A month ago a Financial Times reader pithily described their investment strategy for 2021 as “just buying what my kids want to buy and holding eyes firmly shut on valuation”. For much of the year it would have worked like a dream. Until now.

The primary cause for the recent bout of market turbulence was the emergence of a new, highly contagious coronavirus strain and the Federal Reserve’s simultaneous pivot to a more hawkish stance to contain the threat of inflation. That has forced investors to start pencilling in earlier interest rate rises in 2022.

Superficially, markets have handled it coolly. Most mainstream stock market indices remain near their peaks. But look closer and the pain becomes more apparent. Across the board, many of the year’s most outrageously successful trades — and in the eyes of some market veterans, most heinously silly — have come undone.

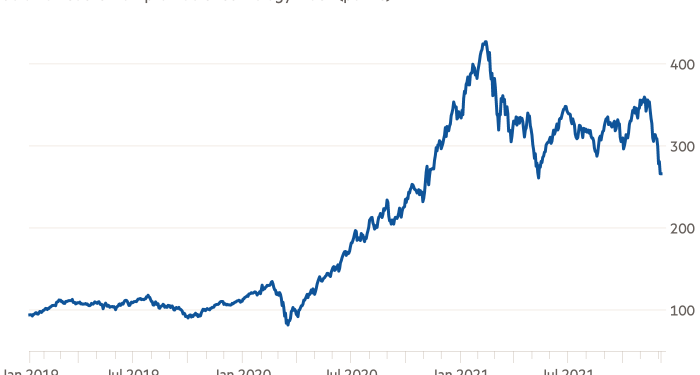

Cathie Wood’s Ark Invest was emblematic of the rally, and encapsulates the recent setback. Her flagship fund gained almost 150 per cent last year as investors embraced its theme of “disruptive innovation” in areas such as artificial intelligence and genomics. Despite a strong midweek bounce, it has now tumbled more than 21 per cent this year, pushing it into a bear market.

However, Ark is merely the tip of a vast iceberg of speculation that has grown to monstrous proportions over the past year. It is now starting to melt a little.

A Goldman Sachs index of unprofitable US tech stocks has lost more than a fifth of its value over the past month. Bitcoin is 28 per cent off its peak. So-called meme stonks such as cinema chain AMC and GameStop — beloved by the self-confessed “apes” and “degenerates” on Reddit — have been taken to the woodshed. ‘Special purpose acquisition vehicles have lost their boomtime bloom.

Is this just a blip, or is sanity making a tentative return? And if it is the latter, could it presage the beginning of a broader stock market downturn?

Many veterans hope this is just the end of the silly phase. The severity of the declines in the riskiest trades indicates that “peak insanity” is behind us, according to Doug Ramsey, chief investment officer at The Leuthold Group.

“We think 2021 has earned its place in the books as the wildest and most speculative year in US stock market history, eclipsing even 1929 and 1999. That doesn’t mean 2022 will bring a panic or a crash, maybe just a degree of sobriety,” he argued.

This would be a dream scenario for the US central bank. Although inflation has accelerated, policymakers for the most part remain confident that the data will moderate next year. But the euphoria in some corners of the financial system will have worried them.

If the signalled acceleration of the “tapering” of the Fed’s bond purchases — and the implied earlier interest rate increases in 2022 — helps blow some of the froth out of markets without plunging them into turmoil, it would be the perfect outcome for the central bank. Many investors would also welcome it, on the basis that a sober rally is a more durable rally.

However, the mania of the past year may be harder to dispel than many think. For more than a decade, the dominant theme has been “buy the dip”. Again and again, it has proved to be a successful trading strategy, helping the mentality worm its way into the subconscious of everyone from ordinary day traders to titanic hedge fund managers.

Indeed, Bank of America notes that all three of its major client segments — hedge funds, big investment funds and wealthy individuals — have all bought the dip this past week. Reddit’s infamous r/WallStreetBets forum is teeming with defiant memes from uncowed traders.

That is understandable. After all, Goldman’s unprofitable tech stock index has still returned 164 per cent over the past two years, even after the recent tumble. And for all the understandable concern about central banks becoming less charitable in 2022, it remains doubtful that they will be willing or even able to raise interest rates significantly.

Government bond yields are therefore likely to remain negative in real, inflation-adjusted terms for years to come. Trillions of dollars are still sloshing around the financial system, desperately sniffing about for even the faintest whiff of potentially abundant returns. That is a wonderful environment for long-shot bets like those espoused by Ark Invest, even if many, by their nature, will not pan out.

Yet dangers lurk. As long as inflation stays uncomfortably hot, central banks may be more reluctant to ease monetary policy if markets suffer a broader, steeper fall — which has been the primary reinforcement mechanism for the buy the dip mentality.

For example, in late 2018 it was relatively easy for the Fed to back away from plans to tighten monetary policy and reverse a violent financial market sell-off because inflation remained quiescent. Doing so is much harder when prices are rising at the current rate.

The sell-off in silliness could therefore still prove to have been the first quiver of a coming earthquake. Even the dotcom bust was not recognised as such until well after it was a reality.

robin.wigglesworth@ft.com

Follow on Twitter: @robinwigg