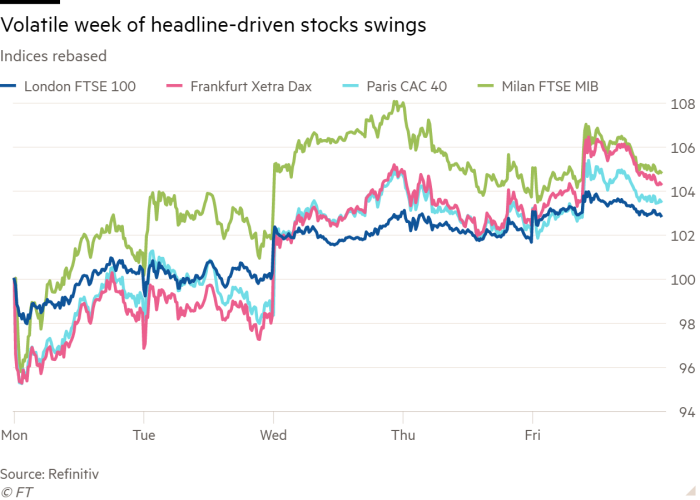

Stock markets in Europe, by contrast, ended Friday on a positive note. The regional Stoxx Europe 600 rose 2.2 per cent for the week, recovering some of last week’s 7 per cent slide.

Investors pulled $13.5bn out of European equities in the week to March 9, the largest weekly redemption since data provider EPFR began tracking the flows in 2000.

“What we have seen so far is an indiscriminate sell-off, particularly of European equities but also globally,” said Francesco Sandrini, global head of multi-asset at Amundi. “Extremely defensive sectors that were not affected by the crisis have been sold heavily, so the rebound is no surprise.”

Brent crude oil, which has swung in recent days as investors assessed the possibility of producer group Opec raising output to compensate for US sanctions against Russia, climbed 3.1 per cent to settle at $112.67 a barrel after EU leaders said at a summit they were debating further moves against Moscow.

In Asia, Hong Kong’s Hang Seng index shed 1.6 per cent and Japan’s Topix fell 1.7 per cent. Australia’s S&P/ASX 200 dropped 0.9 per cent, while China’s CSI 300 was up 0.3 per cent.

The Hang Seng Tech index fell as much as 8.9 per cent on Friday — later closing down 4.3 per cent — after the Nasdaq Golden Dragon China closed down 10 per cent at its lowest level since 2016.