Hey Fintech Fam!

The past five years have seen more innovation in the payments industry than during the previous two decades, the chief executive of Visa, Al Kelly, told me when we chatted for the FT’s Global Banking Summit last week. Regulators also know this to be true and are scrambling to keep up with the pace of change which has led to whiplash-inducing guidelines from financial authorities around the world.

In this week’s newsletter, we get an update from Chloe Cornish in India, where regulators have floated an all-out crypto ban. Read on for stories that highlight how the world is trying to adjust to a changing payments landscape.

Plus, there’s a Q&A with Socure, the largest start-up in the digital identity space helping finance companies combat fraud as payments move online.

Write to the FintechFT team at imani.moise@ft.com and sid.v@ft.com.

India weighs crypto ban as venture capital floods the country

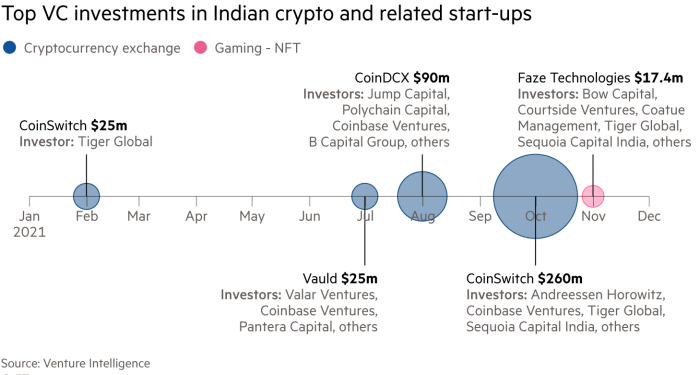

Venture capital investors unnerved by China’s tech crackdown are chasing opportunities in India and showing an acute interest in the cryptocurrency space. More than half a billion dollars have poured into Indian crypto companies so far this year, according to Venture Intelligence, compared to just $25m the year before.

But as Siddharth reported from Chennai in last week’s newsletter, jitters are beginning to develop in India’s growing crypto market. A proposal was introduced in parliament to “prohibit all private cryptocurrencies” in the country, sparking a sell-off.

Newcomers to the turbulence of crypto-land may have been, understandably, spooked by the threat of a ban. But old crypto hands will have seen regulatory panics hitting the market before.

Crypto start-ups have had a rough ride in India, in contrast to the government’s enthusiastic leadership on the country’s impressive digital payments infrastructure. A 2018 central bank order forbade Indian banks from providing services to crypto businesses, making it painfully difficult for trading platforms to operate in India.

But the Reserve Bank of India’s interdiction was overturned by a Supreme Court decision in March. The flood gates opened: crypto exchanges’ aggressive marketing, fuelled by huge venture capital injections, introduced millions of Indians to digital currencies.

One new trader told me “FOMO” had caused her to start buying into bitcoin last spring — she’d seen friends buying iPhones with their trading profits, and she didn’t want to lose out on the opportunity. She did not want her name published in case bitcoin and other digital tokens became illegal, but doubted a total ban was imminent.

Indian officials in favour of a ban fear that inexperienced traders are especially vulnerable to the sharp swings of digital currencies. This newbie trader however is trying her luck with crypto alongside the stock market investments in her “systematic investment plan” or SIP. For her, bitcoin and ether make up “another SIP, a more fun SIP.” For now, she plans to sit on her modest crypto gains.

Considering there are nearly 1.4bn people in India, crypto makes up a small percentage of overall trading. While platforms like CoinSwitch Kuber boast more than 10m registered users, they admit the number of people who have actually bought coins is much lower.

Ashish Singhal, CoinSwitch Kuber’s chief executive, told me that only 6m of the platform’s 13m registered users had transacted at least once. That’s coming from India’s most highly valued crypto start-up, at a cool $1.9bn, which snared Andreessen Horowitz’s first-ever Indian investment.

Of course, starting small means there is massive space to grow. And in a sign that India’s government is interested in pursuing the potential benefits of cryptocurrencies’ underlying blockchain technology, India’s Ministry of Electronics and Information Technology published a national strategy paper on Friday.

A ban on cryptocurrencies would be the worst-case scenario for the burgeoning sector, but lawyers and crypto business leaders said regulation was more likely than prohibition.

So far there are few details about what India’s crypto bill will ultimately say, so traders there will have to wait and see how safe it is to HODL. (Chloe Cornish)

Quick Fire Q&A

Every week we ask the founders of fast-growing fintechs to introduce themselves and explain what makes them stand out in a crowded industry. Our conversation, lightly edited, appears below.

I caught up with Socure CEO Johnny Ayers shortly after a $450m Series E funding round brought his company’s valuation to $4.5bn. This makes Socure the most highly valued private company in the digital identity verification space. Banks and fintechs alike reported a surge in fraud activity as the pandemic forced more transactions online, and finance firms have flocked to technology providers like Socure to help them verify that customers are who they claim to be.

How did you get started? The idea was that the way that identities were verified historically just didn’t work. You had credit data being the foundation of where a lot of identity information was being used, and then you had the kind of rules-based systems not using any graph databases, or machine learning to actually verify [a specific customer]. So we’ve spent the past nine years building out [a database of] every element of identity — email, phone, address, date of birth, social device, IP, and physical documents — to be able to deliver the most accurate comprehensive identity verification service in the US.

Who are your investors? Capital One, Citigroup, Wells Fargo, Synchrony Financial and Santander

You’ve built out a system to manage fraud risk, do you want to do credit risk as well? I am now at this nucleus, where I’m seeing all these identities at scale. Why can’t I then start to go into ‘This is the real consumer, but do I want to do business with this consumer?’ And so if I have all these customers and this huge network reporting back into me I know if this person has bounced checks, does she dispute [charges], or does she have three to five accounts that are all in good standing and have been in good standing for 15 years? That becomes really valuable to the network. We’re developing right now and we’ll move into that type of risk grading.

Does your US focus make it hard to win business from international companies? We’re primarily focused on the US today, because we generally find it’s 40 per cent of the global total addressable market in our world. A global issuer generally has country-specific strategies that they’re developing. We generally find those types of global issuers are not building global strategies that flow everywhere. They have regional data sources. That doesn’t scale internationally. There’s also data storage requirements where data can’t move across countries. There’s privacy requirements. So generally, we find folks building strategies with best-in-class providers in that country.

Fintech fascination

‘Cash is King’ but monarchies fall Global cash payments fell 16 per cent in 2020 and are unlikely to rebound as fintech companies in emerging markets accelerated a shift toward digital payments, according to a new McKinsey study. As cash becomes less relevant around the world, we need to rethink the way we approach financial literacy, the FT argues as part of its Financial Literacy and Inclusion Campaign.

Singapore blocks crypto exchange Singapore’s financial regulator suspended prominent digital currency exchange Bitget after a digital token on the platform falsely claimed ties to K-pop sensation BTS. The south-east Asian regulator is only the latest to scrutinise influencers’ role in advertising financial products. But as online shopping shifts from retail sites to social media platforms, influencers continue to have a growing impact on how people use their money.

Lloyds pivots under pressure UK banking giant Lloyds Banking Group is working on a new strategy to diversify its income streams after low-interest rates and fintech competition have squeezed its core business. The firm is considering quadrupling the budget of its new private home rental market brand.