T Rowe Price diversifies with Oak Hill deal

T Rowe Price is known for several things: strong actively managed fund performance, low staff turnover and successful investments in companies such as Twitter and Warby Parker long before they went public. One thing it is not typically associated with is dealmaking. The Baltimore-based group has reached $1.61tn in assets under management (making it a top 20 player globally) largely through organic growth — shunning the route of so-called transformational mergers and acquisitions that some rivals have gone down.

But that all changed on Thursday when T Rowe unveiled the acquisition of New York-based Oak Hill Advisors for up to $4.2bn in cash and shares. It is the largest deal in T Rowe’s 84-year history, and ranks number 13 in terms of the biggest asset management industry deals of all time, according to Dealogic. Shares in the asset manager rose 5.7 per cent on the day the deal was announced, and this year they have nearly doubled the S&P 500’s performance. Read the full report from me and US investment editor Michael Mackenzie here.

So what does this transaction tell us about the state of the asset management industry?

Private markets are hot right now (as if we needed further confirmation)

For T Rowe, the deal marks a shift from being an active asset manager focused mainly in equities to a more diversified business, with a strong and growing position in one of the most desirable parts of the market: alternatives. Oak Hill has $53bn in assets under management across private, distressed, special situations, liquid, structured credit, and real asset strategies.

“There are three areas that investors are allocating their money towards. Passive, ESG and private markets,” said Rob Sharps, president and head of investments at T Rowe, who takes over as chief executive from Bill Stromberg when he steps down in January. “Passive is not a strategic aim for us,” added Sharps. “We are building our ESG presence, so that leaves private markets.”

Investors are rushing into private capital strategies in pursuit of growth, hoping that returns there will counteract the dimming outlook for traditional equity and bond markets. The overall industry, which includes sectors such as private credit, private equity and infrastructure, grew to $7.4tn at the end of 2020, is now about $8tn, and is expected to hit $13tn by the end of 2025, according to Morgan Stanley.

The oft-heard mantra is alive: differentiate or die

The march of low-cost passive providers such as BlackRock, Vanguard and State Street dealt a strong blow to the active asset management industry, heaping pressure on prices they can charge investors. The asset-weighted average cost of an actively managed US mutual fund has shrunk by a third over the past three decades, according to Morningstar, and no one in the industry thinks this trend is going to stop any time soon.

In this environment, groups such as T Rowe, Capital Group and Baillie Gifford have justified their existence — and their fees — by proving that you can beat the index if you take long-term, concentrated bets on individual stocks.

In many ways the growth of private assets (just look at the booming value of the five US listed groups) is another weapon in the fight against the passive tide: these strategies command a premium for locking up your money, they are difficult to replicate in a low-cost exchange traded fund, and they are growing as quickly as passive investing. Their growth reflects the “barbell” approach that many investors are adopting: allocating to cheap ETF strategies at one end of the spectrum, expensive alternatives strategies at the other — and squeezing out everything in between.

Toppy times: ‘systemic risks’ ahead

T Rowe’s purchase price for Oak Hill implies a mid-teens to high-teens multiple on 2022 earnings after-tax distributable, according to Morgan Stanley, a valuation that analysts said reflects heady competition for assets in this space.

But it is also worth sounding a note of caution amid the gold rush. My colleagues Robin Wigglesworth, Joe Rennison and Antoine Gara covered a striking report from Moody’s rating agency last week, which warned that opacity, eroding standards and the difficulty in trading private credit pose “systemic risks”.

While the rise of non-bank lenders such as Apollo, Blackstone and Ares has been a boon to many companies at a time when banks have retrenched, Moody’s says the “explosive” growth of private credit is storing up risks in a hard-to-monitor corner of the financial system. Meanwhile, Robin also argued in a recent column that the private capital party is getting dangerous and investors chasing after high returns could ultimately be left disappointed.

What do you think? Will the private credit party end in tears? Let me know your thoughts: harriet.agnew@ft.com

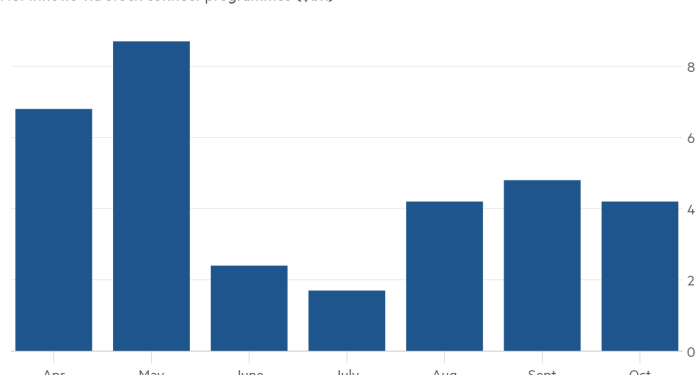

Chart of the week

Some of the world’s largest investors have turned positive on China, three months after a series of regulatory shocks led to a hefty sell-off and concerns that the emerging economy had become uninvestable. Goldman Sachs analysts have named 50 Chinese stocks that they believed would avoid policy traps connected to President Xi Jinping’s “common prosperity” campaign. They favour themes such as renewable energy, mass consumption, manufacturing and reforms to state-owned enterprises.

Five unmissable asset management stories this week

Dan Loeb’s activist hedge fund Third Point has built a large stake in Royal Dutch Shell and called for the oil supermajor to break itself up. But Shell’s chief executive Ben van Beurden has warned that replacing long-term shareholders with hedge fund investors risked derailing the energy sector’s transition plans at a critical moment in the climate crisis. And Abrdn, one of Shell’s biggest shareholders, has dismissed Third Point’s proposal, saying it would be too complicated and unlikely to add value for long-term investors. Meanwhile, Dutch pension giant ABP said it would dump €15bn in fossil fuel holdings.

My colleague Joshua Oliver has a bonkers tale from crypto land: a digital token named after Elon Musk’s dog has launched a major advertising campaign on London’s public transport system, funded by a “tax” on new buyers. (For all the animal lovers out there, Musk’s puppy is a Shiba Inu Japanese hunting dog named Floki). The direct marketing of coins to the public is likely to intensify regulators’ focus on crypto ads: the UK’s Financial Conduct Authority has said it needs more powers to rein in promoters of crypto ventures.

Chancellor Rishi Sunak on Wednesday delivered a “tax, spend and save” Budget. The team over at FT Money took a look at who will be hit and how, and the steps householders and savers can take to soften the blows. Meanwhile, household finances are facing further pressure as UK banks and building societies have started to increase mortgage rates in response to rising inflation, signalling an end to the era of ultra-low borrowing costs.

As the great and the good gather in Glasgow this week for the COP26 climate summit, expect to see asset managers announce a flurry of interim targets for climate emissions. Meanwhile, Time magazine had an interesting cover story on how John Kerry is bringing America back into the climate fight. Former US vice-president Al Gore and financier David Blood are launching a climate change asset manager that will largely focus on private markets. And the growing climate threat is a boon for one part of the market: catastrophe bonds.

Good news for Prime Minister Boris Johnson’s sales pitch to boost post-Brexit investment: one of Canada’s largest pension fund managers has unveiled plans for a C$15bn (US$12bn) spending spree on private assets in the UK and Europe. Caisse de dépôt et placement du Québec (CDPQ), the C$400bn global investment group, told my colleague Josephine Cumbo that the UK stood out because of its “pro business” stance.

And finally

For those of us not in Glasgow this week, which is the best scotch egg outside of Scotland? My vote goes to Jikoni in Marylebone, where chef Ravinder Bhogal’s quail egg encased in prawn toast is an ingenious mash-up of cuisines. Served with banana ketchup and picked cucumber. Check out some of her recipes here.