Tech stocks have generally enjoyed a good week with the tech-heavy Nasdaq Composite on course for a 3 per cent rise, but the record of IPOs over the past five days is revealing which subsectors are in or out of favour.

In digital media, BuzzFeed has had a disastrous week. The company went public on Monday after we learnt investors in the Spac it used had pulled 94 per cent of their money out, signalling scepticism over the media group’s prospects. Its shares popped 50 per cent higher initially, but they are currently down 50 per cent on their listing price and the company received only $16m from the initial $288m raised by its Spac, 890 Fifth Avenue Partners. Anna Nicolaou says the IPO represents something of a referendum on the new wave of digital media companies, which have not fulfilled their early promise.

In contrast, fintech companies are very much in vogue. Nubank, the Brazilian company backed by Warren Buffett and Tencent, has become the most valuable financial group in Latin America with a valuation of almost $50bn after its initial public offering. Shares in the lossmaking digital lender jumped by a quarter when they started trading on Thursday in New York, after it raised $2.6bn with the sale of a minority stake.

AI is a hot subsector, but it is also politically charged, and the Biden administration’s expected move to blacklist facial recognition tech company SenseTime appears to have delayed the pricing of its IPO today. The Chinese company was expected to raise as much as $767m in Hong Kong’s largest new stock listing in months, giving it a valuation of up to $17bn.

Lex says recent Chinese tech listing flops in Hong Kong have added to concerns about SenseTime’s ability to secure sufficient funds to ensure its continued growth. It shrunk the size of its planned listing down from as much as $2bn earlier this year. SenseTime’s biggest local rival, Megvii, had scrapped its Hong Kong listing plans last year after it was also placed on a US trade blacklist.

With ride-hailing group Didi Chuxing delisting from the New York Stock Exchange and preparing to go public in Hong Kong, the territory is becoming a tech IPO hotspot for companies. Yet the reception they receive from investors will depend on the larger political forces at work.

The Internet of (Five) Things

1. Netflix to benefit from F1 climax

The success of Netflix’s Drive to Survive, which profiles Formula 1, holds clues to how sports can use digital media to attract new audiences, says FT Scoreboard. The video streaming service will also have blockbuster material for next season as the championship reaches an incredible climax this weekend. Meanwhile, Disney’s chief has been talking about his streaming war with Netflix, for FT Magazine.

2. ‘Queen of the bull market’ faces her toughest test

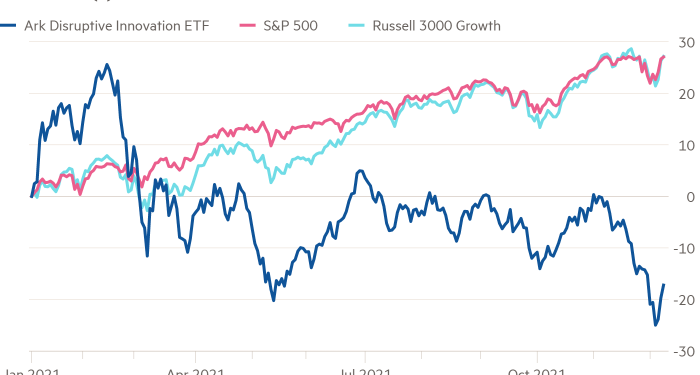

No one comes close to embodying the US stock market boom quite like Ark Invest’s Cathie Wood. By harnessing social media, with a skill rarely seen on Wall Street, Wood has attracted legions of retail investors and billions of dollars by pitching aggressive bets on companies and technologies she says will reshape the world. The results have been spectacular — until now.

3. Must Britain choose between science and the arts?

Higher education funding for arts and design was cut this year in favour of science and mathematics, frustrating Sir Jony Ive, chancellor of London’s Royal College of Art and former Apple design guru. Here’s how creative minds are finding ways to bypass the binary.

4. Hermès and NFT handbags at dawn

The artist behind a colourful collection of fluffy non-fungible tokens based on the well-known Birkin bag, who claimed that scammers were profiteering from his idea, has been hit with a similar accusation from fashion house Hermès. Mason Rothschild, the artist who created NFTs of the bags which have traded for 200 ethereum (about $790,000) in sales as of Friday, estimated scammers have made $35,000 from selling fake versions of his creations, called MetaBirkins.

5. Where will the crypto ‘anarchy’ end?

The rapid spread of bitcoin and other digital assets has bedazzled investors and worried the financial establishment. Dissent, greed, idealism and fear of missing out have spurred the growth of this revolutionary technology. In this video our Lex team asks where will it all end?

Tech tools — the Crypto Christmas jumper

Friday is the annual Christmas Jumper Day in the UK, with the wearing of these festive freaked-out garments linked with raising money for charity. It seems fitting (I’m a medium size) to try on one from social enterprise notjust, which is selling a Cryptocurrency festive jumper, featuring bitcoin and ether. It can even be paid for at the checkout with crypto (it’s £38 in old money). Fifty per cent of profits will be donated to charities supporting mental health. Merry Cryptmas one and all!