European stocks bounced back from their lowest level in a year and Wall Street futures rose as traders bet on EU policymakers moving to safeguard the bloc’s economies from the fallout of Russia’s invasion of Ukraine.

The Stoxx 600, which has fallen in the past four sessions as investors assessed the economic implications of sanctions, rose 3.1 per cent in morning trade. Germany’s Xetra Dax jumped 5.4 per cent higher, having entered a bear market, defined as a 20 per cent drop from a recent peak, earlier in the week.

Renewed risk appetite also looked set to carry over to Wall Street. Stock futures tracking the S&P 500 added 1.7 per cent after the broad US equity gauge closed on Tuesday at its lowest since June 2021. Contracts following the tech-heavy Nasdaq 100 share index rose 2.3 per cent.

Sentiment towards prospects for the eurozone, which faces a risk of recession from spiralling commodity prices, has shifted ahead of an EU summit on Thursday where leaders will discuss a new growth and investment model and reducing dependence on Russian energy.

“There are expectations Europe is going to do something massive,” said Gergely Majoros, investment committee member at asset manager Carmignac. “We don’t know what is going to be decided,” he added, but the fact EU leaders were set to “even talk about” an integrated response was “supportive”, he said.

Hopes about avoiding a recession in Europe had “really helped rejuvenate some form of risk-on environment on global stock markets,” said Aneeka Gupta, research director at exchange traded fund (ETF) provider WisdomTree.

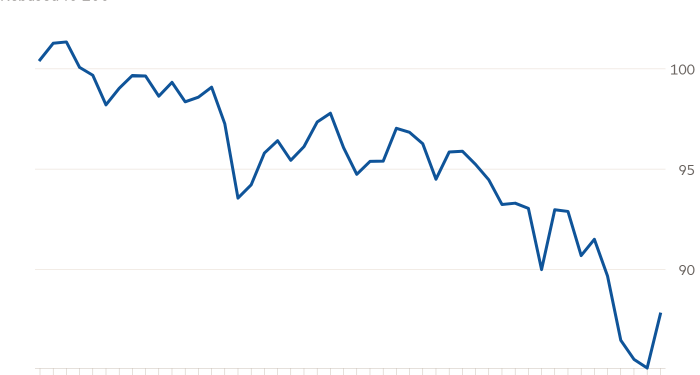

The euro, which has weakened steadily against the dollar since Russia’s President Vladimir Putin sent troops into Ukraine late last month, rose 0.9 per cent to $1.10. The dollar index, which tends to rise when risk aversion is high, dropped 0.7 per cent.

The Stoxx sub-index of bank shares rose 6 per cent, though it remains more than 10 per cent lower for the year.

Analysts believe the European Central Bank, which holds its monetary policy meeting on Thursday, might delay plans to withdraw emergency stimulus measures put in place to counter the financial shocks wrought by coronavirus two years ago.

But prices of eurozone government bonds softened on Wednesday reflecting speculation about the bloc’s strongest nations funding extra EU borrowing. The yield on Germany’s 10-year government bond added 0.07 percentage points to 0.18 per cent as its price fell. The equivalent French bond yield rose 0.06 percentage points to 0.62 per cent.

Elsewhere, energy prices dropped following strong gains in recent weeks driven by concerns about sanctions choking off supplies. Futures linked to TTF, Europe’s wholesale gas price, fell 20 per cent to €168 a megawatt hour. A year ago these contracts traded at about €16.

Brent crude, the international oil benchmark, fell 4 per cent to about $122 a barrel. While US President Joe Biden declared a ban on Russian oil and gas imports on Tuesday, Brent remains about 26 per cent above its closing level on February 23, the day before Russia invaded its neighbour.

Asian equity markets mostly ended Wednesday’s session lower. Hong Kong’s Hang Seng index dropped 0.7 per cent and the Nikkei 225 in Tokyo fell 0.3 per cent.

The yield on the 10-year US Treasury note, a barometer for borrowing costs worldwide, added 0.03 percentage points to 1.91 per cent.