Global stock markets closed out 2021 with double-digit gains for the third year in a row, as easy monetary policy and a flood of fiscal stimulus helped propel an economic recovery from the pandemic.

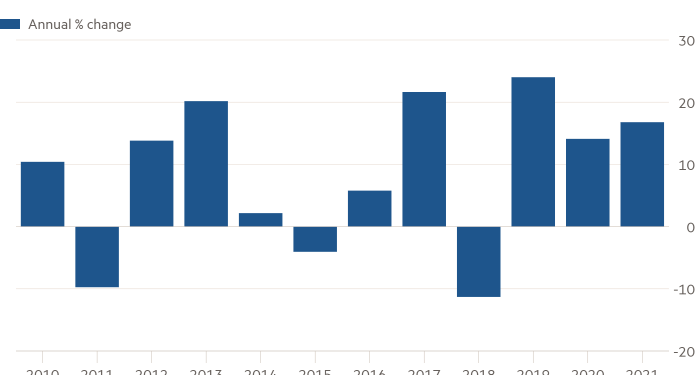

The FTSE All-World share index rallied 16.7 per cent in dollar terms in 2021, surpassing the previous year’s 14.1 per cent gain, but coming up short against the blockbuster 24 per cent jump in 2019, the year before the coronavirus crisis.

Investors came in to 2021 bullish about the year ahead, with vaccines beginning to be rolled out and pent-up demand expected to result in an economic resurgence.

Supportive policies from many of the world’s largest central banks helped to push financial markets higher, bolstered by government stimulus packages and a re-emergence from the most severe restrictions put in place to try to contain Covid-19 infections.

The prospect of central bank’s removing crisis-era support for financial markets, alongside rising cases of Covid-19 stemming from the rapid spread of the Omicron variant, threatened to alter investors’ fortunes towards the end of the year. However, stock markets pulled through the heightened volatility that despite putting a lid on runaway gains failed to derail the rally.

The All-World index squeezed out a gain of almost 1 per cent from its peak in September through to December 31.

“It has been incredible,” said Kristina Hooper, chief global market strategist at Invesco. “Monetary policy, fiscal stimulus and the vaccine rollouts have been powerful engines for stocks.”

The favourable conditions have helped corporate earnings recover from losses sustained in 2020 when the pandemic weighed on economic activity.

Companies were largely able to pass on a sharp rise in prices, as economic demand outpaced supply, allowing them to benefit from the reopening of the global economy.

In the US, year-over-year earnings growth is forecast to reach 45 per cent once fourth quarter reports are in, its highest on record according to data from FactSet going back to 2008.

“There are shortages of every good imaginable, runaway inflation, political strife, race and class wars but there are also some of the best corporate earnings ever,” said Jim Paulsen, chief investment strategist at Leuthold Group. “It’s bizarre but it’s hard to keep the stock market down in the face of such a revival.”

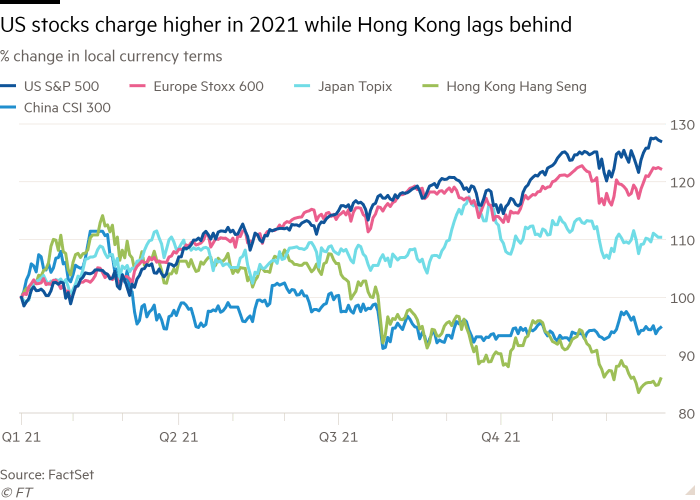

The rise in global stock markets has been particularly pronounced in the US. Wall Street’s blue-chip S&P 500 gauge climbed almost 27 per cent this year, led by a close to 50 per cent surge in energy stocks as oil prices have soared, and followed up with a more than 40 per cent rise in real estate stocks.

Devon Energy topped the index with a gain of almost 190 per cent. A total of 11 companies at least doubled their stock price, including Ford Motor, Moderna and Marathon Oil.

This marks a shift from the previous two years where the technology sector, which still posted a 33 per cent gain in 2021, had dragged the market higher. Cathie Wood’s Ark Innovation exchange traded fund fell more than 23 per cent this year, in a sharp reversal of fortunes from its meteoric 150 per cent gain in 2020, made from betting on some of the best-performing tech companies through the pandemic.

Nonetheless, the biggest tech stocks still stood out as the top contributors to the S&P 500’s gain. Their colossal size relative to other companies made their comparably smaller share price rises more impactful, because of the way that the index is weighted.

The top six contributors to the S&P 500’s performance were all big tech names, led by Microsoft and Apple, the two largest companies in the world by market capitalisation. The behemoths, which are valued at $2.5tn and $2.9tn, respectively, rose 51 per cent and almost 34 per cent over the past year.

Tech also continued to push markets higher across the Atlantic, leading a 22 per cent gain for the pan-European Stoxx 600 index. That marks the second-best performance for the index since 2009, narrowly falling short of a 23 per cent gain in 2019.

In Asia, Japanese stocks also enjoyed a strong year, with the Topix index rising 10.4 per cent, compared to a less than 5 per cent ascent in 2020.

Yet standing in contrast to strong gains across developed markets, Hong Kong’s Hang Seng index sunk more than 14 per cent, weighed down by a regulatory crackdown by Beijing, which particularly targeted the education and tech sectors. The mainland China CSI 300 index fell more than 5 per cent.

The drop contributed to a 5.3 per cent decline in dollar terms in the broader MSCI Emerging Markets index. A similar index from MSCI that excludes Chinese stocks rose more than 9 per cent.

Heading into 2022, investors remain cautiously optimistic about the potential for stocks to continue their upwards trajectory.

Covid-19 cases have continued to surge around the world amid concerns over how far the new strain could affect supply chains, the cost of goods and company performance. Dizzying stock market swings in the wake of the emergence of the Omicron variant underscored how confidence can be shaken by unexpected pandemic twists.

At the same time, tightening monetary policy presents another prospective headwind for the year ahead.

US Federal Reserve officials expect to raise interest rates three times in 2022, as the central bank moves to damp inflationary pressures. The Fed also outlined plans in December to double the pace at which it withdraws its pandemic-era $120bn-a-month bond-buying programme.

Nonetheless, the rapid rise in stock prices when lined up against other asset classes means they will retain their appeal in the new year, said several investors. Albeit with some trepidation.

“I think there will be an equity correction by the end of the first quarter. Not necessarily a sustained correction but still a correction,” said Andrew Brenner, head of international fixed income at National Alliance Securities. “But there is nothing stopping equities rallying for the first part of the year.”