The news around Russia’s invasion of Ukraine is moving fast. To the extent that almost any article that one starts becomes horribly out of date by the time it’s finished.

But one thing that can’t be denied is the volatility in commodity prices at the moment. This Monday morning, Brent hit almost $140-a-barrel, gold $2,000 per ounce and European natural gas €345 per megawatt hour. Wheat, palladium and tin, to name but a few, are also going parabolic.

The movements come after Antony Blinken, the US secretary of state, said over the weekend that Washington was considering a ban on Russian oil imports.

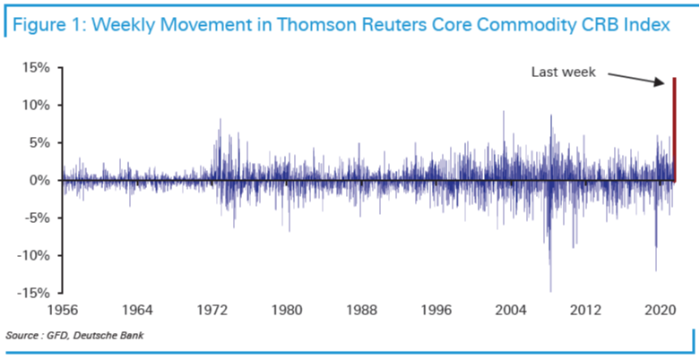

To get a sense of how volatile commodity markets are right now, take a look at the chart below from Deutsche Bank’s Jim Reid, based on Thomson Reuters’ core commodity index.

The moves we’ve seen this morning make this, as far as commodity markets go, “the biggest week on record”, Reid says.

If things remain as rocky as they have been this morning, then it will, as Reid points out, be difficult to ignore comparisons with the energy price shocks of the 1970s.

We should start reading up on stagflation eh?